Double Counting and Medicare Part A

Last month, Social Security and Medicare Trustee Chuck Blahous sparked a controversy by saying that the Affordable Care Act would add to the deficit, arguing that the law was double counting savings from Medicare Part A because Part A is already restrained by a trust fund that is scheduled to expire this decade. Thus, the Medicare savings from the law would only be used to extend the life of the trust fund. We noted at the time that this analysis was technically correct, but against budgetary convention and would mean that we would have a significantly rosier debt picture if we used a "trust fund exhaustion" baseline.

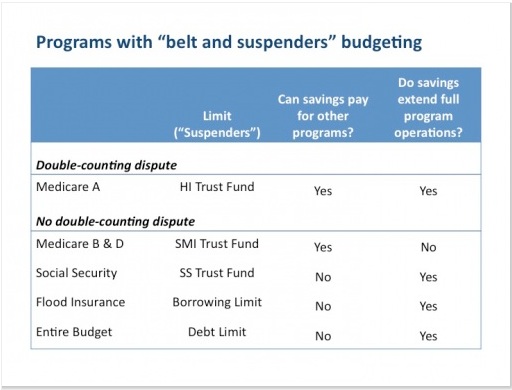

In a blog post this morning, former acting CBO director Donald Marron brings some clarity to the controversy by talking about how congressional budget rules treat various budget limits (trust funds or otherwise) with regards to double-counting. Here's a breakdown of how limits are treated:

- Medicare Part A: Marron notes that Medicare Part A's Hospital Insurance (HI) trust fund is the only limit in the budget that allows for double-counting, per budget rules. Savings can be used to pay for other programs and extend the life of the trust fund, because budget projections assume that general revenue will be transferred when the trust fund runs out to keep full benefits going.

- Medicare Parts B and D: Parts B and D are funded by the Supplemental Medical Insurance (SMI) trust fund, which gets dedicated financing from premiums and state contributions but also from general revenue transfers to keep the trust fund above zero. Thus, savings in Parts B and D cannot be used to extend the life of the trust fund, since it is by definition always solvent. Savings can be used to pay for other programs, though, as the Affordable Care Act also did.

- Social Security: Whether it's the combined old age, survivors, and disability insurance (OASDI) trust fund or the separate OASI and DI trust funds, according to current law savings in the program cannot be used to pay for other programs. Obviously, savings can be used to extend the life of the trust fund, which is a focus for many Social Security reforms (although we prefer simply looking at the gap in spending and dedicated financing).

- Flood Insurance: The National Flood Insurance Program (NFIP) works somewhat differently from the previous three mentioned. NFIP is financed by premiums, but it can finance deficits by borrowing from the federal government up to a certain limit (essentially, its own trust fund). Currently, the program is set to run deficits until it reaches that limit, so like with Social Security, savings must be used to extend the point at which it reaches the borrowing limit instead of paying for other programs.

- Entire Budget: The debt limit, as we are all too aware after last summer, can function as a de facto limit on government borrowing. If the government runs into the debt limit, it must reduce spending in some way to bring it exactly in line with revenue (whether through across-the-board cuts or prioritization of spending). Enacting savings in the budget in the short term does extend the point at which the government reaches the debt limit. Obviously, savings in the budget cannot be used to pay for other programs, because the budget encompasses all programs.

The chart below from Marron's blog shows what each of these limits are, whether savings can be used to pay for other programs, and whether savings can extend the time frame when the limit is reached (e.g. extend a trust fund).