CBO Releases May 2022 Budget and Economic Outlook

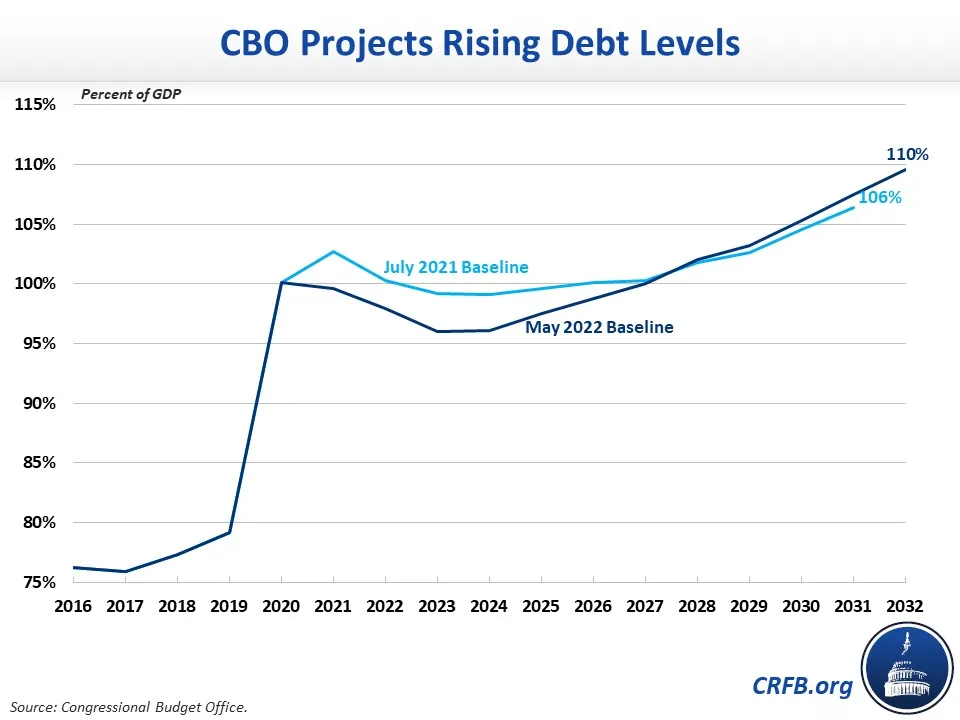

The Congressional Budget Office (CBO) just released its May 2022 Budget and Economic Outlook, its first baseline since July 2021. Under CBO's new projections, deficits will average $1.6 trillion per year over the next decade. CBO projects debt will fall to a low of 96 percent of Gross Domestic Product (GDP) in Fiscal Year (FY) 2023 as a result of high inflation and economic recovery but will rise to nearly 110 percent of GDP by 2032.

Relative to its July 2021 budget projections, CBO's new baseline incorporates the high inflation and strong job growth seen over the past year and also integrates new regulations and the enactment of the bipartisan Infrastructure Investment and Jobs Act, the FY 2022 appropriations package, and months of new economic data.

Under current law, CBO projects the budget deficit will total $1.0 trillion (4.2 percent of GDP) in FY 2022 and rise to $2.3 trillion (6.1 percent of GDP) by 2032. Deficits will total $15.7 trillion (5.1 percent of GDP) between FY 2023 and 2032.

After rising from 79.4 percent of GDP at the at the end of FY 2019 to 99.6 percent of GDP by the end of 2021, CBO expects debt to decline to 96.0 percent of GDP by the end of 2023 as high inflation erodes the value of past debt. However, high inflation will boost federal spending on everything from Social Security and Medicare to interest payments going forward. These underlying pressures will increase debt to a new record of 107.5 percent of GDP by the end of FY 2031 and to 109.6 percent of GDP by 2032, both of which will be more than twice the historical average and above the previous all-time record high of 106.1 percent of GDP.

In nominal dollars, debt will grow by $16.4 trillion, from $23.8 trillion today to $40.2 trillion by the end of FY 2032.

CBO projects $2.4 trillion more of nominal borrowing between FY 2022 and 2031 compared to its previous baseline. $2.36 trillion of this increase comes from legislation, including the bipartisan Infrastructure Investment and Jobs Act, the FY 2022 appropriations package, and assumed extensions of discretionary increases from those pieces of legislation. Economic and technical changes had little net effect on the deficit, with the former worsening it by over $1 trillion and the latter improving it by about $1 trillion.

Changes in CBO's Baseline Budget Projections

| Source of Change | 2022-2031 |

|---|---|

| Deficits Projected in July 2021 Baseline | $12,093 billion |

| Legislative Changes | $2,355 billion |

| Economic Changes | $1,075 billion |

| Technical Changes | -$1,000 billion |

| Deficits Projected in May 2022 Baseline | $14,523 billion |

| Change in Baseline Deficits | $2,429 billion |

Source: Congressional Budget Office.

Note: All numbers include debt service. Numbers may not sum due to rounding.

In addition to its budget projections, CBO released a new ten-year economic forecast. It expects real GDP (on a fourth-quarter-to-fourth-quarter basis) will grow by 3.1 percent in calendar year (CY) 2022, 2.2 percent in 2023, and an average of 1.7 percent per year beyond that.

CBO projects Consumer Price Index inflation will total 4.7 percent in CY 2022, 2.7 percent in 2023, and average 2.3 percent per year thereafter.

CBO projects the unemployment rate will rise from 3.6 percent today to 3.7 percent by the end of CY 2022 and then fall back to 3.6 percent by the end of 2023. From there, the unemployment rate will rise steadily, reaching 4.5 percent by the end of CY 2032.

Lastly, CBO estimates the interest rate on ten-year Treasury notes will rise from 2.8 percent today to 3.2 percent by CY 2025 and to 3.8 percent by 2028 and remain there through 2032.

The Committee for a Responsible Federal Budget will release our full analysis of CBO's report later today.