Could Reconciliation Deliver a Tax Cut to the Rich?

Note: This analysis was updated for new data and details on October 29, 2021. See the updated analysis here.

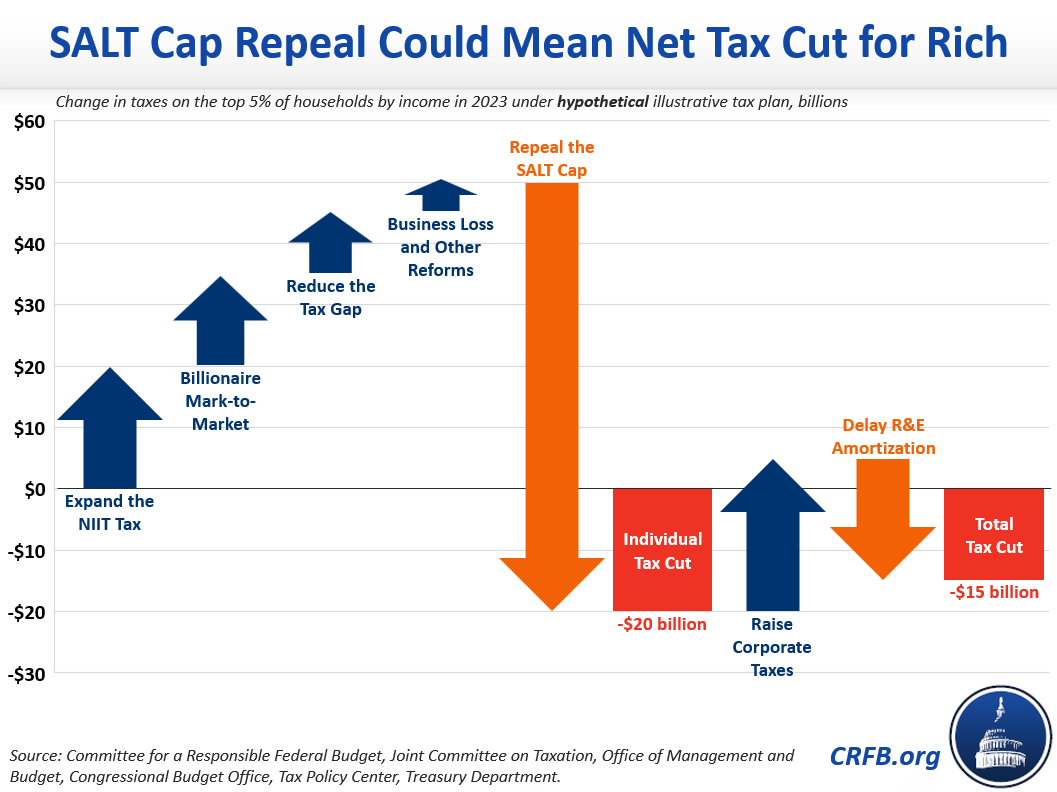

While much of the discussion surrounding the Build Back Better reconciliation package has focused on tax increases on the rich, the final legislation could potentially deliver a tax cut to high-income households – at least in the first two years. With rate increases potentially off the table and discussion of a two-year repeal of the $10,000 cap on the State and Local Tax (SALT) deduction, the effect of provisions increasing taxes on high earners in 2022 and 2023 could be outweighed by SALT cap repeal and other measures, resulting in a net tax cut.

Since details of the current Build Back Better reconciliation package are currently unknown and in flux, it's impossible to know whether the legislation will ultimately increase or reduce taxes at this time. However, the rumored two-year SALT cap repeal would represent a roughly $70 billion tax cut for the top 5 percent of earners in 2023. Lawmakers may have a hard time counteracting such a large tax cut with other tax increases.

As an illustrative example, for this analysis we assume policymakers would raise roughly $1 trillion over a decade from individual taxes – including $400 billion from narrowing the tax gap, $250 billion from expanding the base of the Net Investment Income Tax (NIIT), $200 billion from a new market-to-market tax on unrealized capital gains of billionaires, and the rest from other provisions such as extending the Tax Cuts and Jobs Act’s (TCJA) limit on business losses. We assume remaining offsets would come from higher taxes on corporations and health savings.

Those individual provisions would raise taxes on those in the top 5 percent by roughly $50 billion in FY 2023, resulting in a $20 billion net direct tax cut for those in the top 5 percent in that year when combined with SALT cap repeal. Furthermore, we estimate over $10 billion of that cut would benefit the top 1 percent of households.1

Of course, high-income households also bear much of the burden of corporate tax increases. Assuming policymakers raise $400 billion of new revenue from corporate tax increases – mainly through reforms to international tax rules, a domestic minimum tax, a tax on stock buybacks, and other measures – the tax cut to the top 5 percent could be negated. Depending on the details, we estimate these provisions would increase the tax burden on the top 5 percent of households by roughly $25 billion ($20 billion from the top 1 percent).2

However, lawmakers are also likely to delay amortization of research and experimentation (R&E) expenses, as well as enact or expand tax credits for renewable energy, electric vehicles, housing construction, infrastructure, and other purposes. Even when incorporating just the R&E amortization delay, which has a negligible ten-year cost but a large near-term cost, this illustrative scenario would still deliver a net tax cut to those in the top 5 and 1 percent of the income spectrum.

This analysis requires a few very important caveats.

First, it is highly speculative. We don’t know what the final tax plan will look like or how much it will raise or lose in 2023. Our illustrative example is simply meant to demonstrate that the plan could represent a tax cut for high earners. Second, it is likely the plan would still represent a tax increase for billionaires. Though the wealthiest 700-or-so Americans would benefit tremendously from SALT cap repeal, they will be heavily affected by corporate tax changes and mark-to-market taxation of their capital gains. Finally, the reconciliation bill would almost certainly increase taxes on high earners beyond two years, assuming SALT cap relief is allowed to expire as scheduled. Unfortunately, we expect a 2-year repeal of the SALT cap would be followed by an aggressive effort to make that repeal permanent, at an additional cost of roughly $100 billion per year.

If lawmakers truly intend to raise taxes for high earners, SALT cap repeal makes that goal much more of a challenge. Instead, a much more progressive and fiscally responsible decision would be to abandon SALT cap repeal and keep all potential offsets on the table.

Read more options and analyses on our Reconciliation Resources page.

1 We assumed taxes on high earners are borne exclusively by those in the top 5 percent, while the distribution of tax compliance revenue matched the distribution of the tax gap itself.

2 We assume the distribution of the burden of corporate tax changes matches the burden of the corporate income tax itself.