Committee Sends Letter to CMS on Medicare Advantage

On August 31, the Committee for a Responsible Federal Budget commented on the Centers for Medicare and Medicaid Services' request for information on ways to support the affordability and sustainability of the Medicare Advantage (MA) program.

Below is the text of the comment:

RE: File code CMS-4203-NC

Dear Secretary Becerra and Administrator Brooks-LaSure:

The Committee for a Responsible Federal Budget welcomes the opportunity to comment on the Centers for Medicare & Medicaid Services’ (CMS) request for information on ways to support the affordability and sustainability of the Medicare Advantage (MA) program published in the Federal Register, vol. 87, no. 146, pp. 46918–46921 (August 1, 2022).

We are a nonpartisan organization dedicated to educating the public and working with policymakers on fiscal policy issues. Our focus on the nation’s long-term fiscal challenges, along with our Trust Fund Solutions project and Health Savers Initiative, has led us to believe that reforms to the Medicare Advantage program are crucial for extending Medicare trust fund solvency and achieving overall sustainability for the Medicare program and its beneficiaries.

Background

The Medicare Trustees project that the Hospital Insurance (Part A) trust fund will be insolvent within six years. Spending on the program itself is projected to grow from 3.9 percent of GDP in 2022 to 6.0 percent by 2040 and stay at roughly 6.5 percent each year from 2070 onward. Under the Chief Actuary’s more realistic alternative scenario, total Medicare spending could grow to 8.6 percent of GDP in 2096. Thus, action is needed soon to extend solvency and constrain the program’s spending growth.

The set of policy actions required to tackle Medicare insolvency and spending growth will need to include changes to Medicare Advantage. Within the next few years, it is estimated that half of all Medicare-eligible beneficiaries will be enrolled in a MA plan.1 MA costs are also projected to grow faster than Medicare costs overall and on a per capita basis.

Furthermore, our research, and the consensus among MedPAC, CBO, and other policy experts, shows that MA is more expensive to the federal government than traditional Fee-For-Service (FFS) Medicare when providing care to similarly situated beneficiaries.

This evidence cuts against one of the primary policy rationales for introducing managed care in Medicare: the potential for cost-savings and efficiencies from the alternative insurance design. Thus, even though there is some evidence that managed care can reduce costs, every year of MA plan overpayment reduces market incentives for innovation by allowing plans to profit from the overpayments rather than through improvements in quality and efficiency.

Additionally, overpayments to MA plans not only pose a threat to Medicare sustainability, but also are borne by Medicare beneficiaries in the form of higher premiums –including those who remain in traditional FFS Medicare.

In order to tackle the problem, reforms should focus on correcting for misaligned diagnostic coding incentives and moving to budget neutrality for quality bonuses.

Addressing Coding Intensity

Medicare Advantage overpayments primarily stem from incentives that lead MA plans to report enrollee diagnoses more completely than physicians billing FFS. MA plan beneficiaries thus appear sicker than they are relative to FFS beneficiaries, which leads to higher risk scores and higher payments. While CMS adjusts payments to account for differences in diagnostic reporting (called “coding intensity”), our research and MedPAC’s show that adjustments have fallen short of correcting the problem.

In our brief, Reducing Medicare Advantage Overpayments, we presented a simple method to estimate the size of coding intensity adjustments needed to correct for the problem and discuss the budgetary savings and Medicare Part A trust fund savings that could be obtained by reducing overpayments through this method. We also estimated savings using MedPAC’s methodology for estimating coding intensity.2

Our brief uses the Demographic Estimate of Coding Intensity (DECI) method, developed by Dr. Richard Kronick of the University of California, San Diego. The method suggests that fully adjusting for coding intensity in 2017 would involve a 15.4 percent adjustment of plan payments, and in 2019, a 19.3 percent adjustment. Instead, CMS has only adjusted payments at the statutory minimum of 5.9 percent.

MA plans use a variety of strategies to document all diagnoses to get the highest possible risk scores, including home-based risk assessments, chart audits performed by outside vendors, and sharing premium revenue with medical groups, which incentivizes physicians to record diagnoses that increase payments. An entire industry has developed in order to help MA plans maximize payments.

Historical data comparing risk scores in MA versus FFS shows how successful these efforts have been. In 2006, the average MA risk score was 98 percent of the FFS average; by 2017 it had grown to an estimated 112 percent and by 2019, 117 percent. There is substantial evidence that MA plans are benefiting from upcoding rather than enrolling sicker beneficiaries, which might justify the higher payments. Not only are beneficiaries more costly when they are enrolled in a MA plan, but there is evidence that they disenroll and return to FFS in high numbers in the last year of their lives when care is most expensive.3

Our brief looked at other measures of risk and found that MA enrollees are estimated to be less risky than FFS beneficiaries. MA members have demographic characteristics that lead us to expect lower expenditures on MA members than on FFS beneficiaries, take fewer drugs that are associated with high-cost conditions, and have lower mortality rates. The only measure on which MA members appear to be sicker than FFS beneficiaries is the measure that MA plans strongly influence – their diagnosis-based risk score. This finding, similar to findings from other researchers, provides support for the proposition that MA members appear to be sicker not because they are actually sicker, but because diagnostic information is reported differently by MA plans.

The DECI method assumes that controlling for demographics, MA members are no healthier and no sicker than FFS beneficiaries. The model further assumes that any difference in the currently used diagnostic risk scores and demographic-only risk scores are the results of differential coding between MA and FFS. The model estimates the coding intensity adjustment by comparing the relative risk of MA to FFS using the diagnostic model with the relative risk of MA using the demographic model.

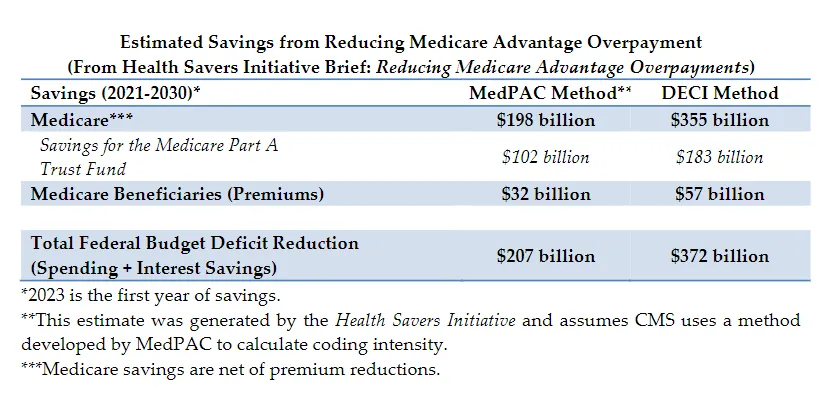

Our brief used the coding differentials estimated with the DECI and MedPAC’s methods to illustrate the savings that policymakers could obtain by eliminating MA overpayments. As shown in the table above, we estimated a range of savings over the 2021-2030 budget window that could be achieved if CMS were to adjust payments beyond the 5.9 percent statutory minimum, with 2023 being the first year we assume a plan payment adjustment would be possible.

If the DECI method of estimating and adjusting were implemented, we estimate net Medicare spending could decline by $355 billion. Of the savings, $183 billion would accrue to the Medicare Part A trust fund. In addition, Part B beneficiary premiums would be $57 billion lower. If the MedPAC method were used, we estimate savings would be lower compared to the DECI method. Net Medicare spending would decline by $198 billion, with $102 billion in savings accruing to Part A and $32 billion in reduced Medicare premiums.4

Subsequent to the publication of our brief, CMS made plan payment data for 2018 and 2019 available. Analysis of those data made clear that coding intensity efforts increased in 2018 and 2019, and updates to the analyses reported in our brief point to even larger savings than we estimated.5

Using either the DECI or MedPAC method, it is clear that the current coding intensity adjustment is too small and that a larger adjustment should be made to avoid continued overpayments to MA plans. The estimates above assume a full adjustment is implemented at the earliest date possible (in 2023). CMS could decide to ramp up adjustments more gradually in order to limit disruption to MA plans and beneficiaries.

Moving to Budget Neutrality for Quality Bonus Payments

The problem with coding differentials and MA risk adjustment more broadly is that they stray from the principle of budget neutrality. Neutrality is required in risk adjustment for the Affordable Care Act Marketplaces, for instance. Payment model demonstrations in Medicare FFS, Medicaid 1115 waivers, and changes to the Outpatient Prospective Payment System and the Medicare Physician Fee Schedule also require budget neutrality.

In MA, budget-neutral risk adjustment would hold the federal budget harmless in balancing payments between MA plans and between MA and FFS Medicare. Instead, Medicare adds payments as risk increases. Thus, in theory, all plans could enroll beneficiaries with an average risk score above 1.00 and earn additional payments under Medicare. The increased profit and enrollment incentives from such a system runs counter to the purpose of risk adjustment. This makes little sense, especially in a plan market as robust as MA with nearly half of Medicare enrollment.

The budget neutrality concept should also be applied to quality bonuses in the MA program. The Quality Bonus Program (QBP) was designed for CMS to internally measure MA plan quality and report the measure externally, so beneficiaries could make better plan choices. Medicare then pays bonuses (or “double bonuses” in certain locations) to plans that achieve a high “star” rating.

However, the QBP pays bonuses without subtracting payments from poorly performing plans. Furthermore, Medicare seems to grade on a curve. MedPAC has reported that nearly 90 percent of MA plans were rated four or five stars and received bonus payments, although they note that the number is somewhat larger than normal due to a relaxation in reporting requirements during the pandemic.6

This system has led to bonus payments increasing every year since 2015 7 and costing Medicare nearly $12 billion in 2022 alone.8

In addition to the fiscal costs, the QBP design itself doesn’t work. If nearly all plans receive high ratings, the ratings themselves are largely meaningless to potential enrollees to comparison shop. The quality bonuses, as currently implemented, are also biased against plans that enroll a large percentage of disadvantaged beneficiaries and therefore contribute to health inequities. To fix that, CMS and Congress should look at MedPAC’s recommendation that the quality bonus system be replaced by one that stratifies groups of enrollees by social risk factors across plans and compares them with similar enrollees in other plans to not penalize plans with higher shares of disadvantaged populations.9

We estimate, based on CBO estimates, that moving to budget neutral reform and eliminating quality bonuses could save as much as $200 billion over 10 years, nearly half of it going to the Medicare trust fund.10

Conclusion

Overpayments to Medicare Advantage plans are borne by the federal budget, the Medicare trust fund, and beneficiary premiums. The misaligned incentives and faulty design that have led to this situation are not inherent to having commercial insurance participation in the Medicare program and the ability for beneficiaries to have a choice when selecting their health insurance. In fact, fixing the design issues would improve competition between plans and especially between MA and FFS.

Thank you for the opportunity to submit comments. It is imperative to address these issues as cost growth and increased MA enrollment threaten the sustainability of the Medicare program. We welcome further engagement with CMS on these issues as well as any other areas of our research.

1 Committee for a Responsible Federal Budget, “Medicare Advantage Costs Continue to Rise,” May 19, 2022, https://www.crfb.org/blogs/medicare-advantage-costs-continue-rise

2 Committee for a Responsible Federal Budget, “Reducing Medicare Advantage Overpayments,” The Health Savers Initiative, July 22, 2021, https://www.crfb.org/papers/reducing-medicare-advantage-overpayments

3 United States Government Accountability Office, “Medicare Advantage: Beneficiary Disenrollments to Fee-for Service in Last Year of Life,” June 2021, https://www.gao.gov/assets/720/715370.pdf

4 MedPAC estimates that differential coding caused MA risk scores to be 9% higher than they would have been in 2019 if MA and FFS coding patterns had been identical. To estimate the 10-year savings, we assume that differential coding will cause that 9% estimate to increase at the same rate assumed for the DECI estimate, which started at a 1% increase in 2017, decreasing to 0.5% by 2030

5 Richard Kronick and F. Michael Chua, “Industry-wide and Sponsor-Specific Estimates of Medicare Advantage Coding Intensity,” November 2021, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3959446

6 In 2022 MedPAC noted that due, in part to the relaxation of quality reporting rules during the pandemic, 90% of MA enrollees were in plans that received quality bonuses.

7 Jeannie F. Biniek et al., Kaiser Family Foundation, “Spending on Medicare Advantage Quality Bonus Program Payment Reached $10 Billion in 2022,” August 25, 2022, https://www.kff.org/medicare/issue-brief/spending-onmedicare-advantage-quality-bonus-program-payment-reached-10-billion-in-2022/

8 Medicare Payment Advisory Commission, “Testimony: Improving the Medicare Advantage Program (Energy and Commerce),” June 28, 2022, https://www.medpac.gov/wp-content/uploads/2022/06/EC-Medicare-Advantagetestimony-FINAL-v2_SEC.pdf

9 Medicare Payment Advisory Commission, “June 2021 Report to the Congress: Medicare Payment Policy,” March 15, 2021, https://www.medpac.gov/wp-content/uploads/import_data/scrape_files/docs/defaultsource/reports/jun20_ch3_reporttocongress_sec.pdf

10 Committee for a Responsible Federal Budget, “Can Medicare Advantage Reforms Save the Trust Fund?” July 22, 2021, https://www.crfb.org/blogs/can-medicare-advantage-reforms-save-trust-fund