Analysis of CBO's July 2022 Long-Term Budget Outlook

Today, the Congressional Budget Office (CBO) released its July 2022 Long-Term Budget Outlook. Although CBO’s extended baseline is based on outdated economic assumptions, it nonetheless shows that the federal budget is on an unsustainable long-term trajectory. CBO’s report shows:

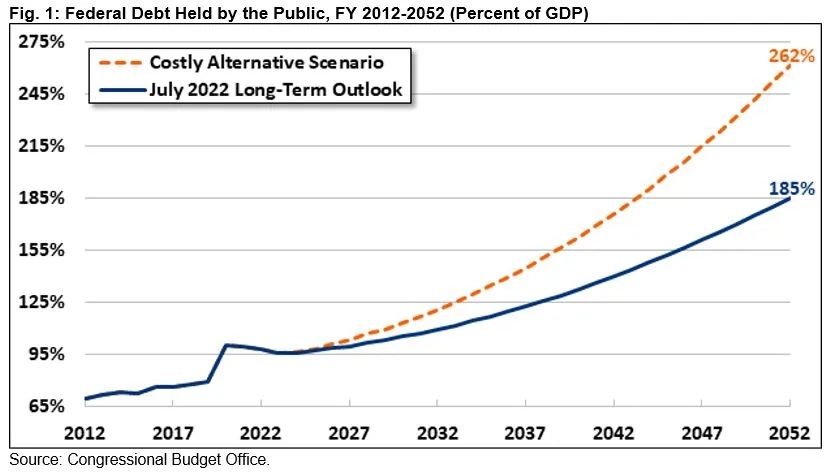

- Deficits and Debt Are on an Unsustainable Path. Under current law, CBO projects federal debt held by the public will rise from 98 percent of Gross Domestic Product (GDP) at the end of Fiscal Year (FY) 2022 to a record 107 percent by 2031 and 185 percent by 2052. Deficits will grow from 3.9 percent of GDP in 2022 to 11.1 percent in 2052.

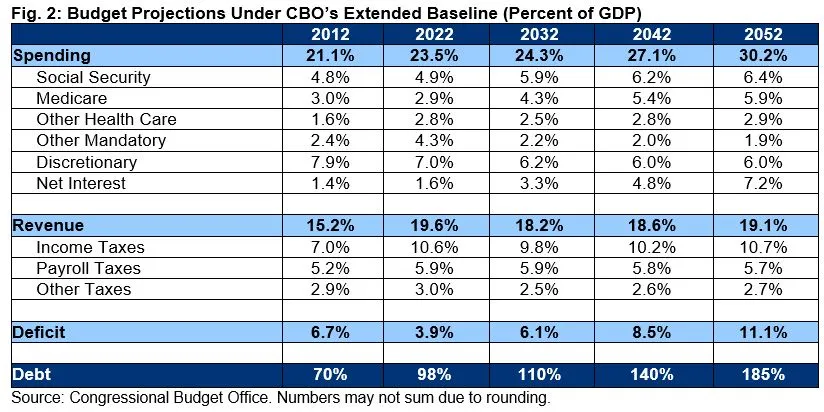

- Spending Will Outpace Revenue, and Interest Costs Will Explode. CBO projects spending will grow from 23.5 percent of GDP in FY 2022 to 30.2 percent in 2052, while revenue will reach only 19.1 percent of GDP. Interest costs are projected to more than quadruple as a share of the economy, from 1.6 percent of GDP in 2022 to 7.2 percent in 2052.

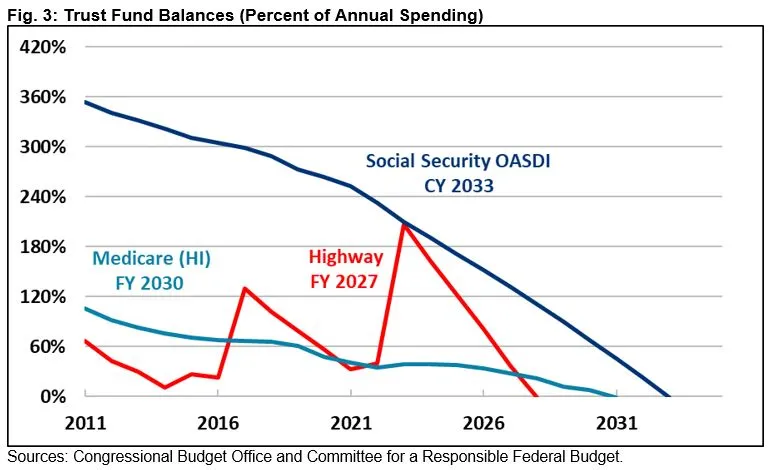

- Major Trust Funds Are Headed Toward Insolvency. CBO projects Highway Trust Fund (HTF) insolvency in FY 2027, Medicare Hospital Insurance (HI) insolvency in FY 2030, Social Security Old-Age and Survivors Insurance (OASI) trust fund insolvency in calendar year 2033, and Social Security Disability Insurance (SSDI) trust fund insolvency in calendar year 2048. On a theoretical combined basis, the Social Security trust fund will exhaust its reserves in 2033.

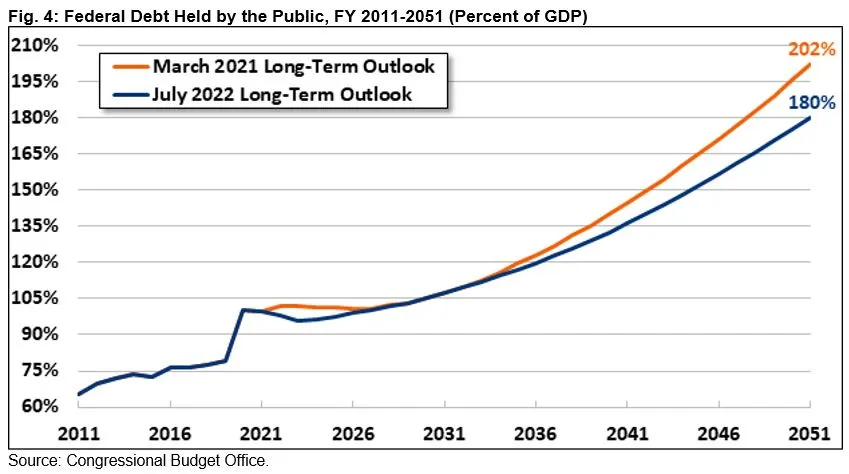

- The Long-Term Outlook is Better Than Last Year’s But Still Troubling. CBO projects debt will reach 180 percent of GDP by FY 2051, somewhat lower than the 202 percent it projected last year. This improvement is due to a combination of higher expected revenue and lower health costs over the next three decades along with lower expected interest rates in the second two decades.

- Debt Could Grow Much Faster than Projected. Should policymakers extend various expiring provisions and appropriate at higher levels, debt would grow much higher. CBO generates three alternative scenarios that assume higher discretionary spending and lower revenue than in its baseline. Under these scenarios, debt would grow to between 218 and 262 percent of GDP. Against current law, CBO also finds that higher interest rates or slower growth could boost debt to as high as 235 percent of GDP.

Ultimately, high debt levels will slow income and wage growth, increase interest payments on the national debt, place upward pressure on interest rates, reduce the fiscal space available to respond to an economic recession or other emergency, put an undue burden on future generations, and heighten the risk of a fiscal crisis. Policymakers should work today to get our long-term fiscal house in order.

Deficits and Debt Are on an Unsustainable Path

Under current law, CBO projects that federal debt held by the public will rise from 98 percent of GDP at the end of FY 2022 to a record 107 percent by 2031 and to 185 percent by 2052. For context, the 50-year average of debt held by the public is 46 percent of GDP. In nominal dollars, debt will grow by $114 trillion, from $24 trillion today to $138 trillion in 2052.

Deficits will also grow dramatically over the long term, from 3.9 percent of GDP in FY 2022 to 11.1 percent in 2052. This level of borrowing will be higher than at any time in modern history outside of World War II and the COVID-19 pandemic and over three times the 50-year average of 3.5 percent of GDP.

Debt and deficits could be significantly higher with alternative policy assumptions. Under CBO’s costly alternative scenario – where revenue and discretionary spending return to their historic averages – debt would rise to 262 percent of GDP by FY 2052 and the deficit would total 18.2 percent of GDP.

As CBO discusses, there are several adverse and potentially dangerous consequences of high and rising deficits and debt – many of which we discussed in our recent paper, “Risks and Threats from Deficits and Debt.” They include slower income and wage growth, higher interest payments on the national debt, upward pressure on interest rates, reduced fiscal space to respond to an economic recession or other emergency, an undue burden on future generations, and a heightened risk of a fiscal crisis. Under CBO’s costly alternative scenario, rising debt would reduce per-person income by $4,900 in 2052 compared to current law despite lower tax rates.

Spending Will Outpace Revenue, and Interest Costs Will Explode

Rising deficits and debt are driven by growing spending and the failure of revenue to keep up. CBO projects spending will grow from 23.5 percent of GDP in FY 2022 to 30.2 percent in 2052. Meanwhile, revenue – which is unusually elevated as a result of inflation and asset market gains – will fall from 19.6 percent of GDP in 2022 to a low of 17.6 percent in 2025 before growing to 19.1 percent in 2052.

Excluding interest payments on the national debt, primary spending will grow from 21.9 percent of GDP in FY 2022 to 23.0 percent in 2052, with increases in health and retirement costs partially offset by assumed reductions in discretionary spending as a share of GDP. CBO projects Social Security spending will grow by 1.5 percentage points of GDP, Medicare by 2.9 percentage points, and other health care by 0.1 percentage points. Other mandatory spending and total discretionary spending will fall by 3.4 percentage points of GDP.

As debt and interest rates both rise, CBO projects interest costs to be the fastest growing and, ultimately, the largest part of the federal budget. Specifically, interest costs will rise from 1.6 percent of GDP in FY 2022 to a record 3.3 percent in 2032 and 7.2 percent in 2052. Net interest spending will exceed defense spending by 2030, Medicare spending by 2046, and will be the single-largest line item in the federal budget by 2049.

While spending will rise rapidly, revenue will grow slowly (after its initial decline) and largely as a result of real bracket creep, as well as the expiration of many provisions in the Tax Cuts and Jobs Act, set to expire at the end of calendar year 2025. CBO projects individual income tax revenue will rise from 9.0 percent of GDP in FY 2025 to 9.8 percent in 2027 and 10.7 percent by 2052. Other revenue will remain relatively flat at about 8.5 percent of GDP per year in perpetuity.

Major Trust Funds Are Headed Toward Insolvency

Several important federal programs are financed through trust funds. CBO projects four major trust funds are approaching insolvency, three within the next 11 years. CBO projects the Highway Trust Fund will deplete its reserves by FY 2027, the Medicare Hospital Insurance trust fund by FY 2030, the Social Security Old-Age and Survivors Insurance trust fund by calendar year 2033, and the Social Security Disability Insurance trust fund by calendar year 2048. The theoretically combined Social Security trust funds will run out by calendar year 2033.

Framed another way, the Medicare trust fund will run out of reserves when today’s youngest retiree turns 70, and the Social Security trust fund will run out when they turn 73. The Highway Trust Fund will exhaust its reserves – recently replenished in the bipartisan infrastructure law – in just five years.

Upon insolvency, statute requires spending on these programs to be reduced to equal available revenue. CBO estimates that if policymakers allow this cut, Social Security benefits will be abruptly cut by 25 percent (rising to 30 percent) for all beneficiaries across the board. Medicare spending will be cut by 8 percent (rising to 11 percent) and highway spending by 45 percent.

Closing the trust fund shortfalls could significantly improve the long-term budget outlook. Based on our previous estimates, doing so in a pro-growth manner, while paying for all new initiatives, could be sufficient to stabilize debt at about the size of the economy (which is still quite high). Our Trust Fund Solutions Initiative has put forward numerous revenue and spending options to secure the highway, Medicare, and Social Security trust funds.

The Long-Term Outlook is Better Than Last Year’s But Still Troubling

CBO’s latest long-term budget outlook shows somewhat lower debt than in its March 2021 Long-Term Budget Outlook. By 2051, CBO projects debt to total 180 percent of GDP as opposed to 202 percent and a deficit of 10.8 percent of GDP as opposed to 13.3 percent.

The 2.5 percent of GDP reduction in the 2051 deficit outlook is driven largely by a combination of higher expected income tax revenue, lower health care costs, and reduced interest spending – partially offset by higher discretionary spending because of the FY 2022 omnibus bill. Lower interest spending stems partially from a methodologic change, under which CBO now forecasts lower interest rates in the second two decades of the long-term window.

Debt Could Grow Much Faster Than Projected

CBO’s latest long-term budget projections may prove to be overly optimistic. The extended baseline is based on economic assumptions set in March, which were projecting lower inflation, lower interest rates, and stronger economic growth than what the country has experienced to date. Additionally, CBO’s extended baseline does not account for several pieces of legislation on the verge of enactment, including the Honoring Our PACT Act. Finally, CBO’s projections assume a current law scenario where discretionary spending grows with inflation over the next decade and various tax cuts expire as scheduled.

CBO estimates that if discretionary spending grew with GDP instead of inflation over the next ten years, debt would reach 218 percent of GDP by 2052 instead of 185 percent under current law. If revenue also remained at 18 percent of GDP instead of increasing gradually over the long term, debt would grow to 233 percent of GDP by 2052. Additionally, if revenue further held to its 50-year average of 17.3 percent of GDP after 2025 – approximating an extension of all temporary tax provisions – debt would reach 262 percent of GDP by 2052.

Meanwhile, if interest rates grew an additional five basis points faster each year (150 basis points higher by 2052) or productivity grew 50 basis points slower, debt would reach roughly 235 percent of GDP by 2052 under current law. Under the reverse scenarios where interest rates were lower or productivity growth were higher, debt would reach 147 or 140 percent of GDP, respectively.

Conclusion

CBO’s latest long-term budget outlook reminds us of what we’ve known for some time but policymakers choose to ignore: the federal budget is on a long-term unsustainable trajectory. CBO’s extended baseline shows the budget outlook will deteriorate over the next three decades due to irresponsible tax and spending policies and the projected growth of health, retirement, and interest costs.

Under current law, debt will rise from an already massive 98 percent of GDP at the end of FY 2022 to 185 percent by 2052. The deficit, meanwhile, will total 11.1 percent of GDP in 2052 – higher than the 3.5 percent of GDP average seen over the past 50 years and higher than at any point in modern history outside of World War II and the COVID-19 pandemic. And interest costs will reach 7.2 percent of GDP by 2052, more than twice the prior record.

The long-term budget outlook could be much worse than CBO projects. Under CBO’s most costly alternative scenario, the deficit would total 18.2 percent of GDP and debt would rise to 262 percent of GDP by FY 2052. Under alternative economic assumptions (but current law policy assumptions), debt could reach 235 percent of GDP.

Ultimately, high debt levels will slow income and wage growth, increase interest payments on the national debt, place upward pressure on interest rates, reduce the fiscal space available to respond to an economic recession or other emergencies, put an undue burden on future generations, and heighten the risk of a fiscal crisis.

There is no silver bullet to fix the fiscal challenges we face. Policymakers ultimately need to take action to narrow the structural gap between spending and revenue and to restore solvency to the major trust funds.

Fortunately, many of the policy options to help combat inflation today can also improve the nation’s long-term fiscal outlook. Policymakers should act soon on these reforms.

Tags

What's Next

-

Image

-

Image

-

Image