CBO Releases June 2024 Baseline Update

The Congressional Budget Office (CBO) today released new ten-year budget and economic projections – an update from its February baseline – again confirming that the national debt is on an unsustainable path. According to CBO's new projections:

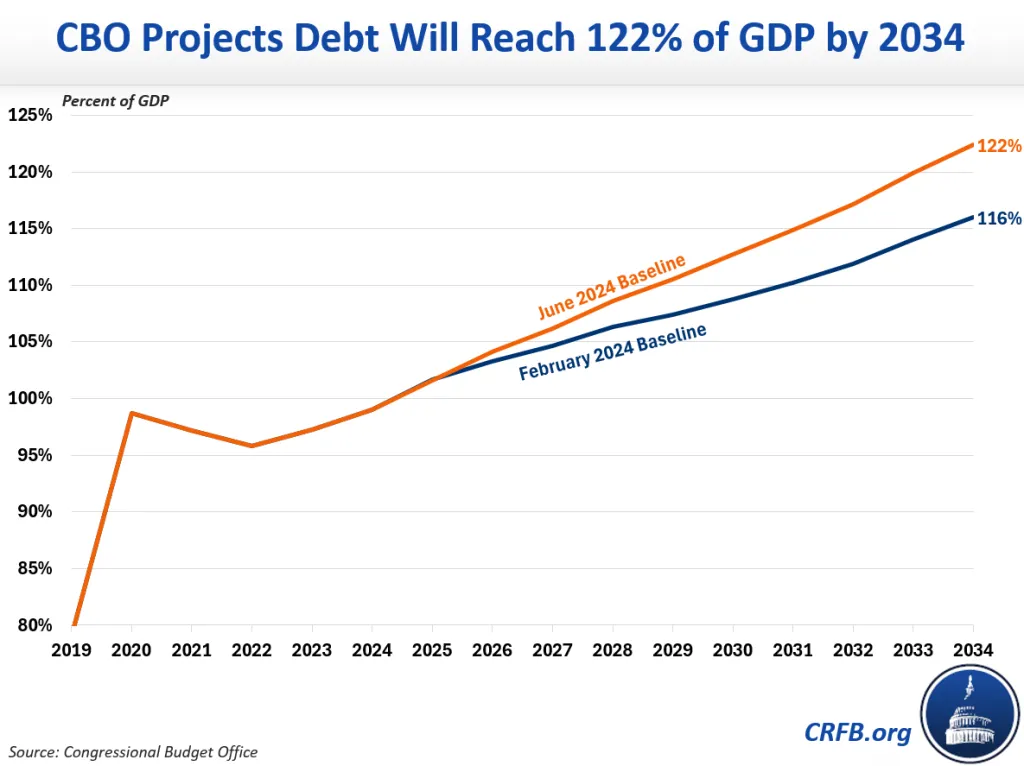

- Debt held by the public will reach a new record by the end of Fiscal Year (FY) 2027 – 106.2 percent of GDP – and rise to 122.4 percent of GDP by the end of 2034.

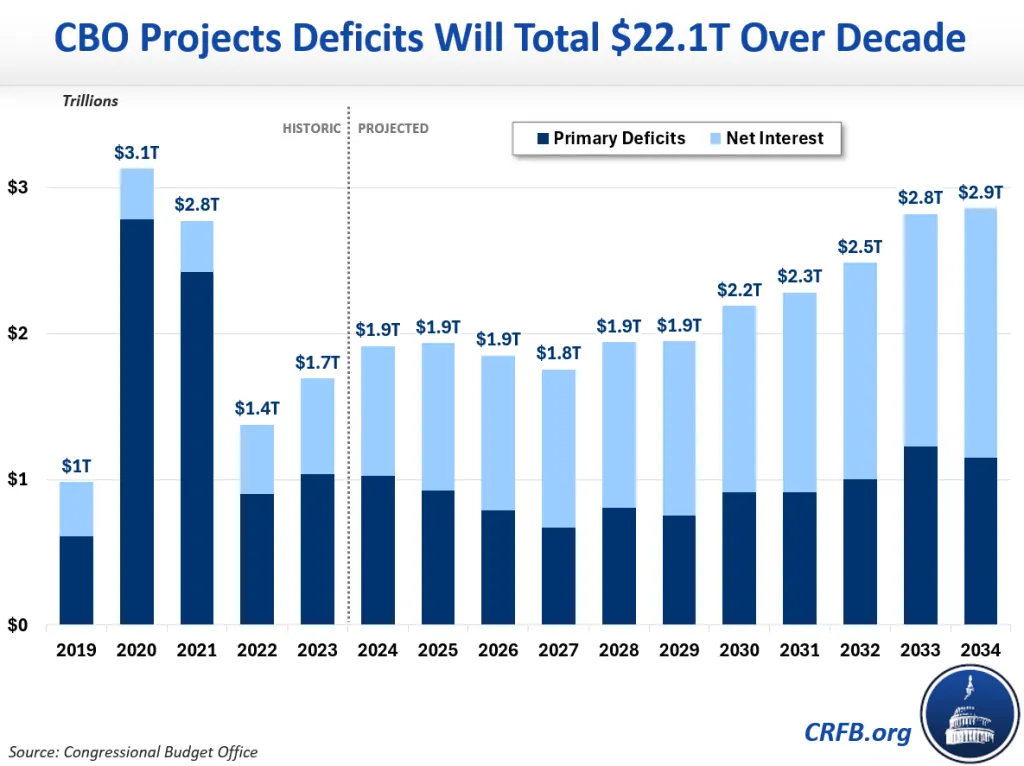

- The budget deficit will rise to $1.9 trillion (6.7 percent of GDP) in FY 2024 and $2.9 trillion (6.9 percent of GDP) by 2034, totaling $22.1 trillion over the 2025-2034 budget window.

- Interest costs will reach a near-record 3.1 percent of GDP this year – exceeding defense and Medicare spending – set a new record next year and grow to 4.1 percent of GDP by FY 2034.

Under CBO’s latest baseline, federal debt held by the public will grow by $23 trillion through FY 2034, from over $27 trillion today to nearly $51 trillion by the end of 2034. As a share of the economy, debt will rise from 97.3 percent of Gross Domestic Product (GDP) at the end of 2023 to 106.2 percent by 2027 – surpassing the prior record set just after World War II – and 122.4 percent of GDP by 2034. Debt in 2034 will be $2.4 trillion and 6.4 percent of GDP higher than projected in February.

CBO projects the budget deficit will total $1.9 trillion (6.7 percent of GDP) in FY 2024, decline to $1.8 trillion (5.5 percent of GDP) in 2027, and then grow to $2.9 trillion (6.9 percent of GDP) in 2034. Deficits will total $22.1 trillion (6.3 percent of GDP) over the FY 2025 to 2034 budget window – $2.1 trillion more than projected in the February baseline.

Rising debt under CBO's baseline is driven by a large disconnect between spending and revenue, with spending totaling $84.9 trillion (24.1 percent of GDP) over the next decade and revenue totaling $62.8 trillion (17.8 percent of GDP). By FY 2034, spending is projected to reach $10.3 trillion (24.9 percent of GDP) and revenue $7.5 trillion (18.0 percent of GDP). By comparison, the 50-year historic average is 21.0 percent of GDP for spending and 17.3 percent for revenue.

Interest spending is a particularly large driver of growing spending and deficits. Interest costs are projected to more than double from $345 billion in FY 2020 to $892 billion in 2024, reaching a near-record of 3.1 percent of GDP this year and costing more than either defense or Medicare. Interest costs are projected to exceed their record as a share of the economy next year, top $1 trillion in 2025, and continue to grow to $1.7 trillion – or 4.1 percent of GDP – by 2034.

CBO’s updated baseline accounts for legislation and executive orders enacted since February. It also incorporates updated economic projections, which account for changes in inflation and interest rates, economic growth, and other economic factors. Of the $2.5 trillion increase in projected deficits over the FY 2024 to 2034 period, $1.6 trillion comes from legislative changes and $1.5 trillion from technical changes – including executive actions. Economic changes reduced deficits by $638 billion. The large growth in the projected FY 2024 deficit – a $408 billion increase over February's projection – is largely attributable to increases in outlays related to the President's proposed student debt cancellation as well as other technical factors.

CBO also projects two major trust funds will become insolvent over the next decade. They project the Highway Trust Fund to be insolvent in FY 2028 and the Social Security Old-Age and Survivors Insurance trust fund in 2033. Upon insolvency, the law requires spending to be cut across the board to match revenue.

The Committee for a Responsible Federal Budget has put out a press release on CBO's new baseline and will publish our full analysis of CBO's Update to the Budget and Economic Outlook later this week.