Comparing "Repeal and Replace" Bills

Note (7/27/17): This blog has been updated to reflect the Congressional Budget Office's score of a hypothetical "skinny repeal" bill with additional proposals but fewer savings than we previously anticipated.

As the Senate considers legislation this week to repeal and replace the Affordable Care Act (ACA or "Obamacare"), we've aggregated the proposed legislation and less-formal plans into two handy graphics for comparison.

The graphics focus on five major plans currently being discussed by lawmakers:

- "Skinny Repeal" – This plan would at least repeal the individual and employer mandate penalties and the medical device tax. Other possible provisions that have been speculated for this plan include defunding the Prevention and Public Health Fund, prohibiting funding to organizations like Planned Parenthood for one year, increasing funding to Community Health Centers, and any other provision lawmakers wish to include while sticking to the required savings.

- Full ACA Repeal – While not possible to do without 60 votes in the Senate, full repeal would entirely repeal the ACA's taxes, spending, regulations, and savings.

- Obamacare Repeal Reconciliation Act (ORRA) – This plan is an updated version of the 2016 repeal bill vetoed by then-President Obama; it is also known as "repeal and delay" as it would immediately repeal the ACA's taxes and repeal the coverage provisions after a two-year delay.

- American Health Care Act (AHCA) – This plan was passed by the House in May; it repeals the ACA's taxes (except the Cadillac tax) and replaces the insurance subsidies with a flat credit based on age to purchase insurance. It also turns Medicaid into a per-capita cap system.

- Better Care Reconciliation Act (BCRA) – Introduced originally in June and subsequently modified, this plan is largely similar to the AHCA but contains fewer tax cuts, a subsidy structure based on income more similar to the ACA, and a different growth rate for Medicaid per-capita caps, among other changes.

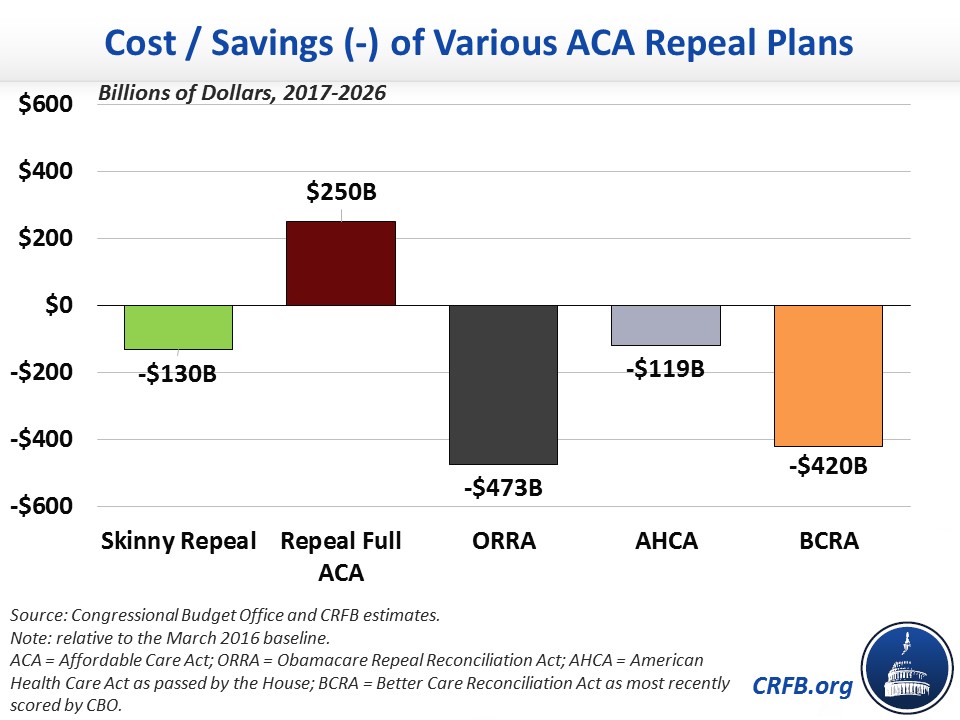

The first graphic compares the budgetary effects of each plan, which ranges from a $250 billion deficit increase for full repeal to $473 billion deficit reduction for the ORRA.

The second graphic compares the coverage effects of each plan, which range from a 16 million increase in the uninsured for "skinny repeal" to a 32 million increase for the ORRA.

Related Analysis: