CBO Releases February 2023 Budget and Economic Outlook

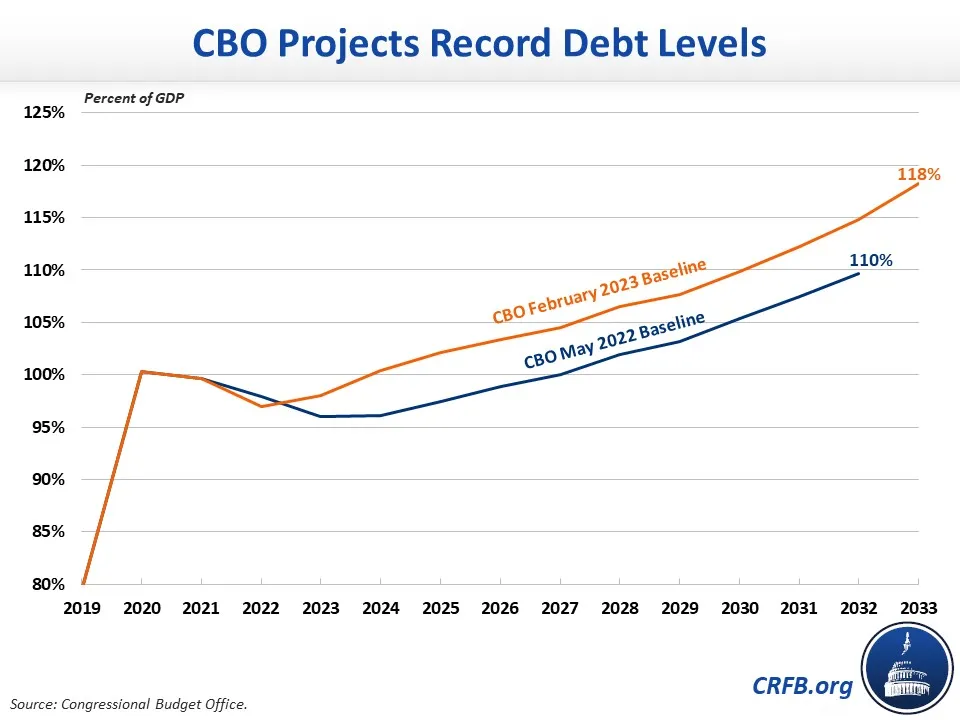

The Congressional Budget Office (CBO) just released its February 2023 Budget and Economic Outlook, its first baseline since May 2022. CBO's new budget projections show that the fiscal outlook has worsened since; it estimates deficits will average $2.0 trillion per year – or 6.1 percent of Gross Domestic Product (GDP) – over the next decade. CBO projects debt will reach a new record of 107 percent of GDP by the end of Fiscal Year (FY) 2028 and reach 118 percent of GDP by the end of 2033. CBO's new projections are much worse than CBO's May 2022 forecast, which showed debt reaching 110 percent of GDP by 2032, and are similar to our November forecast that showed it reaching 116 percent.

CBO’s new projections incorporate legislation and administrative actions put into place since May of 2022. CBO also accounts for the continued high inflation and faster rising interest rates, while assuming a significant slowdown in real GDP growth and an increase in unemployment.

Under current law, CBO projects the FY 2023 budget deficit will rise from $1.38 trillion (5.5 percent of GDP) in 2022 to $1.41 trillion (5.4 percent of GDP) in 2023, to $1.6 trillion (5.8 percent of GDP) in 2024, and to nearly $2.9 trillion (7.3 percent of GDP) by 2033. Deficits will total $20.3 trillion (6.1 percent of GDP) over the FY 2024 to 2033 budget window.

Federal debt held by the public under CBO's baseline will grow by nearly $22 trillion over the next decade, from $24.6 trillion today to $46.4 trillion by the end of FY 2033. As a share of GDP, debt will rise from 97 percent of GDP at the end of FY 2022 to 107 percent of GDP by 2028, surpassing the prior record of 106 percent of GDP set at the end of World War II and amounting to more than twice the historical average. By the end of 2033, debt will reach a record 118 percent of GDP.

In addition to its budget projections, CBO released a new ten-year economic forecast. CBO projects real GDP to remain flat this year, growing by only 0.1 percent on a fourth-quarter-to-fourth-quarter basis. At the same time, CBO projects the unemployment rate will rise from 3.7 percent in the fourth quarter of 2022 to 5.1 percent by the end of 2023 and then fall to 4.8 percent in 2024 and 4.6 percent in 2025. It will then fall to 4.5 percent by the end of 2026 and remain at that level through 2033. Importantly, CBO's economic assumptions were "locked in" in December of 2022, and economic performance has been somewhat stronger since then.

In terms of inflation, CBO projects a gradual return to normal. After growing 7.1 percent from the fourth quarter of 2021 to 2022, CBO projects Consumer Price Index (CPI) inflation to total 4.0 percent in 2023, 2.4 percent in 2024, and average 2.2 percent per year thereafter.

Lastly, CBO estimates the interest rate on ten-year Treasury notes will average 3.9 percent in calendar year 2023, a one percentage point (100 basis points) increase over CBO’s previous forecast. The ten-year Treasury rate will average 3.8 percent in 2024 and remain at that level through 2033.

The Committee for a Responsible Federal Budget will release our full analysis of CBO’s report later today.