Annual Deficits Could Hit $2.3 Trillion

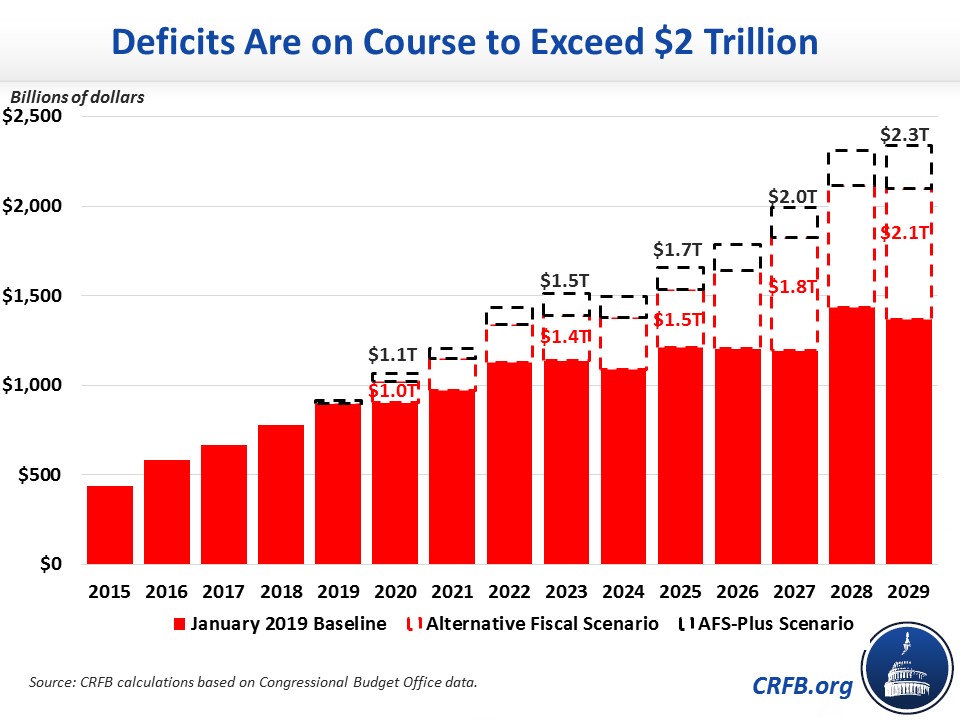

Deficits are rising quickly under current law, as the Congressional Budget Office's (CBO) recent budget outlook demonstrates. Under current law, CBO projects deficits will eclipse the trillion-dollar mark by 2022 and reach $1.4 trillion by the end of the decade (averaging about 4.4 percent of Gross Domestic Product). Sadly, actual deficits could grow far faster if policymakers continue to extend fiscally irresponsible policies. By our estimates, deficits could rise to as high as $2.3 trillion, or 7.7 percent of GDP, over the next decade.

Under current law, much of the fiscally-irresponsible legislation enacted in recent years will ultimately expire. CBO's Alternative Fiscal Scenario (AFS) assumes the individual tax rate cuts and business expensing provisions from the 2017 tax are extended, recent increases in discretionary appropriations are continued (allowing them to grow with inflation rather than return to sequester levels), tax extenders are continued, and major health care taxes that have been delayed several times over the past few years remain postponed.

Under CBO's AFS projections, deficits would hit the trillion-dollar mark next year, and by 2029 deficits would total $2.1 trillion – or 7.1 percent of GDP. Deficits have never been that high as a share of GDP except around the Great Depression, World War II, and the Great Recession.

Sadly, even the AFS may be an optimistic reflection of current policy. It assumes disaster spending remains well below historical averages, current tariffs are continued, and various "health extenders" are allowed to expire or are paid for. It also assumes that several future tax increases are allowed to "sunrise" as scheduled under the 2017 tax law in future years – including tightening of interest expense deductions and amortization of research and experimentation (R&E) expenses starting in 2022 and making three foreign tax provisions more strict starting in 2026. It also assumes the expiration of alcohol tax changes in 2020.

Adjusting for these changes, we project deficits will hit the $2 trillion mark by 2027 and reach $2.3 trillion by the end of the decade. As a share of GDP, deficits would reach 7.7 percent by 2028 before arriving at 7.5 percent by 2029.

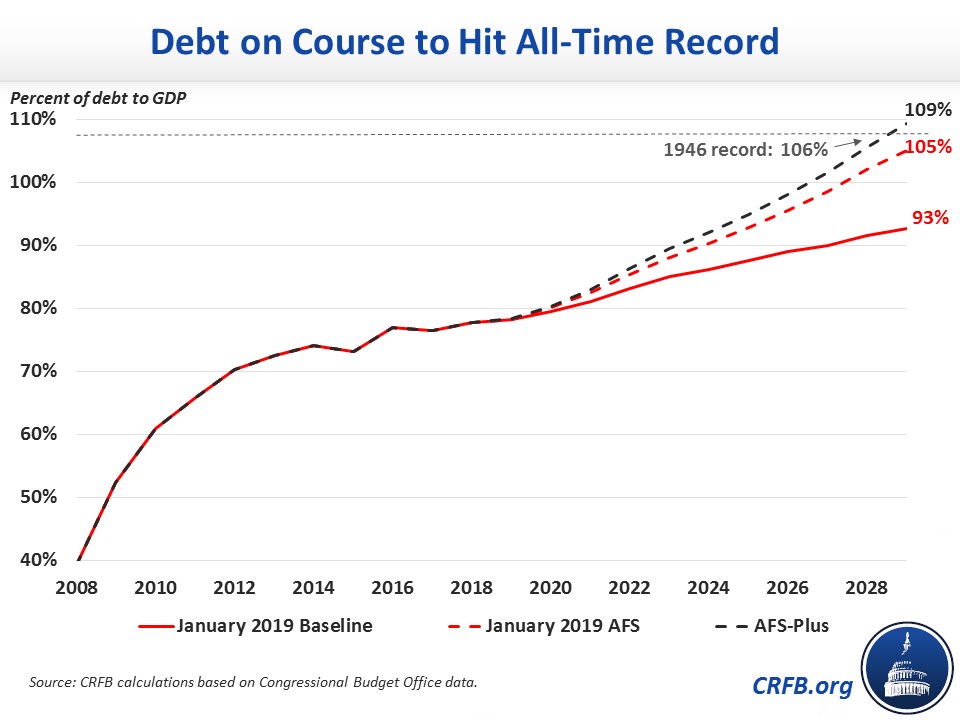

Debt as a share of GDP would also rise rapidly under this scenario, reaching 109 percent by 2029. Never in the country's history has debt been that high; the previous record of 106 percent of GDP was set in 1946 – just after World War II – and was followed by a sharp fall in the debt-to-GDP ratio thanks to a relatively balanced budget and rapid economic growth.

Deficits and debt often rise when the economy is weak, but never have deficits and debt been this high when the economy is this strong. Now is the time to put our country on a more sustainable course, not to allow deficits and debt to continue to grow rapidly.

Appendix: Bridge From Current Law to Alternative Scenario

| Policy | Ten-Year Cost/Savings (-) |

|---|---|

| Current Law Deficits | $11.6 trillion |

| Increase appropriations with inflation after 2019 | $1.790 trillion |

| Extend the TJCA individual tax cuts | $960 billion |

| Extend full expensing of equiptment from the TJCA | $170 billion |

| Repeal deferred ACA taxes | $390 billion |

| Extend other expiring tax provisions | $100 billion |

| Interest | $430 billion |

| Alternative Fiscal Scenario Deficits | $15.5 trillion |

| Various tax sunrises do not occur | $510 billion |

| Tariffs revert to 2017 levels | $380 billion |

| Disaster spending rises to mid-decade average | $190 billion |

| Health spending extenders continue | $60 billion |

| Interest | $170 billion |

| AFS-Plus Deficits | $16.8 trillion |

Source: Congressional Budget Office, CRFB calculations.