The Republican Study Committee's Budget "Securing America's Future Economy"

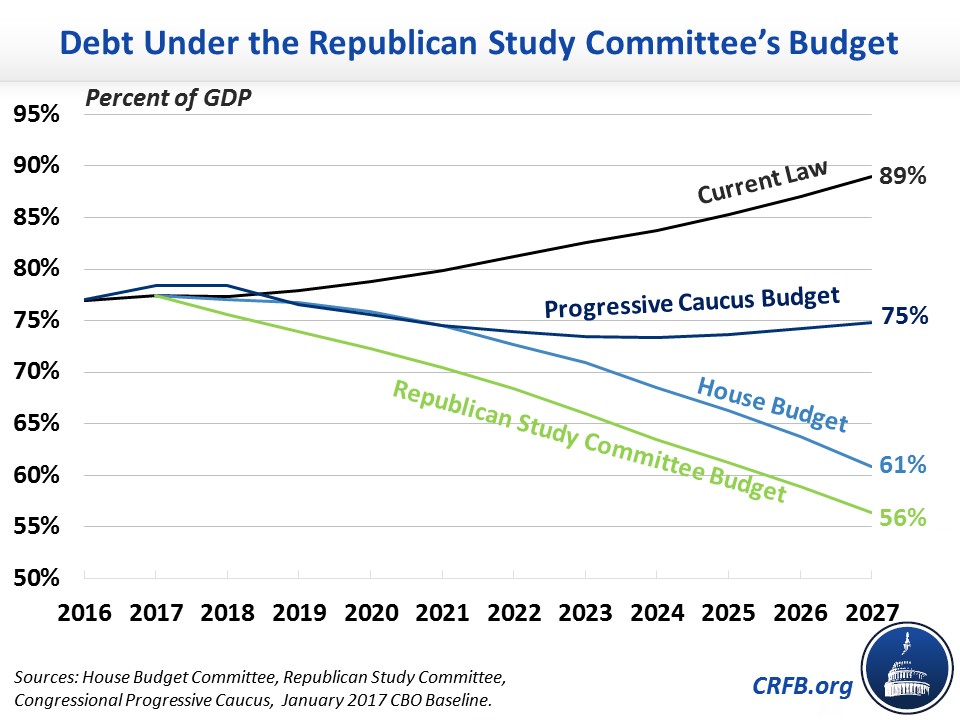

As the House and Senate move forward in considering the Fiscal Year (FY) 2018 budget over the next few weeks, the Republican Study Committee (RSC) continues to tout its alternative, which aims to balance the budget in six years and reduce the ten-year deficit by $9.1 trillion. As a result, debt would decline to 56 percent of Gross Domestic Product (GDP) by 2027, down from 77 percent today and below the 61 percent projected in the House Republican budget.

According to the RSC, the plan would cut spending from 20.7 percent of GDP in 2017 to 17.5 percent by 2027, largely from cutting non-defense discretionary spending and health and welfare programs. Revenues, meanwhile, would rise from 17.8 percent of GDP in 2017 to 18.0 percent in 2027, but they would be more than $1 trillion lower than current law levels over ten years.

Policy Changes in the RSC Budget

| Policy | 2018-2027 Savings |

|---|---|

| Cut Non-Defense Discretionary Spending Programs | $1,935 billion |

| Repeal and Replace Obamacare (including its taxes) and Enact Medicaid/CHIP Reforms | $2,591 billion |

| Cut Income Security and Other Mandatory Spending Programs | $2,661 billion |

| Overhaul Medicare | $898 billion |

| Reform Social Security | $245 billion |

| Reform Taxes and Reduce Tax Revenue | -$247 billion |

| Net Interest Savings | $1,030 billion |

| Total Savings | $9,112 billion |

Source: Republican Study Committee.

Cut Non-Defense Discretionary Spending

The budget would reduce non-defense discretionary budget authority in FY 2018 to $394 billion, or $122 billion less than the statutory spending caps. Much of the savings in this category would come from reducing the Budget Control Act's caps on non-defense discretionary spending, partially reduced by increasing defense discretionary spending. It would also zero-out the Overseas Contingency Operations (OCO) account, instead placing the defense funds in the base defense category and eliminating the non-defense OCO funds. It would increase FY 2018 defense budget authority to $668 billion – the total amount requested by President Trump and $119 billion above the caps. Over ten years, the RSC budget would reduce total discretionary outlays by $1.9 trillion compared current law baseline levels.

Repeal and Replace Obamacare and Enact Medicaid/CHIP Reforms

The RSC budget fully repeals the ACA, including its taxes and spending, and replaces it with the American Health Care Act, though it is unclear whether the replacement is fully reflected in the budget's numbers. It also includes a number of other health care spending reforms such as allowing the purchase of health insurance across state lines, medical malpractice reform, and block granting Medicaid and the Children’s Health Insurance Program (CHIP) at pre-ACA levels.

Cut Income Security and Other Mandatory Programs

The largest savings in the RSC budget comes from reducing other mandatory program spending by nearly $2.7 trillion over a decade. This is mostly done through adding work requirements into welfare programs, moving food stamps into the annual appropriations process and block granting them, and making other changes to income security programs to reduce spending.

Overhaul Medicare

The RSC budget would reduce Medicare spending by nearly $900 billion over a decade. It would do so by converting Medicare to a premium support system starting in 2022 for new beneficiaries, increasing means testing, and aligning the program’s eligibility age with the Social Security normal retirement age, among other reforms.

Reform Social Security

The RSC budget would eliminate Social Security’s long-run shortfall and make the program sustainably solvent by adopting Representative Sam Johnson’s (R-TX) “Social Security Reform Act,” which would slow initial benefit growth for higher-earners, gradually raise the normal retirement age to 69, and means-test annual cost-of-living adjustments, which would be calculated based on the chained Consumer Price Index (CPI).

As it did in last year’s budget, the RSC also proposes a number of reforms to the Social Security Disability Insurance (SSDI) program, many of which are based on proposals put forward by the McCrery-Pomeroy SSDI Solutions Initiative. The budget would also require beneficiaries to have worked more in recent years, create a new time-limited benefit for those whose medical improvement is expected, update eligibility requirements, prevent double-dipping between SSDI and unemployment insurance, increase the waiting period for Medicare eligibility to five years, and reform the appeal process.

Reform Taxes and Reduce Tax Revenue

The budget calls for tax reform that largely mirrors the House GOP's "Better Way" plan, though it does not mention much of the aspects that would pay for the changes in "Better Way" or other ways to make up for the revenue loss from the rate reductions it calls for. It proposes consolidating income tax brackets and lowering the top rate to 33 percent, reducing the corporate rate to no higher than 20 percent, and allowing a 50 percent exclusion for capital gains, dividends, and interest income. It would also repeal the estate tax and alternative minimum tax, adopt full expensing of business investment, move to a territorial tax system, and eliminate “tax expenditures that were enacted for the purpose of social engineering and corporate welfare.”

According to the budget, this tax reform plan would be revenue-neutral on a dynamic basis relative to a "partially current policy" baseline. Specifically, they would assume the continuation of 50 percent bonus depreciation – even though the 2015 tax deal phases down bonus depreciation to 30 percent and then 0 percent. As a result, their tax plan would cost at least $247 billion over a decade on a dynamic basis and likely much more under conventional scoring.

However, the plan would need to include much more aggressive base broadening or smaller tax cuts to even achieve this significantly lower bar for revenue neutrality.

***

The RSC budget balances in just six years and puts debt on a steady downward path through aggressive reductions in federal spending, although the large tax cut described in the budget could substantially reduce its overall savings. Importantly, it does so without assuming overly rosy economic assumptions – an important and praiseworthy distinction from the President's budget and the House budget.

You can read more about our coverage of the 2018 budget process here. We also took a look at the Congressional Progressive Caucus's budget, which you can read here.