The Worst Lame Duck Ideas That Can Add $1.5 Trillion to the Debt

Policymakers are considering using the lame duck session to substantially worsen the nation's budget. A commonly discussed package would add potentially as much as $1.5 trillion over the next 10 years. According to news reports [last one is behind a paywall], politicians of both parties have talked about deficit-financing a permanent continuation of tax breaks that expired last year and a replacement of the Medicare SGR. A lame duck session is not an excuse to throw fiscal responsibility out the window. We recently released the PREP plan, which shows one way lawmakers could pay for these changes.

Failing to offset these policies would add a huge amount to the debt. Continuing the extenders would wipe away all the new revenue raised in the fiscal cliff deal, while failing to offset the SGR reprieve would break with years of precedent, as the doc fix has been paid for 98 percent of the time since 2004.

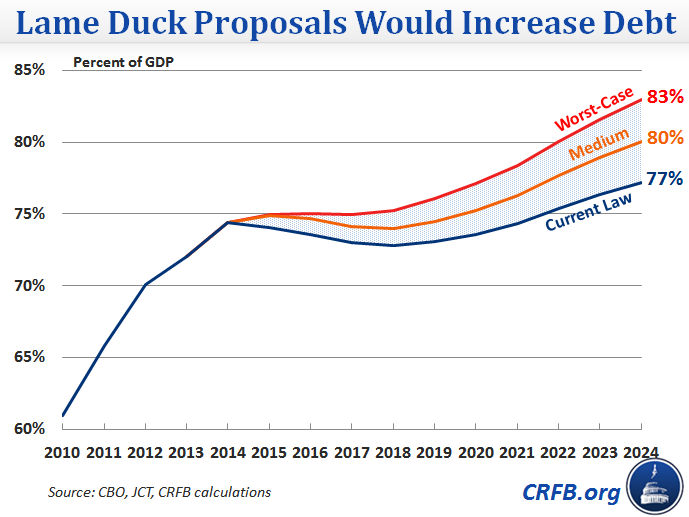

A moderate-sized package that includes the SGR and health extenders, plus one of the most-often discussed combinations of tax extenders, would add $640 billion to the debt ($760 billion with interest), increasing the debt by another 3 percent of GDP. In a worst case scenario if lawmakers take the most costly approach (described below), debt would rise from a near record-high 74 percent of GDP today to 83 percent of GDP by 2024. Conversely, if policymakers follow current law spending levels, debt will be much lower – still growing, but reaching 77 percent of GDP by 2024.

The worst-case $1.5 trillion increase in debt comes from two sources.

First, it assumes recent reports that Democrats and Republicans will horse trade for a bad deal on tax extenders are accurate, with that trade ultimately leading to all extenders – plus proposed expansions – being made permanent or continuously extended. All of these provisions could cost up to nearly $1.2 trillion over the next ten years. Second, it assumes that lawmakers enact a permanent deficit-financed replacement of the doc fix, as some lawmakers have suggested. This would cost $144 billion; also extending the "health extenders" would cost another $35 billion.

If all of these policies passed during the lame duck session, ten-year deficits would increase by nearly $1.3 trillion, or $1.5 trillion after interest.

Continuing Current Policy Costs Trillions

| Policy | Ten-Year Savings |

| Expand tax provisions, as proposed by the Ways & Means Committee | $805 billion |

| Renew all other tax provisions that expired in 2013 | $205 billion |

| Permanently extend policies that expire in 2017* | $165 billion |

| Permanently replace the SGR & continue health extenders | $180 billion |

| Potential Costs of the Lame Duck |

$1,290 billion |

| Interest Costs | $250 billion |

| Total Debt Impact |

$1,540 billion |

Source: CBO, JCT, CRFB calculations. Numbers differ slightly from previous tables due to updated JCT estimates.

*The American Opportunity Tax Credit is counted in both the cost of the Ways & Means expansions and with the 2017 provisions, so the total line removes this double-counting,

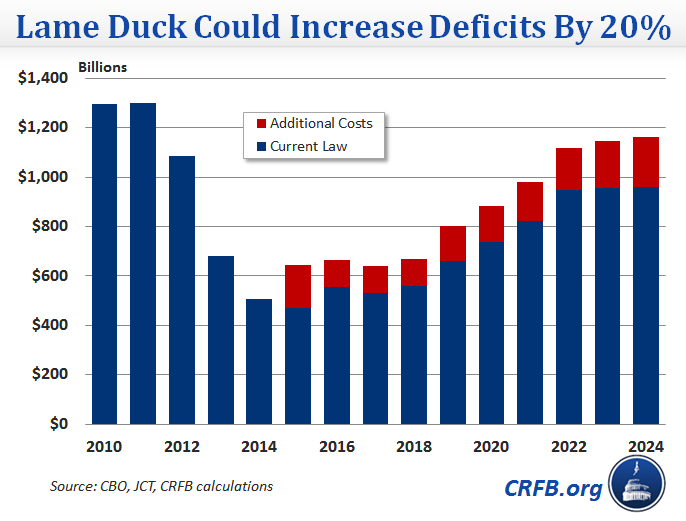

Under the worst-case scenario, the budget deficit, which has fallen in recent years as the economy recovered, would increase by 35 percent next year and about one-fifth in the following years.

The lame duck should not be an excuse to add trillions to our national debt. Policymakers can make constructive choices during the lame duck session by finding savings to offset the costs of any policies they choose to extend. If policymakers are looking for ideas, they can start with our Paying for Reform and Extension Policies (PREP) Plan, which shows how lawmakers could pay for SGR reform and continuing the extenders with sensible policies that improve value in health care and reduce tax loopholes.

Further Reading:

Extending the tax provisions without offsets:

- Lowers the baseline for tax reform,

- Makes costs disappear from the budget process, and

- Increases the risk of abandoning PAYGO altogether.

table.alternate

{

border:1px solid black;

border-collapse:separate;

border-spacing:1px;

}

table.alternate tr:nth-child(odd) td{

background-color:rgb(227,235,244);

}

table.alternate tr:nth-child(even) td{

background-color:white;

}

table.alternate tr:last-child

{

border-top-style:double;

border-top-color:black;

}

table.alternate a {text-decoration:none;}