Tax Extensions Wipe Away the President’s Budget Savings

The President’s Fiscal Year (FY) 2025 budget proposal calls for $3.3 trillion of net deficit reduction through 2034. However, these savings could disappear if the President extends various expiring tax provisions without additional offsets. In the budget, President Biden suggests he will work with Congress to responsibly extend expiring elements of the Tax Cuts & Jobs Act (TCJA) for taxpayers earning less than $400,000. The budget also temporarily extends one element of the TCJA – the Child Tax Credit (CTC) – through the end of 2025.

In this piece, we estimate:

- Extending the TCJA and CTC expansion for incomes below $400,000 would likely cost $2.8 to $3.8 trillion through 2034.

- Without additional offsets, these new costs would turn the $3.3 trillion of deficit reduction in the budget to somewhere between $500 billion of savings and a $500 billion debt increase.

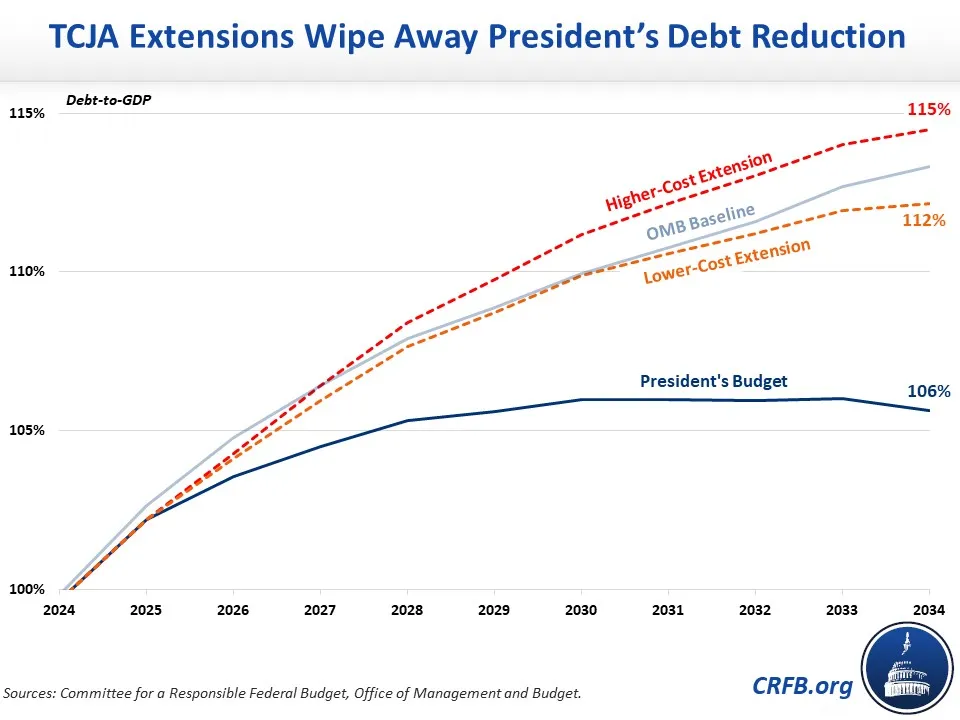

- Without additional offsets, these extensions would boost debt to between 112 and 115 percent of Gross Domestic Product (GDP) by 2034 under the budget, compared to 106 percent without these extensions.

At the end of 2025, most of the individual income and estate tax provisions under the 2017 Tax Cuts & Jobs Act are scheduled to expire.1 Extending them in full would cost around $3 trillion through 2034, while allowing them to expire would lead to a significant change in the tax code between 2025 and 2026.

| Join the Committee for a Responsible Federal Budget on March 28 for a summit focusing on the 2025 tax cut expirations and future tax policy – When the TCJA Expires: A Tax Policy Summit. |

For the most part, the President’s budget itself ignores these expirations.2 Instead the budget includes language asserting that the President opposes tax cut extensions for Americans earning over $400,000 per year and that he will work with Congress to pay for extensions for those making below $400,000. The budget does not specify what any of these pay-fors would look like, but it does make two major changes to the TCJA prior to the 2025 expiration – restoring the top rate to 39.6 percent (up from 37 percent) and significantly expanding the Child Tax Credit.

The cost of extending the TCJA tax cuts below $400,000 depends heavily on the details. For example, we estimate that extending all elements of the TCJA other than the top rate (restored to 39.6% as proposed in the budget) and the estate tax (returned to pre-TCJA levels) would cost about $2.45 trillion relative to the President’s budget. If the President also allowed the Alternative Minimum Tax (AMT) and Pease limitation to return above $400,000 and allowed the 20% pass-through deduction to expire above $400,000, the cost of extension would drop to $1.55 trillion.

In either case, extending the President’s proposed revival of the American Rescue Plan’s Child Tax Credit expansion – a fully refundable and advanceable $3,000 per child ($3,600 per young child) – would cost an additional $900 billion through FY 2034.

With interest this suggests an additional $2.8 to $3.8 trillion of costs, leading the budget to save only $500 billion assuming the more targeted extensions or actually add $500 billion to the debt under the broader extension.

President's Budget Including Tax Extensions for Individuals

| Lower-Cost Extension | Higher-Cost Extension | |

|---|---|---|

| Savings in Budget | -$3,300 | -$3,300 |

| Extend TCJA below $400,000 | $1,550 | $2,450 |

| Extend expanded CTC | $900 | $900 |

| Additional Interest Costs | $350 | $450 |

| Subtotal | $2,800 | $3,800 |

| Updated Budget Cost/Savings (-) | -$500 | $500 |

Sources: Committee for a Responsible Federal Budget, Office of Management and Budget. Estimates of extensions account for overlaps with the President’s policies, specifically with the proposals to increase the marginal rate on taxpayers above $400,000 to 39.6 percent and to strengthen the limitation on business losses. Numbers are in billions of dollars.

Encouragingly, the President has said he would fully offset these new costs and do so with “additional reforms.” However, his budget already calls for raising taxes on corporations and those making over $400,000 per year by about $5 trillion over a decade. Extending parts of the TCJA with offsets from that same group would mean roughly $3 to $4 trillion more of tax increases. Combined, the tax increases in the President’s Budget and offsets for TCJA extensions would increase revenues from corporations and those earning above $400,000 by about one-third. This magnitude is likely unrealistic – especially on top of upper-income tax increases the President has hinted at to restore Social Security solvency – and certainly should not be taken for granted without specific offsets.

If the President’s budget were to instead deficit finance these extensions or pay for them out of proposed savings in the budget, debt would rise from 97 percent of GDP today to between 112 percent of GDP and 115 percent of GDP by 2034. That’s significantly higher than the 106 percent of GDP that the Office of Management and Budget projects debt will reach by 2034 under the budget as written.

1 Expiring provisions include lowering individual income tax rates across the board, replacing personal and dependent exemptions with an expanded standard deduction and doubled Child Tax Credit, repealing the alternative minimum tax for most taxpayers, repealing the “Pease” surtax, establishing a 20 percent pass-through deduction percent of qualified business income, doubling the estate tax exemption to $11 million ($13.9 million by 2025), limiting the state and local tax (SALT) deduction to $10,000 per tax unit, capping mortgage interest deduction at $750,000, repealing certain other itemized deductions, and limiting the deductibility of business losses against non-business income (expires after 2028).

2 The budget does permanently extend (and modestly expand) the limitation of the deductibility of business losses against non-business income. It also modifies the top tax rate and Child Tax Credit set by the TCJA.