Reconciliation May Deliver a Tax Cut to the Rich

While much of the discussion surrounding the Build Back Better reconciliation package has focused on tax increases on the rich, the final legislation could potentially deliver a tax cut to high-income households – at least in the first two years. Though the current Build Back Better framework includes a number of tax increases focused on higher earners, the regressive tax cut from adding in repeal of the $10,000 cap on the State and Local Tax (SALT) deduction would more than counter those increases.

The following is an update of a previous analysis published before the framework details were released.

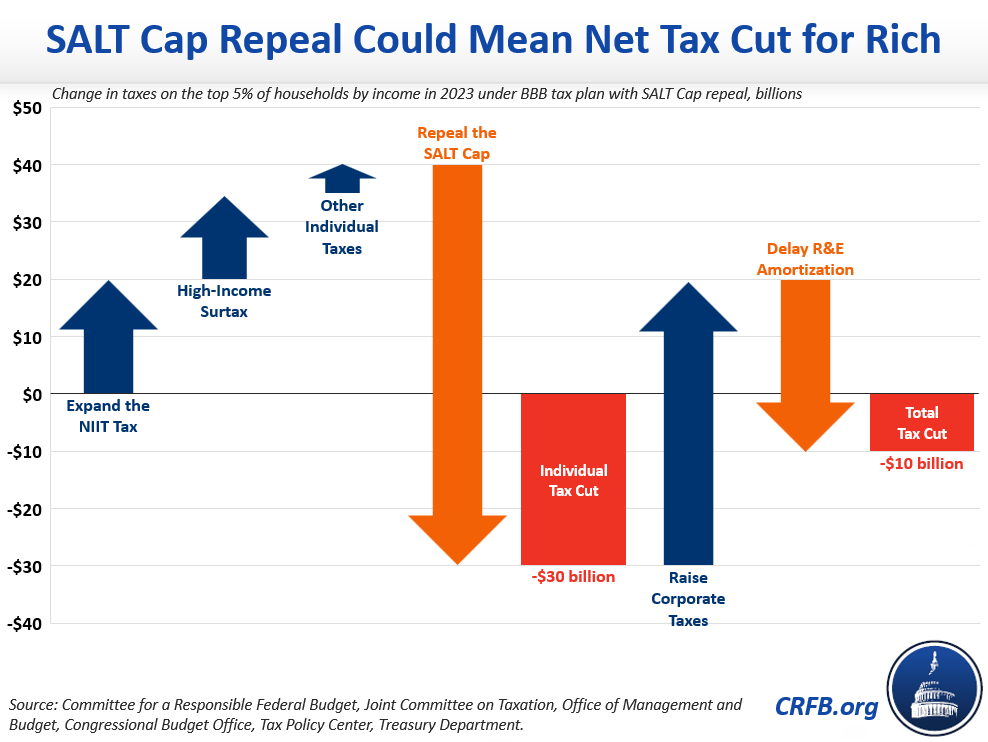

For individuals, the current framework would raise $250 billion of revenue from expanding the base of the Net Investment Income Tax (NIIT), $230 billion from new surtaxes on income above $10 million and $25 million, and additional revenue from an extension of the Tax Cuts and Jobs Act’s (TCJA) limit on business losses, and increased Internal Revenue Service (IRS) funding to narrow the tax gap. We estimate these provisions would raise taxes on those in the top 5 percent by roughly $40 billion in Fiscal Year (FY) 2023.1

However, a two-year SALT cap repeal – if included – would reduce taxes on the top 5 percent of earners by over $70 billion in FY 2023. The result would be a $30 billion net direct tax cut for those in the top 5 percent when SALT cap repeal is in effect. Those in the top 1 percent would also face a net tax cut, though we have not estimated the magnitude.

Of course, high-income households also bear much of the burden of corporate tax increases, and the latest Build Back Better framework appears to raise roughly $800 billion over a decade from corporations. We believe this would increase the tax burden on the top 5 percent of households by roughly $50 billion in FY 2023. However, the Build Back Better framework also includes a delay amortization of research and experimentation (R&E) expenses, as well as enacting or expanding tax credits for renewable energy, electric vehicles, and other purposes. Even when incorporating just the R&E amortization delay, which has a negligible ten-year cost but a large near-term cost, the legislation represents a $10 billion tax cut for those in the top 5 percent.2

The tax cut is even larger when excluding those making over $10 million per year. Recent estimates from Jason Furman found that repealing the cap on the state and local income tax deduction alone (not the property tax) would provide a $472,000 annual tax cut to a couple in California earning $9.9 million per year, a $312,000 annual tax cut for couples in Iowa, and a $285,000 annual tax cut for couples in Arizona.

Importantly, these numbers are rough and will change when the Joint Committee on Taxation (JCT) provides a final score of the reconciliation package. Furthermore, while Build Back Better with SALT cap repeal would represent a tax cut for those in the top 5 percent and top 1 percent, it might not represent a tax cut for those in the top 0.1 percent of the income spectrum. Finally, the reconciliation bill would almost certainly increase taxes on high earners if and when the SALT cap repeal expires. Unfortunately, we expect a temporary repeal of the SALT cap would be followed by an aggressive effort to make that repeal permanent, at an additional cost of roughly $100 billion per year.

If lawmakers truly intend to raise taxes on high earners, SALT cap repeal makes that goal much more of a challenge. Instead, a much more progressive and fiscally responsible decision would be to abandon SALT cap repeal and keep all potential offsets on the table.

Read more options and analyses on our Reconciliation Resources page and our SALT Deduction Resources page.

1 We assumed taxes on high earners are borne exclusively by those in the top 5 percent, while the distribution of tax compliance revenue matched the distribution of the tax gap itself.

2 We assumed the distribution of the burden of corporate tax changes matches the burden of the corporate income tax itself.