Bush Proposes Social Security and Medicare Reform Plan

This blog is part of a series of "Policy Explainers" for the 2016 presidential election, where we explain some of the candidates' policy proposals that affect the federal budget.

Today, Republican presidential candidate and former Florida Governor Jeb Bush unveiled a new plan – among the most detailed we have seen so far from any presidential candidate – to reform Social Security and Medicare. According to our estimates, Gov. Bush's plan would save about $285 billion (including interest) over ten years and very roughly $2.7 trillion over twenty years. It would also close Social Security's shortfall over 75 years and beyond.

| Savings in Governor Bush's Plan | ||

| Policy | 10-Year Savings | 20-Year Savings |

| Implement Medicare Premium Support | $110 billion | $425 billion |

| Means-Test Medicare Premiums | $40 billion | $250 billion |

| Improve CMS Program Management Practices | $5 billion | $25 billion |

| Allow All Seniors to Make HSA Contributions* | -$35 billion | -$150 billion |

| Modify Fee-for-Service Provider Payments (includes interactions) | $50 billion | $175 billion |

| Total Medicare Savings | $170 billion | $725 billion |

| Savings from Social Security Plan | ~$90 billion | ~$1.5 trillion |

| Net Interest Savings | ~$25 billion | ~$500 billion |

| Total Debt Reduction | ~$285 billion | ~$2.7 trillion |

Source: CBO, rough CRFB calculations

*Note this estimate is particularly rough and uncertain

Numbers may not add due to rounding

Social Security Reform

Gov. Bush's plan would close Social Security's shortfall over the next 75 years and beyond by gradually reducing scheduled benefits to below expected revenue levels. In addition to a number of policies meant to improve retirement security through private saving (not discussed here), the plan focuses on changes that would promote longer working lives and that would slow the growth of benefits, particularly for higher earners.

Promote Work

A number of the policy proposals are aimed to encourage people to work longer and retire later. Most significantly, the plan would increase the early and normal retirement ages by one month per year until they reach 65 and 70, respectively (up from 62 and 67). The plan would also increase the penalty for early retirement, increase the bonus for late retirement, eliminate the Retirement Earnings Test, and eliminate the employee's share of the payroll tax for people above age 67.

Modify Benefit Calculations

In addition to the changes intended to promote work, Gov. Bush's plan would slow the growth of initial and continued benefits, particularly for higher earners. Most significantly, his plan would make the benefit formula more progressive and less generous overall by changing the PIA factors – effectively Social Security's replacement rates – from 90%-32%-15% to 93%-21%-5%. At the same time, his plan would establish a new minimum benefit equal to 125 percent of the poverty line for people who have worked at least 30 years. Finally, the plan would adopt the chained CPI for cost-of-living adjustments (COLAs).

| Solvency Effect of Gov. Bush's Social Security Plan (Percent of Payroll) | ||

| Policy | 75-Year Effect | 75th Year Effect |

| Raise Early Eligibility Age and Normal Retirement Age | +0.85% | +1.80% |

| Eliminate Retirement Earnings Test | * | * |

| Adjust Benefits for Seniors Who Choose to Retire Early or Work Past the Retirement Age | +0.50% | +0.75% |

| Eliminate the Employee Portion of the Payroll Tax for Workers Over Age 67 | -0.20% | -0.25% |

| Subtotal, Promote Work | +1.15% | +2.30% |

| Progressively Slow Benefit Growth | +1.45% | +2.95% |

| Measure COLAs with the Chained CPI | +0.55% | +0.75% |

| Establish a New Minimum Benefit | * | * |

| Subtotal, Modify Benefit Calculations | +2.00% | +3.70% |

| Interactions Between Provisions | -0.30% | -0.60% |

| Total | +2.85% | +5.40% |

| Percent of Shortfall Closed | 105% | 115% |

| Memo: Current Actuarial Shortfall | -2.68% | -4.69% |

Source: CRFB calculations based on Social Security Administration estimates. Note that estimates are very rough.

*Between -0.025% and 0.025% of payroll

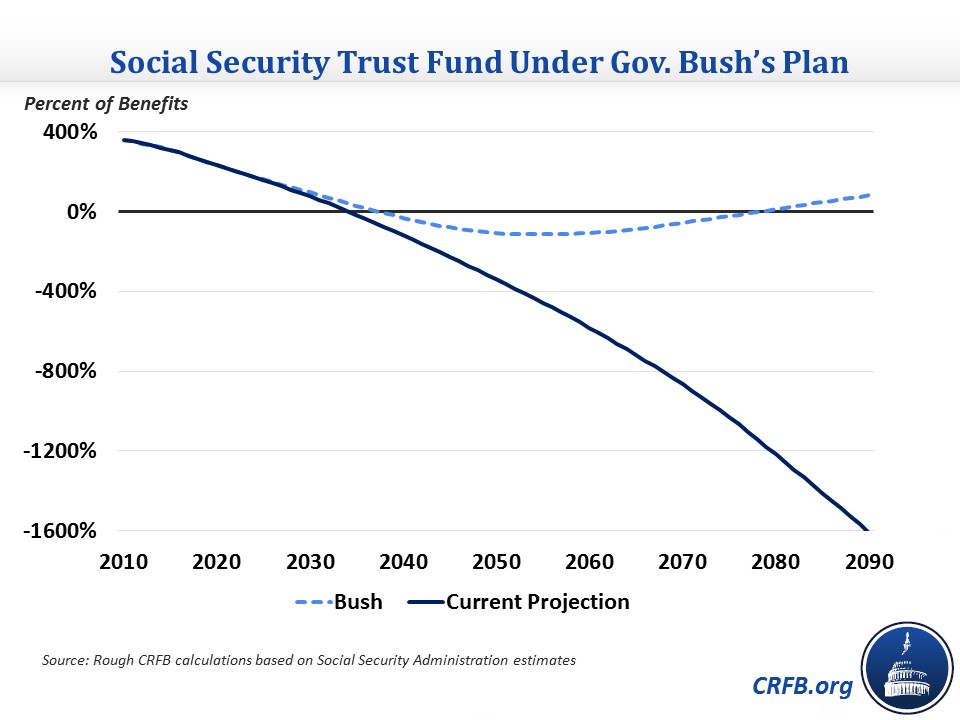

Overall, we very roughly estimate that Gov. Bush's plan would reduce Social Security's actuarial shortfall by over 2.8 percent of payroll, closing roughly 105 percent of the program's 75-year shortfall and about 115 percent of the 75th year deficit. Although we estimate the plan would reach long-term actuarial balance and eventually run significant surpluses, changes do not appear to phase in quickly enough to avoid trust fund depletion sometime around 2040 (part of the cost of waiting to reform Social Security is that gradual changes may no longer be sufficient to avoid insolvency). Assuming a small amount of borrowing authority were allowed, we estimate the trust fund would turn positive sometime around 2080 and would hold about one year's worth of benefits by 2090.

Medicare Reform

Gov. Bush is also proposing significant reforms to Medicare that combined could save roughly $170 billion over the next ten years and a total of more than $700 billion over twenty years. In addition to keeping the Medicare savings from the Affordable Care Act, the plan would adopt a version of "premium support" and enact several other Medicare changes.

Implement Medicare Premium Support

The center of Gov. Bush's Medicare plan is to introduce a premium support, or competitive bidding, system to Medicare in which private plans would more directly compete with traditional fee-for-service Medicare. Under this model, the federal contribution to subsidize Medicare premiums would be set based on the average per-beneficiary cost of traditional Medicare and private Medicare Advantage (MA) plans in each region (that all cover the full suite of guaranteed Medicare benefits), rather than just on the cost of traditional Medicare as is the case today. Beneficiaries would still have the option to enroll in either the public or a private plan, but they would be required to pay higher premiums to cover any incremental additional cost if they choose a more costly plan than the average – even if that plan is traditional Medicare. Similarly, beneficiaries choosing a plan less costly than the regional average would be rebated the full difference in costs.

Since MA plans in most regions are able to provide the Medicare benefit package at a cheaper cost than traditional Medicare, the Congressional Budget Office (CBO) estimates that a premium support system modeled around the average bid in each region would reduce federal Medicare Part A and B spending by 4 percent. And with many plans available for less than the average cost in each region, CBO expects beneficiary costs, on average, to drop by 6 percent.

If such a system took effect in 2019, it would save approximately $110 billion over the budget window from 2017-2026 and roughly $425 billion through 2036.

Enact Other Medicare Reforms

The Governor’s plan would also include other Medicare changes. It proposes to further means-test Part B and D Medicare premiums for high-earners by reducing their premium subsidies and freezing the current income thresholds until 25 percent of beneficiaries are subject to higher income-related premiums – in line with the proposal from President Obama’s budget.

| Size of Medicare Part B Premium Subsidies | |||

| Current Law Threshold | Proposed Thresholds | ||

| Income (single) | Subsidy | Income (single) | Subsidy |

| less than $85,000 | 75% | less than $85,000 | 75% |

| $85,001-107,000 | 65% | $85,001-107,000 | 60% |

| $107,001-160,000 | 50% | $107,001-133,500 | 47.5% |

| $133,501-160,000 | 35% | ||

| $160,001-214,000 | 35% |

$160,001-196,000 | 22.5% |

| $196,001 and up | 10% | ||

| $214,001 and up | 20% | ||

Additionally, the plan would reduce waste from improper payments in Medicare and allow all seniors the ability to contribute into tax-preferenced Health Savings Accounts (HSAs) to pay health expenses.

The campaign also targets $100 billion in savings from “ensur[ing] fee-for-service providers are appropriately reimbursed” (or closer to $50 billion when considered in conjunction with the premium support proposal). This target could be achieved, for example, through a combination of equalizing payments for similar services performed in different sites of care, reducing excess subsidies to academic medical centers, increasing value-based purchasing for inpatient rehabilitation facilities, and limiting post-acute care payments.

Conclusion

Medicare and Social Security are two of the largest and fastest growing parts of the budget, and it is extremely encouraging when candidates put forward plans to address the unsustainable growth of these entitlement program. Gov. Bush's plan is among the most comprehensive and detailed plans released so far – and if enacted, it appears that it would not only slow the growth of Medicare but ultimately close Social Security's long-term shortfall.

It should be noted, however, that the savings from Gov. Bush's Social Security and Medicare reforms are not on their own sufficient to pay for the revenue loss from Gov. Bush's tax plan – at least over the next two decades – which means that the net impact of his tax, Social Security, and Medicare plans would still be to increase the debt. Going forward, we hope to hear more about how Gov. Bush and other candidates plan to pay for their various campaign promises, and we look forward to further plans to reform entitlement programs and fix the debt for future generations.

Note: Estimates in this blog were generated by the staff of the Committee for a Responsible Federal Budget based on public materials, discussions with campaign staff, and our own assumptions with regards to start dates, phase-ins, and some parameter details. Estimates are extremely rough and small changes in assumptions could yield different results. As more details are made available, we will update and refine our estimates.