RSC Releases Its FY 2022 Budget Proposal

The Republican Study Committee (RSC), a group of over 150 House Republicans, released its annual budget proposal for Fiscal Year (FY) 2022 on Wednesday. Like other Congressional caucuses that tend to produce budgets with their policy agendas around the time the Budget Committees are supposed to be working on a budget resolution, the RSC presents its view for spending, revenue, debt, and deficits over the coming decade.

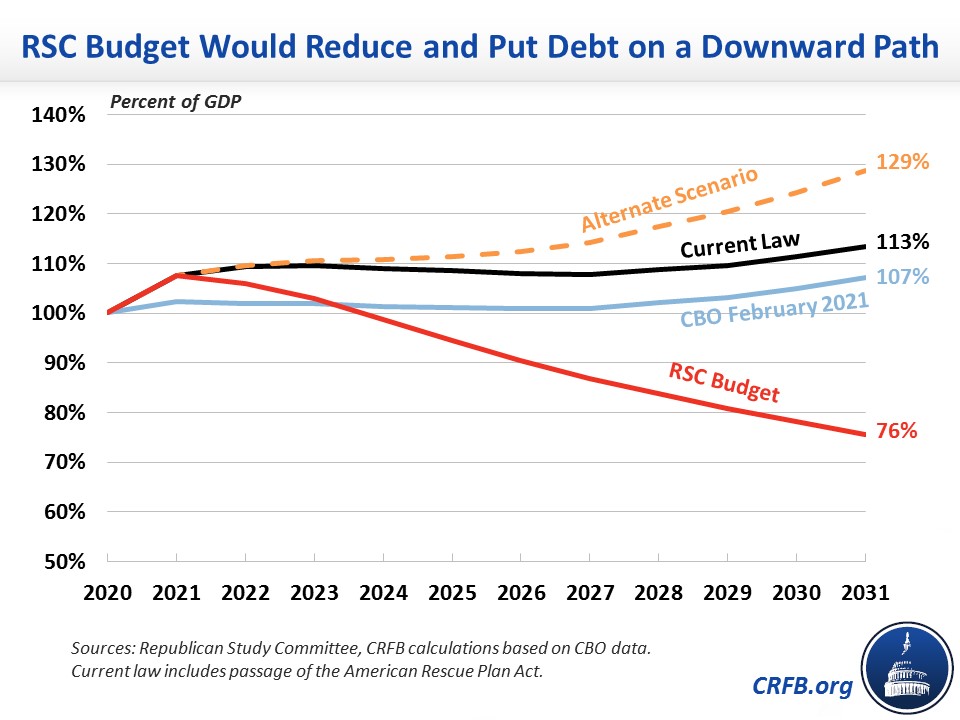

The budget, titled "Reclaiming Our Fiscal Future," calls for nearly $12.5 trillion of deficit reduction over the next decade that would lower debt held by the public as a percentage of Gross Domestic Product (GDP) from a projected 102 percent at the end of FY 2021 to 75 percent by FY 2031. That would be a marked improvement from the Congressional Budget Office's (CBO) projections that debt will reach 107 percent of GDP or our projections that it will reach 113 percent under current law by FY 2031 (or 129 percent of GDP under an alternate scenario where expiring policies are extended).

The budget's deficit reduction is the net effect of $14.4 trillion in spending cuts offset by $1.9 trillion in tax cuts. This would balance the budget by FY 2026 and produce surpluses ranging from $4 billion to $130 billion between 2026 and 2031. As a share of GDP, spending would average 17.1 percent and revenue would average 16.9 percent over the ten-year window, compared to the 50-year historical averages of 20.6 percent and 17.3 percent, respectively. This would result in a 3.5 percent of GDP deficit in FY 2022 disappearing by 2026.

The RSC's budget reaches its targets through a variety of budgetary and non-budgetary proposals. Below is a summary of those with budgetary impact:

Policy Changes in the RSC Budget

| Policy | 2022-2031 Savings |

|---|---|

| Extend the TCJA's Individual Provisions, Enact Full Expensing, and Other Tax Cuts and Base Broadeners | -$1.9 trillion |

| Enact Cuts to Medicaid, CHIP, and ACA Exchanges | $3.3 trillion |

| Overhaul Medicare | $2.5 trillion |

| Reform Social Security | $0.7 trillion |

| Cut Nondefense Discretionary Spending while Increasing Defense Spending | $3.4 trillion |

| Reduce Other Mandatory Programs | $3.5 trillion |

| Interest Savings | $1.0 trillion |

| Net Savings | $12.5 trillion |

Source: Republican Study Committee.

Taxes

The RSC budget would enact several tax cuts while also eliminating certain credits, exclusions, and deductions. The largest proposals are to permanently extend the individual tax cuts enacted in the Tax Cuts and Jobs Act of 2017 (TCJA) and enact immediate full expensing for businesses, but it also includes a variety of other tax cuts such as repealing the estate tax, indexing capital gains to inflation, and creating tax-advantaged Universal Savings Accounts, among other proposals. The cost of these changes would be slightly offset by elimination of several tax breaks, including any deductibility of state and local taxes (the SALT deduction), the American Opportunity Tax Credit, the Lifetime Learning Credit, and the student loan interest deduction, among others. Altogether, the RSC budget's tax changes would reduce revenue by $1.9 trillion over ten years.

Medicaid, CHIP, and ACA Exchanges

Included in the RSC budget is a wide array of changes to all of the major federal health programs. The most significant change would combine Medicaid, the Children’s Health Insurance Program (CHIP), and Affordable Care Act (ACA) subsidies into five block grants to states: one for helping families with children obtain insurance; three for the traditional Medicaid populations of the elderly, people with disabilities, and pregnant women; and one for helping states ensure guaranteed issue of health insurance coverage, including the option of giving new subsidies to individuals in the current Medicaid expansion population. It would also add work requirements, income limitations, and immigration status requirements in order for someone to be eligible for coverage. The RSC estimates these changes would save $3.3 trillion over ten years.

Medicare

The RSC budget would overhaul Medicare by combining Parts A, B, and D into a single "Fed Plan" in addition to allowing Medicare Advantage and Part-D-only plans. The government would then offer means-tested premium subsidies for these plans. In addition to these changes, the RSC budget would align the Medicare eligibility age (currently 65) to Social Security's normal retirement age (scheduled to rise to 67) and index it to increases in life expectancy. It would also adopt several savings proposals that have gained bipartisan support with inclusion in Presidents' budgets of both parties, many of which we've built out policy details to achieve. These include equalizing payments across delivery sites, eliminating Medicare coverage of bad debt, and reforming the Graduate Medical Education program and moving it out of Medicare. In all, the budget's changes would save $2.5 trillion over the next decade.

Social Security

The RSC budget borrows most of its Social Security reforms from the late Representative Sam Johnson's (R-TX) Social Security Reform Act, which would enact a series of changes mostly on the spending side of the program to restore it to 75-year solvency. The RSC would also make significant changes to the Social Security Disability Insurance (SSDI) program – many of which were proposed in the McCrery-Pomeroy SSDI Solutions Initiative – that are aimed to encourage work; increase early intervention; and fight waste, fraud, and abuse, among other proposals. The RSC estimates these changes would save about $700 billion over the decade, though substantial savings would occur over the long term as the changes phase in.

Discretionary Spending

While the Budget Control Act's (BCA) caps on discretionary spending will expire at the end of this fiscal year, the RSC budget calls for continuing the original BCA path for nondefense discretionary (NDD) spending for the next decade. This would result in about $3.4 trillion of savings over a decade backed by several specific policies listed in the budget itself, such as elimination of the Legal Services Corporation, the McGovern-Dole International Food for Education Program, the National Endowment for the Arts, and the National Endowment for the Humanities, among other eliminations. These savings would be slightly offset by increases in defense discretionary spending above baseline budget authority for the first few years of the budget window before growing slower than the baseline, resulting in base defense outlays that are about $38 billion higher than the current CBO baseline.

Other Mandatory Spending

The RSC budget contains many different proposals aimed at reforming, cutting, and consolidating spending on other mandatory programs. This includes, but is not limited to, reforms to agriculture subsidies, changes to higher education financing, ending government conservatorship of Fannie Mae and Freddie Mac, reforming policies related to federal employees and their pensions, and changing veterans disability benefits. In all, the budget estimates $3.5 trillion in savings over a decade from these proposals.

Budget Process

While it doesn't have a dollar impact, the RSC budget also includes a section on fixing the budget and appropriations process. One of the proposals is the adoption of commissions to save federal trust funds in a manner consistent with the TRUST Act. It also makes some suggestions that have gained bipartisan support, such as aligning the fiscal year with the calendar year, accounting for debt-service costs in cost estimates, and ensuring consistent budgetary treatment of Highway Trust Fund spending. The proposal calls for annual overall, non-interest spending caps based on revenue, and it would limit revenue collections as an (unspecified) percentage of GDP. These and other proposals could help remedy our nation's deteriorating fiscal situation.

******

In a year where the budget process has been essentially non-existent, the RSC deserves commendation for putting forward a budget, especially one that addresses our nation's rising debt and puts debt as a share of GDP on a clear downward path. We look forward to seeing other budgets this year, including from the Congressional Progressive Caucus, the Congressional Black Caucus, and, most importantly, the House and Senate Budget Committees. With debt headed to record levels as soon as this year, it is unacceptable for the country to be running without a budget. Beginning with the President's budget request next week, we hope that will change soon.