Paycheck Protection Program Flexibility Act Signed Into Law

Last week, the President signed into law H.R. 7010, the Paycheck Protection Program Flexibility Act, which the House and Senate passed on May 28 and June 3, respectively. The bill reforms the Small Business Administration’s (SBA) Paycheck Protection Program (PPP) to provide greater flexibility to PPP loan recipients. Created as part of the CARES Act, the PPP issues forgivable loans to small businesses in order to help them cover expenses like payroll and rent during the ongoing COVID-19 pandemic.

Recipients of PPP loans must follow certain guidelines in order to qualify for loan forgiveness, which has left many small businesses reluctant to apply or unsure what amount will be forgiven. This new law relaxes some restrictions around PPP loans so they can be used for a broader set of purposes and still be forgiven. The bill:

- Increases the portion of loans that can be used for non-payroll-related expenses from 25 percent to 40 percent

- Extends the window within which all funds must be spent in order to be forgiven from 8 weeks to 24 weeks

- Extends the deadline by which all employees must be rehired in order to receive full forgiveness from June 30 to December 31 and creates exemptions for businesses that can't rehire

- Extends the loan repayment period from two years to five while maintaining the current 1 percent interest rate

- Changes the rules regarding deferral of repayment for non-forgiven portions of loans

- Makes recipients eligible to defer their 2020 payroll taxes to 2021 and 2022

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.

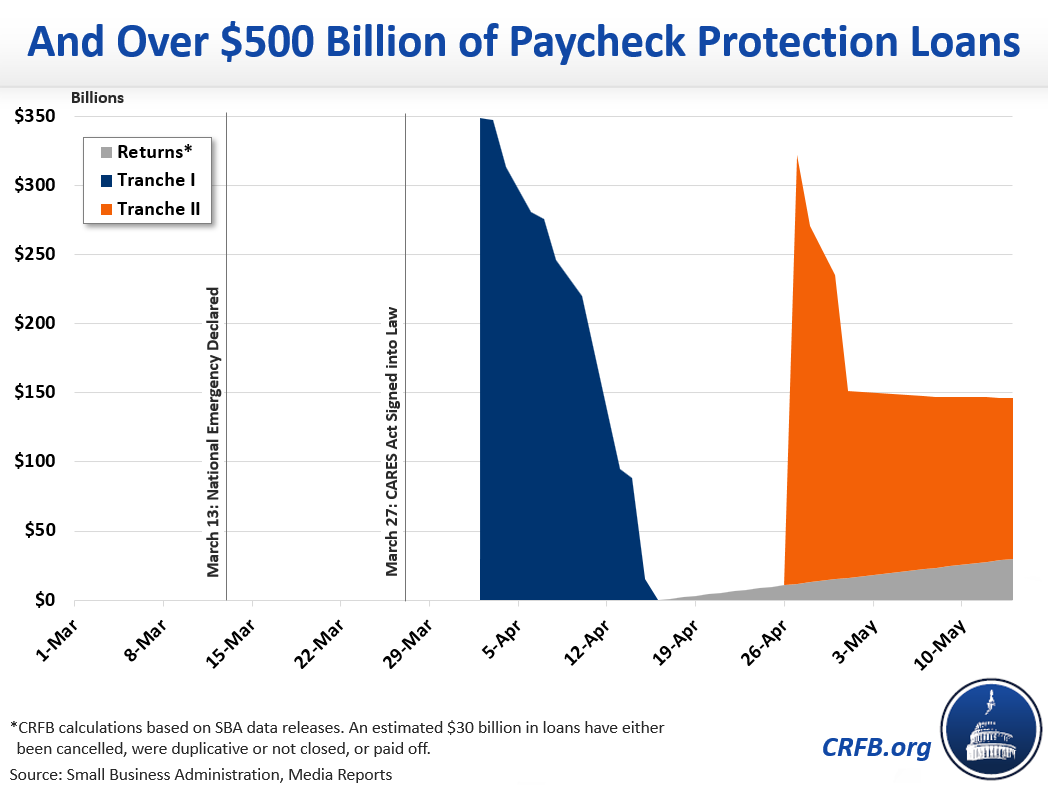

The PPP offers loans of up to $10 million to small businesses, generally defined as those with no more than 500 employees, with some exceptions. These loans can be used to cover payroll expenses, rent, mortgage interest, and utilities. PPP loan recipients are eligible for 100 percent forgiveness, provided they adhere to certain requirements. The PPP received an initial $349 billion of funding through the CARES Act and an additional $310 billion for loans through the PPPHCEA. Currently, around $150 billion of eligible funds remain in the program after cancellations and returns.

Under the Paycheck Protection Program Flexibility Act, the percentage of loan funds that can be spent on non-payroll-related expenses like rent and utilities increases from 25 percent to 40 percent. If a recipient spends less than 60 percent of their loan funds on payroll-expenses, then their amount of forgiveness will be reduced until the amount they spent on payroll equals 60 percent of their loan forgiveness.

The bill triples the length of the expenditure window from eight weeks to twenty-four weeks. Any portion of a loan that remains unspent after this window expires is not eligible for forgiveness. It also extends the “reduction in workforce” deadline from June 30 to December 31, after which recipients must return to pre-crisis payroll levels or face additional loan forgiveness reductions, in order to accommodate the longer expenditure window.

Furthermore, the bill creates two exemptions to these “reduction in workforce” penalties. Businesses are now exempt if they can show, in good faith, that they are either unable to rehire their former employees or find qualified replacements by the new December 31 deadline, or they are unable to resume business at full capacity due to social distancing or other federal health guidance.

The bill includes three other provisions that, while not directly related to the loan forgiveness requirements, provide additional incentives and flexibility for loan recipients. The bill extends the standard repayment period from two years to five, while maintaining the current 1 percent interest rate.

It also changes the rules regarding deferment of loan repayment. Under the CARES Act, all loan recipients were automatically granted deferral of repayment for any non-forgiven loan funds of at least six months, up to one year. Now, recipients who apply for loan forgiveness will be automatically granted deferral of repayment until they receive an official decision regarding how much forgiveness they will receive, which could be up to 150 days after submitting the loan forgiveness application. Recipients have up to 10 months from the end of their expenditure window to submit their forgiveness application before they must begin repaying the loan.

Finally, the bill allows recipients to defer payment of the employer’s share of payroll taxes for two years, even if they ultimately receive no loan forgiveness. Half of deferred payroll taxes will be due in 2021, with the remaining half due in 2022. While this deferral was included in the CARES Act, it was not previously open to PPP recipients.

We will continue to monitor developments to the Paycheck Protection Program and track loan disbursements as part of our COVID Money Tracker initiative.