Event Recap: 2011 CRFB Annual Conference and Dinner

On June 14, the Committee for a Responsible Federal Budget held its 2011 Annual Conference and Dinner on Capitol Hill. This year’s roundtable conference, entitled “The Debt Ceiling, Fiscal Plans, and Market Jitters: Where Do We Go from Here?” featured a keynote address from chairman of the Federal Reserve, Ben Bernanke, and a roundtable with 40 of the nation’s leading fiscal and economic experts. The evening reception and dinner featured keynotes from Office of Management and Budget director Jacob Lew and Fiscal Commission co-chairs Erskine Bowles and Sen. Alan Simpson. The events combined for a day and evening of interesting yet sobering discussion and debate on the nation’s fiscal challenges.

At the roundtable discussion, moderated by CNBC senior economics reporter Steve Liesman, a star-studded cast of budget experts discussed the breadth and scope of the nation’s debt and deficit troubles, the perilous economic situation our country faces if we fail to act on the issues, and the state of play in Washington and prospects for compromise among politicians. Participants included the chairman of the Federal Reserve Board, three current Senators and two current Congressmen, the sitting director of the National Economic Council (NEC), former directors of CBO, OMB, and NEC, former Members of Congress, and numerous representatives from both Wall Street and the economic policy community in Washington, D.C. As CRFB President Maya MacGuineas recounted in an interview this week with PBS's Nightly Business Report, the discussion covered a wide range of topics, but focused mostly on the debt ceiling debate, the various fiscal consolidation plans released in recent months, the necessity for deals both on the debt limit increase and on long-term debt reduction, and the potential for a fiscal and financial crisis. Above all, the resounding theme of the day was political dysfunction.

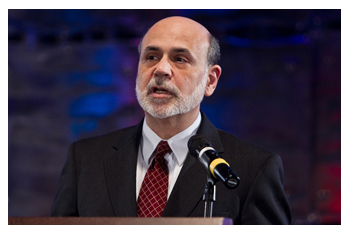

The conference opened with remarks from chairman of the Federal Reserve Ben Bernanke, who gave his strongest remarks yet about the nation’s budget policy and fiscal outlook, what can be done about it, and how to go about enacting a solution. In perhaps the biggest sound-byte of the day, Bernanke voiced his disagreement with the sentiment that the debt ceiling should be used as a tool for forcing action on the deficit. He said that even a short-term disruption of payments made by the U.S. government would have severe impacts on the U.S. and the global economy. But beyond urging action on raising the debt ceiling, he also urged Congress to take quick action on our debt and enact a fiscal plan. While the task is certainly daunting, he said, it is necessary to avoid fiscal and economic calamity in the future.

When talking about what needs to get done, Bernanke joined CRFB's Announcement Effect Club, saying that enacting a long-term fiscal consolidation plan now will help instill confidence in the markets. He argued that sharp, immediate cuts would likely hurt what is a fragile economic recovery, but that we should put in place a plan as soon as possible which phases in changes, giving the economy time to fully recover.

House Budget Committee Chairman Paul Ryan (R-WI) started off by taking pride in the fact that the House, unlike the Senate, had fulfilled its obligations so far in the budget process by passing a budget. Ryan noted that the House budget would dramatically improve the long-term fiscal outlook and lamented the politicization of the specifics he put on the table, perhaps most notably in the House Budget making Medicare a premium support program as opposed to fee-for-service – a policy that has seen much pushback from liberals. Ryan expressed disappointment that the other side had not instead responded with their own equally specific plan.

Senator Michael Bennet (D-CO) also expressed disappointment about how the fiscal conversation has been progressing in Washington. He cited the near government shutdown in early April as an example of the political problems that have been going on and said the same has happened with the debt ceiling. Bennet called for less partisan bickering and stated that his constituents wanted a bipartisan solution to the growing debt – saying he would like to see a plan with the kind of balance seen in the Fiscal Commission’s plan.

It just so happened former Senator and Fiscal Commission co-chair Alan Simpson was next to speak. Simpson, who is also a new member of the CRFB board, opened by talking about how he came to be co-chair on the Commission and said that the purpose of the Commission was not to make things better for their grand-children, but for everyone. There is no way, he explained, that the country can continue to borrow 41 cents for every dollar spent, and there is no way to fix the problem if we fence off a number of parts of the budget, referring to sentiments on the left that mandatory programs such as Medicare and Social Security should be off the table and sentiments on the right that new revenues should be off the table. He concluded, by saying that “if the American public and the Congress remain in thrall to Grover Norquist and the AARP, you haven’t got a prayer.”

Former NEC director Larry Lindsey spoke next, making the case that baseline projections of future deficits and debt understate the magnitude of the problem. First, he said that if interest rates normalized from their record low to their 20-year average in 2013, it would add $400 billion to the deficit (and $5.4 trillion over ten years) unless the Federal Reserve prints money and doesn’t allow interest rates to rise (which he finds problematic). His second point was that the OMB economic projections are too optimistic, and if the economy grew at its trend rate, it would add $2 trillion to the deficit over ten years. His final point was that CBO’s scoring of the health care legislation likely underestimated the cost by a significant amount, due to an underestimation of the number of people that would get insurance coverage through the health care exchanges.

Former NEC director Larry Lindsey spoke next, making the case that baseline projections of future deficits and debt understate the magnitude of the problem. First, he said that if interest rates normalized from their record low to their 20-year average in 2013, it would add $400 billion to the deficit (and $5.4 trillion over ten years) unless the Federal Reserve prints money and doesn’t allow interest rates to rise (which he finds problematic). His second point was that the OMB economic projections are too optimistic, and if the economy grew at its trend rate, it would add $2 trillion to the deficit over ten years. His final point was that CBO’s scoring of the health care legislation likely underestimated the cost by a significant amount, due to an underestimation of the number of people that would get insurance coverage through the health care exchanges.

Next, a few experts talked about the behavior of the markets. PIMCO’s Neel Kashkari fielded a question about why markets would continue to lend the government money at record low interest rates. He responded by saying that in the context of European struggles, we are the “strongest weakling,” but this doesn’t mean we are strong. Waiting for a crisis, he argued, would permanently undermine the view of U.S. Treasuries as risk-free. Michael Pond at Barclay’s also expressed concern that the markets could turn quickly on Treasuries, a sentiment that was generally echoed by many participants throughout the day. Passport Capital founder John Burbank said that the markets may not be responding to the potential technical default in a few months because their mind is focused more on the near-term and the expiration of QE2. IMF Fiscal Affairs director Carlo Cottarelli attributed the U.S.’s low interest rates to their credibility relative to European debt and due to QE2, but warned that even if markets react late, “they react pretty sharply.” He also warned that U.S. gross national debt was higher than that of many European countries that were experiencing problems.

On the topic of the debt ceiling, a number of people were asked to weigh in. Former counselor to the Treasury Secretary and car czar Steve Rattner said that it seemed markets viewed a default as an unthinkable scenario, so they were not panicking about the possibility of a default – a statement that Sen. Bennet attested to. AEI’s Norm Ornstein, however, expressed concern over the likelihood of Congress agreeing to a budget deal in conjunction with raising the ceiling in time, especially considering the hard positions that some lawmakers have taken. Former CBO director and CRFB board member Rudy Penner felt that a deal will be made that centers around a budget enforcement mechanism, perhaps like the targets and triggers recommended by the Peterson-Pew Commission on Budget Reform, on which Penner (and most CRFB board members) served. Marne Obernauer, chairman of the Beverage Distributors Company and also a member of the CRFB board, argued that uncertainty about the debt ceiling and fiscal policy in general made it harder on businesses.

The topic then shifted more towards the politics of fiscal policy. Washington Post columnist Matt Miller said that the fight over the debt ceiling is not about debt since both the House Budget and the President’s Budget Framework would add trillions to the debt; he said that the debt ceiling fight is a result of politicians’ frustration with divided government and using the threat of default as a mechanism to get what they want. Former Senator and CRFB board member George Voinovich talked from experience about how the partisan pressure on lawmakers may make them stubborn on raising the debt ceiling. Touching once again on the topic of markets, former CRFB president Carol Cox Wait underscored the point that the fiscal problem is merely a political one; markets may not be reacting so sharply because they realize the choices to be made are not particularly difficult from an economic perspective.

Steve Liesman took a moment to poll the conference participants on whether or not they felt a deal on the debt ceiling would get done by the August 2 deadline. A majority of participants (roughly two-thirds) signaled they believe the country would avoid default, but also believe the increase would not last through the 2012 election. CRFB president Maya MacGuineas humorously explained that her vote saying that the ceiling would be raised in time was a hedge against a similar vote she made at a previous event in which she leaned the other way. While it brought a laugh, the sense that the politics around increasing the debt ceiling could drive this issue either way is a sobering prospect for all. Urban Institute fellow and CRFB board member Gene Steuerle said he is betting on August 9 as the date Congress raises the ceiling, explaining that he believes they will go to the brink and go just barely over before pulling back. As conference participants discussed, the August 2 deadline seems somewhat fungible (at least to politicians), so others signaled they agreed on the likelihood of a deal being reached just after the deadline has passed.

Two members of the Gang of Six then had a chance to speak with the group. Sen. Mark Warner (D-VA) came up first, making an aggressive call to action. He claimed that one of the best things the government could do for the economy is get the large amount of cash that corporations are sitting on “the sidelines,” and solving our fiscal issues could be a way to do that. He said that the problem was too big to be solved on just one side of the budget, which is a principle the Gang of Six is using in developing its deficit reduction plan. He wondered why the political system would try to wait to deal with the problem until 2013 when it would be risking the health of the economy, saying that the debt ceiling presented a great opportunity for a politically acceptable deal to get done.

Sen. Mike Crapo (R-ID) said that he expected a deal to get done in time, but was skeptical that it would be sufficient to drastically alter the U.S.’s fiscal path. He called for a major “paradigm shift” in fiscal policy with a comprehensive fiscal plan along the lines of the recommendations of the Fiscal Commission, which he served on. He voiced his support for a comprehensive tax reform approach that lowers rates, broadens the tax base, and raises revenue and criticized the “old approach” of simply fighting over rates. He concluded by saying that while any bipartisan fiscal plan will have something for everyone to hate, enacting a plan would be better than the status quo.

Other participants were brought in to comment. Former Congressman and CRFB board member Jim Kolbe said that any fiscal plan would have to include changes to both sides of the ledger and that both parties needed to be less stubborn in the areas they were generally unwilling to accept changes – specifically on entitlements. Former acting CBO director and CRFB board member Barry Anderson said that the August 2 debt ceiling date is not the most important one; there are a few important ones coming up before then. One of those dats is June 15, when some tax payments are due; the amount of revenue that comes in could affect when the deadline date for raising the debt ceiling will be. The other important one is obviously the date in the summer around the August 2 deadline when Congress adjourns.

New York Times columnist David Brooks made the argument that most citizens and most of the Congress did not care about the budget and said that it was “a sociological problem more than anything else” or a problem of “too much democracy.” Both Sen. Voinovich and Sen. Warner disagreed with this assertion. Rep. Peter Welch (D-VT) lamented that the House had been polarized, so it was hard for them to solve any problem without trying to score political points. He also made a point that not solving the problem would hurt public confidence in the institution of Congress.

Former OMB director Franklin Raines agreed with Rep. Welch’s assessment and said that more often today members of Congress are making absolute promises to their constituents, which makes it harder to come to agreement. He admitted he felt that it was unlikely an agreement would be made before August 2. Washington Post writer Ruth Marcus expressed disappointment about the lack of a ringing endorsement of the Fiscal Commission plan after its release last December. She also echoed the concerns about the polarization of Congress (especially in the House) and the lack of public understanding and awareness of the magnitude of changes needed to solve the problem. Many in the public still believe that a large portion of the budget is made up of earmarks and foreign aid, when in reality that accounts for merely a small fraction of the nation's $3.7 trillion budget.

George W. Bush Institute founder James Glassman then attempted to shift the conversation towards focusing on deficit reduction in the context of encouraging economic growth. Specifically, he talked about tax reform, immigration reform, greater investment in education and R&D, and free trade. He noted the CBO projection of long-term growth and said that not only could we do better, but it was essential that we do better. However, Urban Institute president and CRFB board member Robert Reischauer disagreed, saying that while growth is certainly important, just hoping that we grow significantly faster than projected is no substitute for real tax increases and spending cuts. The Urban Institute’s Gene Steuerle talked about how to “minimize the political losses.” A couple strategies he mentioned are to either go big with deficit reduction so that everyone is affected in ways that are fair and even, or to set up targets and triggers so that the pain of doing nothing is greater than the pain of enacting a plan.

George W. Bush Institute founder James Glassman then attempted to shift the conversation towards focusing on deficit reduction in the context of encouraging economic growth. Specifically, he talked about tax reform, immigration reform, greater investment in education and R&D, and free trade. He noted the CBO projection of long-term growth and said that not only could we do better, but it was essential that we do better. However, Urban Institute president and CRFB board member Robert Reischauer disagreed, saying that while growth is certainly important, just hoping that we grow significantly faster than projected is no substitute for real tax increases and spending cuts. The Urban Institute’s Gene Steuerle talked about how to “minimize the political losses.” A couple strategies he mentioned are to either go big with deficit reduction so that everyone is affected in ways that are fair and even, or to set up targets and triggers so that the pain of doing nothing is greater than the pain of enacting a plan.

Norm Ornstein argued that bipartisanship has become less attractive to policymakers because the last time there was a bipartisan consensus on a difficult decision – according to him, the TARP vote – politicians got burned for it. With an already toxic political environment, the result is a level of dysfunction that he has not seen in Washington.

CRFB president Maya MacGuineas took a more optimistic tone, saying that she was encouraged by the number of fiscal plans that had come out recently and the greater level of specificity in the budget debate. She also said that the Fiscal Commission and the Gang of Six represented a model for how a deal would get done. With the debt ceiling, she expected a deal in the neighborhood of $1-2 trillion dealing with low hanging fruit, but worried it would not include any structural reforms to the major entitlement programs, and that delaying would politicize the issues and risk failing to reassure markets. On the topic of growth, she said that both the right and the left had good ideas on how to be conducive to growth including protecting public investments and sensible tax reforms, but it should be viewed as icing on the cake, rather than counted on as a major component of deficit reduction.

With that, the event segued into a speech by current NEC director Gene Sperling. He started by saying that even beyond the economics of the situation, deficit reduction is important for preventing the further erosion of confidence in the political system. However, he decried the threat of U.S. default to accomplish an objective. He praised the willingness of everyone in the Biden Group to come together and take their responsibility in the negotiations with a sense of seriousness, and he hoped to find a way to forge bipartisan consensus and get people off their hard positions.

Sperling said that the purpose of deficit reduction for the Administration is in keeping with the values of the Administration – specifically the promotion of a strong middle class and the promotion of a strong recovery. Consistent with those values, he warned against cutting investments in education, infrastructure, and R&D and implored that lawmakers make smart and targeted reductions in spending, not blanket cuts. On revenues, he noted that it was historical precedent – in 1982, 1983, 1990, and 1993 – that revenue be part of any bipartisan agreement. He pointed out that relying solely on spending cuts would require too-harsh cuts to programs and would undermine the principle of shared sacrifice that he thought made budget deals less unpopular.

Sperling also pointed out that the Administration is willing to compromise, and recognizes that, while they will ask Republicans to put revenues on the table, that they too must put cuts on the table that they don't like. As an example, Sperling pointed out the Medicaid changes suggested in the President's Budget Framework, saying the Administration doesn't recommend finding savings from Medicaid because it is somehow politically popular, but because they recognize that tough choices will have to be made.

After Sperling concluded his remarks, a number of participants were given the chance to make a few final statements. Former SEIU president Andy Stern spoke of the need for revenue measures to fulfill the goal of shared sacrifice. He said that he would like to raise taxes on corporations and would like to allow all of the Bush tax cuts to expire as scheduled in 2012. Carlo Cottarelli gave a few lessons from other fiscal consolidations, saying that growth is paramount for a successful fiscal adjustment.  Former Congressman and CRFB board member John Tanner, in closing remarks, echoed a common theme of the day – the polarization of Congress, which he attributes to the rise of primaries in the House. Tough primary battles, he said, cause those taking office on both sides to be more polarized. This leads to the difficulty of reaching a budget deal.

Former Congressman and CRFB board member John Tanner, in closing remarks, echoed a common theme of the day – the polarization of Congress, which he attributes to the rise of primaries in the House. Tough primary battles, he said, cause those taking office on both sides to be more polarized. This leads to the difficulty of reaching a budget deal.

To conclude, Maya MacGuineas thanked all of the panelists for coming and for a productive, albeit depressing, discussion.

After the conference concluded, participants and audience members crossed New Jersey Ave. to attend a cocktail reception on the picturesque rooftop pool deck of the Liaison Hotel. At the reception, CRFB co-chair and former ranking member of the House Budget Committee Bill Frenzel gave an introduction and salutation to the newest members of the CRFB board. Those new members in attendance were Erskine Bowles, Sen. Charles Robb, Sen. Alan Simpson, Rep. John Tanner, and Sen. George Voinovich. Other new board members who were not able to make it include Paul O’Neill, Rep. John Spratt, and Laura Tyson.

After introducing the new board members, Frenzel introduced the reception’s keynote speaker: OMB director Jacob Lew. Lew tried to lay out the state of play in Washington over the debt limit and fiscal policy, trying to answer the question of “What can we get done?” In an optimistic note, Lew pointed out that there is a clearer call for action now than ever before. Even still, Lew noted that credit agencies have made a distinction between their economic assessment and their political assessment of whether or not we can get our fiscal house in order.

After the reception, guests went to the ballroom at the Liaison to enjoy a dinner event. The dinner included a Q&A session with Fiscal Commission co-chairs Erskine Bowles and Alan Simpson, moderated by Judy Woodruff of PBS’s NewsHour. She started off by asking Bowles about the prospects of a budget deal.

Bowles, who, like Simpson, is a recent addition to the CRFB board, pointed to the growing momentum in Washington toward the idea that the nation needs a comprehensive fiscal plan, and he mentioned the Gang of Six and the prospect for its expansion into a larger group of potentially 25 or more Senators seeking a bipartisan compromise. Sen. Simpson expressed confidence that the Biden Group would produce something to be attached to a debt ceiling increase, but asserted that if no plan was produced with a debt ceiling increase, the rating agencies would turn on U.S. debt.

Despite the stubbornness of both parties on certain parts of the budget, Sen. Simpson also believed that a plan that deals with deficits would be comprehensive, because the cost of excluding entitlements and revenue would cause too much of the burden to fall on the other parts of the budget. Bowles concurred, saying that reforming entitlements had to be done, while raising revenue could be done by reforming the tax code in a pro-growth manner, such as the tax reform recommended by the Fiscal Commission.

When asked about the risk of cutting spending enough to harm the economic recovery, Bowles noted that the recovery was fragile and so the Commission plan agreed with the idea that cutting too quickly was too risky for the economy. Still, Simpson argued that the “tipping point” when the markets would turn on the debt was soon, so reducing the deficit was not just for future generations, but for current generations as well.

In a particularly sobering turn, Bowles compared our current situation to the Weimar Republic after World War I, with parallels in both deficits and loose monetary policy. Ideally, he hoped that a deficit reduction plan of $4 trillion is agreed upon in enough advance of the debt ceiling. Sen. Simpson stated his belief that any plan would have to “go big” because “small ideas have no power to inspire."

The 2011 CRFB Annual Conference and Dinner turned out to be both an informative and entertaining day filled with some very interesting discussion and interplay between budget experts from across the political spectrum. We only hope next year's event can be just as engaging.