Tax Cut Extensions Cost Over $3.3 Trillion

Some parts of the 2017 Tax Cuts and Jobs Act (TCJA) have recently expired or changed, and large portions of the TCJA will expire by the end of calendar year 2025. Extending these provisions without offsets would dramatically worsen the fiscal situation. Based largely on recent projections from the Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) this piece shows:

- Extending the TCJA in full would cost over $3.3 trillion through 2033, or $3.8 trillion with interest.

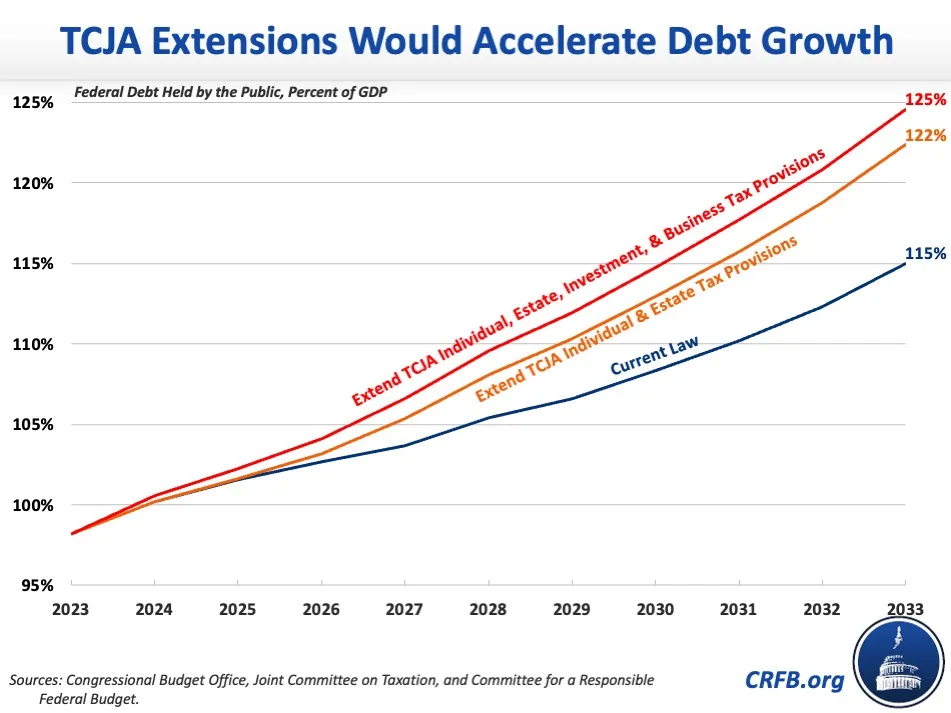

- Extensions would boost debt to 125 percent of GDP by 2033, from 115 percent under current law.

- Extensions would boost deficits above 8 percent of GDP in 2033, from 6.8 percent under current law.

- Extending individual provisions that expire at the end of 2025 would cost $3.4 trillion through 2035.

Given the tremendous cost of extending these tax cuts, lawmakers should carefully consider which provisions are worth extending, which should be modified, and which should be allowed to expire as scheduled. Lawmakers should also ensure that any extensions are fully paid for in the context of a plan to reduce, or at least not add to, the debt. To assist in this process, the Committee for a Responsible Federal Budget is developing a Build Your Own Tax Extensions interactive tool. A beta version of the tool can be downloaded here.

Tax Extensions Would be Costly

Based on recent data from CBO and JCT, extending the TCJA in its original 2018 form would cost more than $3.3 trillion over the next decade. The majority of this expense comes from the $2.6 trillion cost for extending the TCJA's individual income and estate tax provisions that mostly expire at the end of calendar year 2025. This includes lower tax rates at all income levels, replacement of the personal and dependent exemptions with a larger standard deduction and child tax credit, the repeal of the Alternative Minimum Tax (AMT) for most taxpayers, shrinking of the estate tax, the 20 percent deduction for certain pass-through business income, a $10,000 limit on the deduction for state and local taxes (SALT), and other measures.

Deficit Impact of Extending Tax Cuts and Jobs Act Provisions

| Policy (First Year Policy Expires or Changes) | 2024-2033 Cost/Savings (-) |

|---|---|

| Reduced Individual Income Tax Rates (2026) | $1.8 trillion |

| Elimination of Personal Exemptions (2026) | -$1.6 trillion |

| End of Alternative Minimum Tax (AMT) for most taxpayers (2026) | $1.1 trillion |

| Doubled Standard Deduction (2026) | $1.0 trillion |

| $10,000 SALT Deduction Cap and Other Deduction Changes (2026) | -$935 billion |

| Increased Child Tax Credit from $1,000 to $2,000 (2026) | $604 billion |

| 20 Percent Pass-Through Deduction (2026) | $548 billion |

| Limit on Pass-Through Business Loss Deduction (2029) | -$137 billion |

| Doubled Estate Tax Exemption Threshold (2026) | $126 billion |

| Opportunity Zone Capital Gains Deferrals (2027) | $67 billion |

| Subtotal, Extend TCJA Individual and Estate Tax Extensions | $2.6 trillion |

| 100 Percent Bonus Depreciation (2023) | $325 billion |

| Reinstated R&E Expensing (2022) | ~$200 billion |

| Reduced Foreign-Derived Intangible Income (FDII) Deduction (2026) | $111 billion |

| Looser Limit on Qualified Business Interest Deduction | ~$50 billion |

| Other Changes (2026 and 2028) | $39 billion |

| Subtotal, Extend TCJA Business Provisions | ~$720 billion |

| Total, Extend TCJA Individual, Estate, and Business Provisions | $3.3 trillion |

| Interest | $420 billion |

| Total, Extend TCJA Individual, Estate, and Business Provisions with Interest | $3.8 trillion |

Sources: Congressional Budget Office, Joint Committee on Taxation, and Committee for a Responsible Federal Budget. Numbers may not sum due to rounding.

Policymakers may also choose to prevent, revive, or otherwise adjust various changes to the corporate side of the tax code under the TCJA. This could include extending bonus depreciation that has begun to phase out this year, reinstating R&E expensing, adopting the pre-2022 practice of limiting the interest deduction to 30 percent of business earnings before interest, taxes, depreciation, and amortization (EBITDA) as opposed to just before income and taxes (EBIT), a reduction in the foreign-derived intangible income (FDII) deduction from 37.5 percent to 21.875 percent, and other measures. Taken together, these provisions would cost $720 billion. Importantly, the R&E and interest provisions are not included in CBO's recent extensions analysis, but their costs have been estimated elsewhere.

Legislation that extended, reversed, or prevented change to all of these provisions would cost $3.3 trillion through Fiscal Year (FY) 2033, or $3.8 trillion with interest.

Tax Extensions Would Worsen Deficits and Debt

While the national debt is already projected to rise from 98 percent of Gross Domestic Product (GDP) today to a record 115 percent of GDP by the end of FY 2033 under current law, we project it would further grow to 122 percent of GDP if the TCJA's individual provisions were extended and to 125 percent of GDP if the TCJA's business changes were avoided or reversed as well. Debt will continue to rise rapidly over the long-term under this scenario, particularly if rising debt pushes up interest rates enough to generate a debt spiral.

Deficits would also rise substantially with extensions. Under current law, CBO projects deficits will reach 6.8 percent of GDP by FY 2033 – the highest outside of a war or recession. With full extension of the TCJA, deficits would rise to 8.1 percent of GDP by 2033, or $3.2 trillion.

Lawmakers Should Address Expirations Responsibly

How to address the TCJA's expirations will be a major decision point for the next Administration and Congress in 2025. Although policymakers may want to retain parts of the TCJA – some which represented improvements in tax policy – a full extension would be extremely costly and, without offsets, would dramatically worsen the debt. Recent proposals to expand or reverse major parts of the TCJA could boost those costs further.

Rather than pursue costly extensions of the TCJA, lawmakers should view 2025 as an opportunity to re-evaluate what worked and what did not and to consider further tax reforms. Lawmakers should not extend any parts of the TCJA without enough offsets to ensure they reduce – or at least don't add to – the national debt. In practice, this will mean revisiting many parts of the TCJA to make thoughtful choices about parts to end, which to reform, which to build upon, and which to pay for. That's exactly the approach we outlined in 2019 and detailed in our 2022 Fiscal Blueprint for Reducing Debt and Inflation.

We are also developing a Build Your Own Tax Extensions tool to allow users to design their own package to address the 2025 tax expirations and to understand the cost – and needed offsets – for their choices. The Build Your Own Tax Extensions model is currently in beta testing mode, and can be downloaded here (find our updated web-based version here). We welcome any feedback as we continue its development.