Analysis of the President's FY 2025 Budget

The White House released its Fiscal Year (FY) 2025 budget proposal today, outlining President Biden’s tax and spending priorities for the next decade. The budget proposes $3.3 trillion of net deficit reduction through 2034 and projects debt would grow from 97 percent of Gross Domestic Product (GDP) at the end of FY 2023 to nearly 106 percent by the end of 2034. Based on the Office of Management and Budget’s (OMB’s) estimates, our analysis finds that under the President’s budget:

- Debt would approach but not breach its previous record as a share of the economy, growing to a high of 106 percent of GDP by 2030 and stabilizing around that level. In nominal dollars, debt would grow by $17.7 trillion, from $27.4 trillion today to $45.1 trillion by the end of 2034.

- Deficits would total $16.3 trillion (4.6 percent of GDP) between FY 2025 and 2034, reaching $1.7 trillion (3.9 percent of GDP) in 2034.

- Spending and revenue would average 24.4 and 19.7 percent of GDP, respectively, over the next decade, with spending totaling 24.2 percent of GDP and revenue 20.3 percent of GDP in 2034. The 50-year historical average is 21.0 percent of GDP for spending and 17.3 percent for revenue.

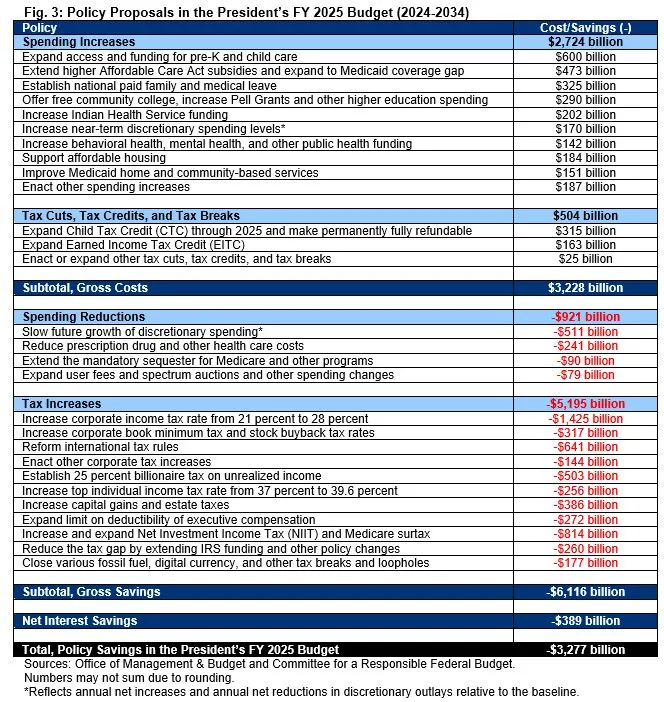

- The proposals in the President’s budget would reduce projected deficits by $3.3 trillion on net through 2034, including $3.2 trillion of new spending and tax breaks, $5.2 trillion of revenue increases, over $900 billion of spending reductions, and nearly $400 billion of net interest savings.

- The budget irresponsibly punts on tax cut extensions and Social Security solvency by calling to extend expiring tax cuts for those earning below $400,000 with offsets and extend Social Security solvency but failing to specify the policies to accomplish these goals or incorporate the cost of the extensions.

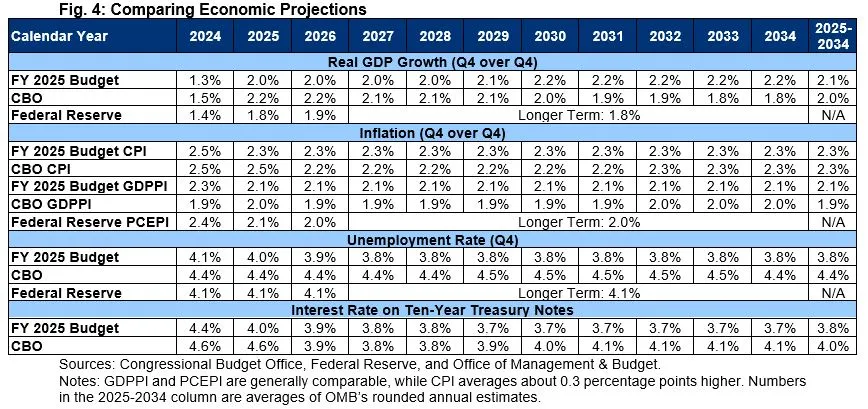

- The budget assumes strong economic growth and stable inflation, with assumptions in line with consensus over the next few years but somewhat more optimistic later in the decade. The budget assumes real GDP growth of 2.1 percent per year, compared to CBO’s 2.0 percent projection. It assumes the ten-year Treasury yield to average 3.8 percent, compared to CBO’s 4.0 percent.

The President’s budget encouragingly pays for new initiatives and reduces deficits. However, it falls short of proposing the necessary deficit reduction that is needed to put the nation on a sustainable fiscal path and fails to recognize the immense cost of extending expiring tax provisions. It includes important measures to improve Medicare solvency and sustainability but fails to say how it would avoid Social Security insolvency. Still, the proposed $3.3 trillion of net deficit reduction would represent an important step toward long-term fiscal sustainability.

Debt, Deficits, Spending, and Revenue Under the President’s FY 2025 Budget

The President’s budget projects debt would grow through FY 2030 and then stabilize at just below the all-time record of 106.1 percent of GDP set just after World War II. Specifically, federal debt held by the public would rise from 97.3 percent of GDP at the end of 2023 to 106.0 percent by 2030, and then remain around those levels through 2034. In nominal dollars, debt would grow by $17.7 trillion, from $27.4 trillion today to $45.1 trillion by the end of 2034.

Although debt would grow over most of the budget window, it would grow more slowly than under OMB’s baseline. OMB projects that debt under current law would reach 113 percent of GDP by the end of FY 2034, which is somewhat lower than CBO’s 116 percent of GDP projection.

Annual budget deficits under the President’s budget would also remain high. Specifically, the deficit would grow from $1.7 trillion in FY 2023 to $1.9 trillion in 2024, then fall to $1.5 trillion in 2029 before rising again to $1.7 trillion by 2034. As a share of GDP, the deficit would rise from 6.3 percent in 2023 to 6.6 percent in 2024, before falling to 3.9 percent of GDP by 2034.

Over the 2025 to 2034 budget window, deficits under the President’s budget would total $16.3 trillion (4.6 percent of GDP), which is $3.2 trillion (0.9 percent of GDP) lower than OMB’s baseline projection of $19.5 trillion (5.5 percent of GDP). In 2034, the deficit would be $556 billion (1.3 percent of GDP) lower than OMB’s baseline projection of $2.2 trillion (5.2 percent of GDP).

The President’s budget would increase both spending and revenue relative to what is projected under current law. Spending would average 24.4 percent of GDP over the budget window, compared to 23.9 percent of GDP under OMB’s baseline. Revenue, meanwhile, would average 19.7 percent of GDP, compared to 18.4 percent of GDP under OMB’s baseline.

In 2034, revenue would reach 20.3 percent of GDP and spending would be 24.2 percent. The 50-year historical average is 21.0 percent of GDP for spending and 17.3 percent of GDP for revenue.

More than the entirety of spending growth under the President’s budget comes from Social Security, Medicare, and interest costs. Social Security is projected to grow by 0.7 percent of GDP between FY 2023 and 2034, Medicare by 0.9 percent of GDP, and interest costs by another 0.9 percent of GDP. Other spending will shrink by a combined 1.0 percent of GDP, as proposed discretionary spending will grow much slower than the economy, and this effect is only partially countered by the cost of new spending initiatives.

Revenue under the President’s budget would rise from 16.5 percent of GDP in 2023 to 19.4 percent by 2027 and to 20.3 percent of GDP by 2034. About 1.4 percent of GDP of this increase is due to tax policy in the budget. The remaining 2.4 percent of GDP is due to a combination of the assumed expiration of many parts of the Tax Cuts and Jobs Act of 2017 (which the budget says will be largely extended with offsets), recovery of depressed revenue levels in 2023, built-in growth from ‘real bracket creep,’ and other factors.

Policy Proposals in the President’s FY 2025 Budget

The President’s budget includes policy changes that it estimates would reduce budget deficits by $3.3 trillion through FY 2034. This claimed deficit reduction is the net effect of $3.2 trillion of new spending and tax breaks, $5.2 trillion of revenue increases, over $900 billion of spending reductions, and nearly $400 billion of net interest savings. We will publish an in-depth analysis of the proposals in the President’s budget in the coming days.

Economic Assumptions in the President’s Budget

The budget’s economic assumptions – which incorporate economic feedback from the President’s proposals – underlie its budget estimates. Strong economic growth and low interest rates can improve the fiscal outlook, and vice versa. Overall, the assumptions in the President’s budget are in line with consensus in the early years, though more optimistic late in the budget window.

The budget forecasts real GDP growth will average 2.1 percent, including 1.3 percent real GDP growth in 2024, 2.0 percent in 2025, and 2.2 percent growth in 2034. CBO forecasts 2.0 percent average growth, including 1.5 percent growth in 2024, 2.2 percent in 2025, and 1.8 percent in 2034. The Federal Reserve forecasts 1.4 percent growth in 2024 and about 1.8 percent growth thereafter.

This stronger growth is reflected in the budget’s employment forecasts, with the unemployment rate stabilizing at about 3.8 percent, compared to CBO’s 4.4 percent and the Fed’s 4.1 percent.

Regarding interest rates, OMB forecasts the ten-year Treasury note yield to average 4.4 percent in 2024, 4.0 percent in 2025, and about 3.7 percent by 2034. It expects the three-month yield to average 5.1 percent in 2024 and fall to about 2.7 percent per year by 2031. By comparison, CBO projects the ten-year yield will total 4.1 percent by 2034, while the three-month yield normalizes around 2.8 percent by 2027.

Finally, the budget projects inflation to normalize next year, with the change in the GDP Price Index totaling 2.3 percent in 2024 and 2.1 percent per year – around the Federal Reserve’s 2 percent target – thereafter. CBO and the Federal Reserve both assume inflation normalize this year or next around the 2 percent target.

Conclusion

While debt under the President’s budget would grow at a slower rate than projected under current law, it would grow faster than the economy at a time when policymakers should be reducing the debt as a share of the economy. Debt would likely grow more rapidly under a re-estimate of the budget by CBO, and it would certainly grow faster if one accounted for the cost of extending expiring tax provisions, as the budget calls for without specifying offsets.

While we are glad the budget calls for extending Social Security’s solvency and offsetting any tax extensions, it is extremely disappointing that the budget does not include any specific policies to achieve these goals. Adding the cost of the tax cut extensions into the budget without further offsets could wipe away most or all of the budget’s deficit reduction. Meanwhile, failing to address Social Security solvency would result in a 23 percent across-the-board benefit cut in 2033.

Even under the budget’s own numbers, federal debt held by the public would rise from 97 percent of GDP at the end of FY 2023 to 106 percent of GDP, nearing the previous record, by 2030. It is discouraging that President Biden’s budget continues to propose trillions of dollars of new spending and tax breaks without putting forward a plan to responsibly address expiring tax cuts, restore Social Security solvency, or put debt on a sustainable downward path.

Nevertheless, President Biden does deserve praise for putting forward a comprehensive budget proposal that not only offsets new spending and tax breaks but would also reduce budget deficits by $3.3 trillion through 2034. These savings are less than half of what is needed to stabilize federal debt over the next decade, but they represent an important step forward and offer an opportunity to build on the savings from the Fiscal Responsibility Act.

We hope Congress and the President will come together on a plan to save at least the $3.3 trillion called for in this budget, responsibly extend expiring policies, and avoid Social Security insolvency – and do so in a fair, pro-growth, and ideally bipartisan manner.

What's Next

-

-

Image

-

Image