Unpaid-for Tax Cuts Would Shrink Incomes, CBO Finds

The Congressional Budget Office (CBO) recently found that extending the 2017 Tax Cuts and Jobs Act (TCJA) and adding $1.5 trillion in additional tax cuts, as the Fiscal Year (FY) 2025 Senate reconciliation instructions propose to do, would significantly reduce per-person income – ultimately by more than the size of the tax cut.

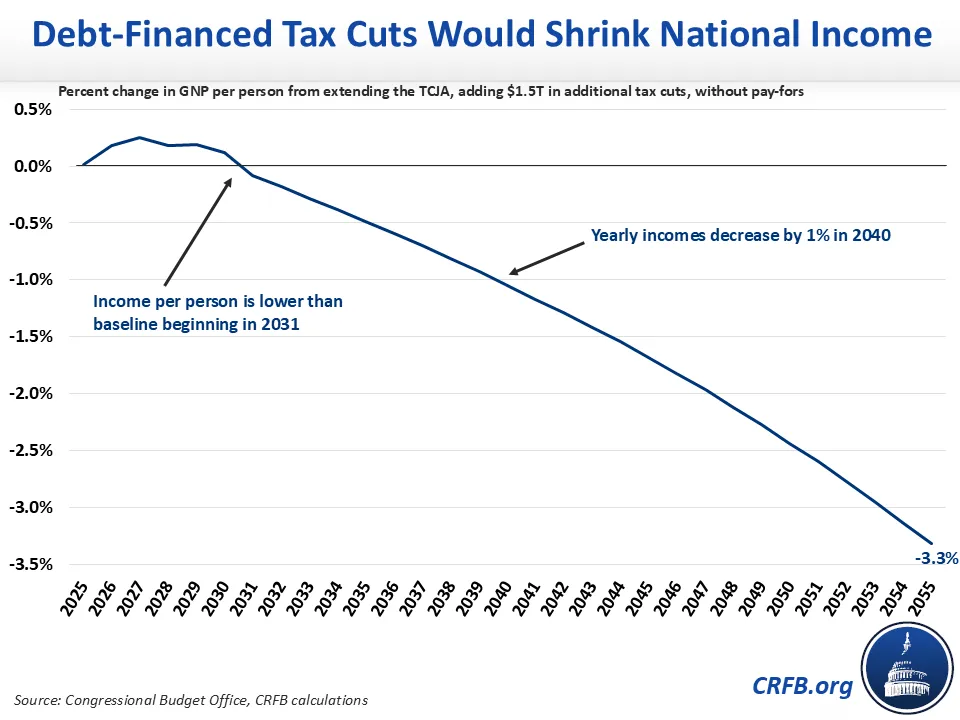

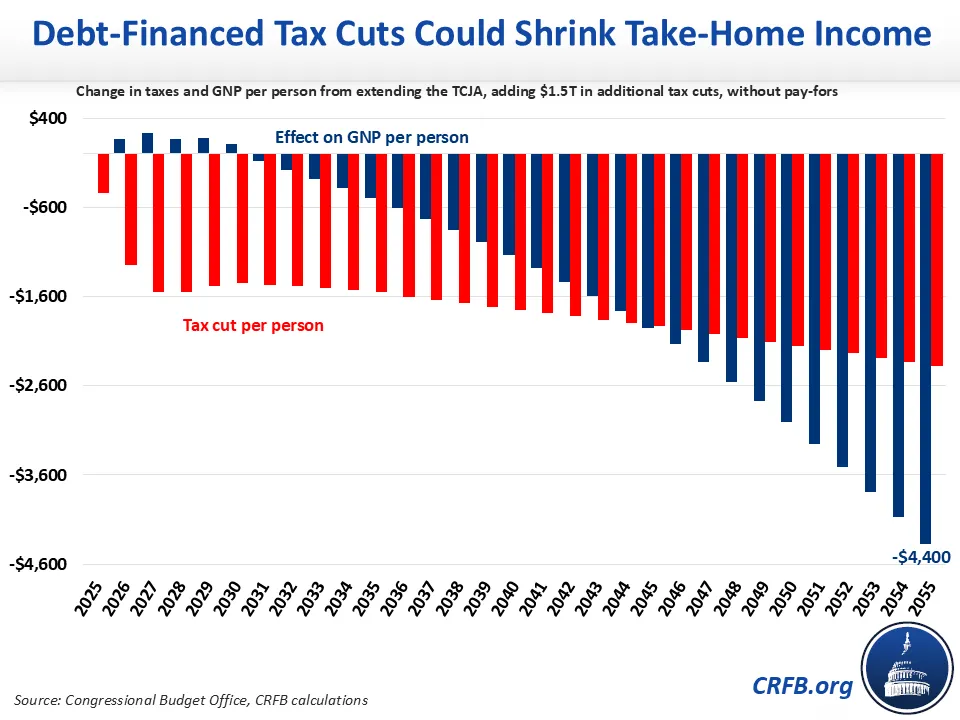

Specifically, CBO finds that such a package – assuming the additional $1.5 trillion tax cuts take the form of a $150 billion per year tax credit – would reduce gross national product (GNP) per person by $4,400, or 3.3 percent, by 2055. That compares to an average tax cut of roughly $2,400 per person in that year.

CBO finds:

- Tax cuts would raise Americans’ incomes by up to 0.3 percent from 2025 through 2027 but shrink Americans’ incomes overall in 2031 and beyond.

- By 2055 incomes will be 3.3 percent lower than they would have been without the tax cuts – a $4,400 yearly drop in income in today’s dollars.

- By roughly 2046, the reduction of income will be larger than the tax cut itself.

- Based on CBO’s numbers, we estimate after-tax income would fall by $4,000 between 2035 and 2055, including by more than $1,000 per year after 2050.

CBO’s latest analysis is similar to an earlier analysis of how extending the TCJA without pay-fors would shrink the economy as measured by Gross Domestic Product (GDP). However, this latest analysis includes an additional $150 billion per year of tax cuts and shows Gross National Product (GNP) per person as opposed to GDP. The key difference is that GNP measures goods and services produced by labor and property supplied by U.S. residents, while GDP measures goods and services produced by labor and property located in the United States. Broadly, GDP can be said to measure national production, while GNP measures national income.

It is important to note that CBO assumes the $150 billion per year of tax cuts comes from a tax credit that has no effect on the incentive to work or invest. If used for pro-growth tax cuts, the overall negative economic effects could be somewhat smaller. Some poorly designed tax changes, on the other hand, could exacerbate the negative economic effects modeled here.

CBO Finds $5.3 Trillion in Tax Cuts Would Shrink Incomes

The first-order effect of tax cuts is generally to boost incomes, not just by lowering taxes paid but also by boosting near-term consumption and increasing incentives to work, save, and invest. But without offsets, tax cuts also add to the national debt – and higher debt can constrain investment by pushing up interest rates, crowding out private investment dollars, and thus reducing Americans’ productivity and incomes. In the case of extending the TCJA and adding additional tax cuts, CBO finds that there will be net positive economic effects for several years, but by 2031 before-tax, per-person incomes will be increasingly lower than in a world where the tax bill does not pass.

In real (inflation-adjusted) dollars, average incomes would be $400 lower in 2034 and $4,400 lower in 2055 than in a future where such a deficit-busting bill never passed. Cumulatively, per-person income would drop by $45,000, in today’s dollars, between 2025 and 2055.

In percentage terms, CBO estimates the tax cuts would increase income per person by about 0.2 percent higher than baseline through 2029, but then gradually reduce per-person income – by 3.3 percent in 2055.

The primary reason incomes will be lower is because CBO estimates this package will explode the deficit by more than $51 trillion over 30 years, bringing debt held by the public to 220 percent of GDP, 63 percentage points higher than in the baseline (after accounting for interest costs).

American Incomes Eventually Drop by More Than the Tax Cut

Although before-tax incomes will begin to fall after 2030, Americans will still enjoy higher after-tax incomes as a result of the tax cut for the next two decades – assuming the higher debt does not necessitate a fiscal correction in the form of future spending cuts or tax increases

By 2045, however, we estimate per-person income will fall by more than the average tax cut per person (as approximated by change in primary deficit). In 2055, for example, the $4,400 reduction in GNP per capita will be nearly twice as large as the $2,400 per-person tax cut. This suggests a significant reduction in after-tax income.

In fact, reductions in per-person income will wipe out the gains of the tax cuts in the second two decades of CBO’s score. Over that period, GNP per capita will fall by $45,000 in today’s dollars, compared to the cumulative per-person tax cut totaling roughly $41,000.

Importantly, these are averages. Some Americans will receive above-average tax cuts (such as those with large tax bills) while some Americans will see above-average income drops (such as workers at employers with high exposure to interest rate increases).

The proposal analyzed here would entail an unprecedented increase in debt and deficits and as a result would slow economic growth. CBO is also not alone in projecting that rising debt will lower future incomes and could cancel out the effect of tax cuts. Congress could lessen the negative impacts on American incomes and economic growth by paying for the package with spending cuts or by eliminating tax expenditures. We have compiled tens of trillions of dollars in potential offsets for such a package in our Budget Offsets Bank.