How Much Would the President's Budget Extend Medicare Solvency?

The Medicare Hospital Insurance (HI) trust fund is only five years from insolvency according to both the Congressional Budget Office (CBO) and the Medicare Trustees. While the text of the President’s Fiscal Year (FY) 2022 budget calls for some substantial changes to Medicare, those changes are not included in the budget numbers, and the budget itself thus lacks specific proposals to meaningfully improve Medicare or control its growing costs. The budget does, however, include proposals to increase revenue dedicated to the Medicare program's HI trust fund while also diverting existing general revenue sources into the trust fund. Based on projections included in the budget, we estimate:

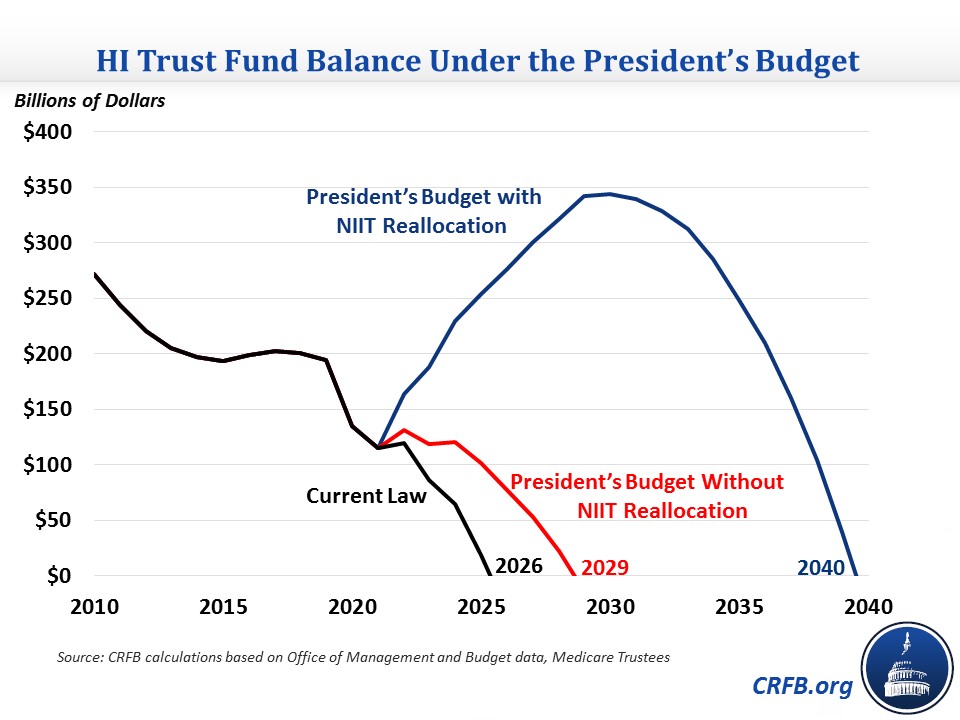

- The President’s budget would extend the solvency of the Medicare HI trust fund from 2026 to 2040, closing nearly 80 percent of the 30-year solvency gap.

- Much of this improvement comes from diverting existing revenue sources to the Medicare HI trust fund. Including only new revenue and savings, the budget would extend solvency from 2026 to 2029 and close only 30 percent of the 30-year solvency gap.

- New Medicare revenue in the budget is effectively “double counted” in the near term because it is used both to strengthen the trust fund and finance the American Families Plan. However, over 20 years, the net savings to the trust funds are not needed to finance the new spending and roughly match the net deficit reduction in the budget.

Policymakers should strongly consider adopting the Medicare-related revenue increases in the President’s budget, which would improve and extend the life of the HI trust fund. However, policymakers should be cautious about addressing trust fund shortfalls by reclassifying existing revenue sources and should pair any such transfers of revenue or spending with adequate offsets in order to ensure meaningful budgetary savings.

What Medicare Policies Are in the President’s Budget?

The President’s FY 2022 budget text calls on Congress to make a number of changes to Medicare – including lowering drug prices through negotiations and price growth caps; reforming insurer and provider payments; expanding access to dental, vision, and hearing coverage; and allowing people to enroll in Medicare starting at age 60. Unfortunately, these proposals lack detail and are not included in the budget itself, which does little to change or improve Medicare. The budget does, however, include new resources to extend the life of the Medicare HI trust fund that is used to finance Part A.

Under current law, based on estimates in the budget, the HI trust fund will run out of funds in 2026, facing a shortfall of roughly $430 billion through 2031 (CBO estimates $515 billion) and $6.2 trillion over 30 years.

Over ten years, we estimate the budget includes roughly $260 billion of policies to strengthen the HI trust fund. The vast majority of these funds would come from closing loopholes that allow some pass-through business income to escape both the net investment income tax (NIIT) and payroll taxes for the self-employed (SECA). Some additional funds would come from improving tax compliance and reducing fraud and overpayments within the Medicare program. Taken together, we estimate these policies would close about two-thirds of the HI funding gap over a decade and 30 percent of the gap over three decades (including 25 percent in the final year).1

| Policy | Ten-Year HI Savings | 30-Year HI Savings |

|---|---|---|

| Close loopholes in NIIT and SECA | $235 billion | $1.2 trillion |

| Improve tax compliance* | $15 billion | $100 billion |

| Reduce Medicare fraud^ | $10 billion | $50 billion |

| Subtotal, Policy Changes | $260 billion | $1.35 trillion |

| Redirect NIIT to HI trust fund | $430 billion | $2.15 trillion |

| Total | $690 billion | $3.5 trillion |

| Percent of Shortfall Closed Including NIIT Transfer | 180% | 80% |

| Percent of Shortfall Closed Excluding NIIT Transfer | 65% | 30% |

Source: CRFB calculations based on Office of Management and Budget and Medicare Trustees data.

Ten-year numbers are rounded to the nearest $5 billion while 30-year numbers are rounded to the nearest $50 billion.

*These estimates may include small effects from other policies that interact with HI payroll tax revenue.

^These estimates may include spillover effects from other health care fraud prevention measures.

In addition to these improvements, the budget would effectively divert $430 billion over ten years from general revenue to the trust fund by taking gross revenue from the existing 3.8 percent NIIT and depositing it into the HI trust fund (note that the gross revenue is much higher than the net revenue, mainly because the NIIT leads to reduced capital gains tax revenue). Including this policy, we estimate the President’s proposals would extend solvency well beyond the ten-year budget window and close 80 percent of the 30-year solvency gap (including 70 percent in the final year).

How Much Would the President’s Budget Extend Solvency?

Our estimates show the President’s budget would extend the life of the HI trust fund by 14 years – delaying insolvency from 2026 to 2040. However, much of this improvement comes from diverting existing tax revenue from the general fund to the trust fund. Only counting net new revenue and savings, we estimate the budget would extend solvency three years – from 2026 to 2029.

Importantly, even this overstates the net financial improvements from the budget’s Medicare policies in some ways. The new revenues raised to improve Medicare solvency would also be used in the budget to help pay for the American Families Plan2 over the first decade and a half. Since the same dollar cannot simultaneously provide more real resources to fund Medicare and offset new spending, it could be described as double counting to claim the same funds for both.

Taking a longer view, the budget does reduce unified budget deficits by roughly $1 trillion over 20 years, by its own estimates – a figure roughly equal to net financial improvements accruing to Medicare and Social Security over that period.3 In that sense, one could think of Social Security and Medicare policies as being used exclusively to strengthen the trust funds while remaining revenue and spending reductions offset the cost of new initiatives over a 20-year period.

Conclusion

While the HI trust fund is only five years from insolvency and in urgent need of reform, solutions should focus on increasing the program’s resources and containing its costs, not papering over the shortfall by diverting revenue currently funding the rest of government. If policymakers transfer existing NIIT revenue to the HI trust fund, they should pair the action with offsetting measures (savings or revenue outside of Medicare Part A).

Policymakers should seriously consider the President’s proposal to expand the NIIT and SECA tax base, which, along with other elements in the budget, would close about 30 percent of the program’s 30-year solvency gap.

Further extending the proposal to those making less than $400,000, which would ensure all business owners appropriately classify their income, could raise even more revenue and also modestly improve Social Security’s finances.4 In addition, lawmakers should identify other revenue and spending changes to secure the HI trust fund. They should especially focus on policies that lower overall health care costs, which can improve the trust fund, improve the federal budget outlook, and reduce medical costs for businesses and individuals.

Restoring solvency to Medicare will eliminate the threat of across-the-board cuts, improve the fiscal outlook, support faster economic growth, and offer the opportunity to improve the delivery of Medicare benefits. Policymakers should enact solutions sooner rather than later.

1 These estimates are based on the Office of Management and Budget’s projections and assumptions and include interest effects.

2 Even with these and other offsets, the budget estimates the American Families Plan would add $270 billion to deficits over a decade.

3 Both figures include interest. Social Security improvements come from improved tax compliance and program integrity measures.

4 A similar proposal in President Obama's final budget in 2016 would increase Social Security revenue by nearly $5 billion per year by 2026.