An Update on the Paycheck Protection Program

The Paycheck Protection Program is one of the larger and most well-known initiatives that has been created to support small businesses during the novel coronavirus outbreak. PPP was initially funded with $349 billion under the CARES Act and was reauthorized for a second round of funding totaling $310 billion under the Paycheck Protection Program and Health Care Enhancement Act (PPPHCEA).

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.

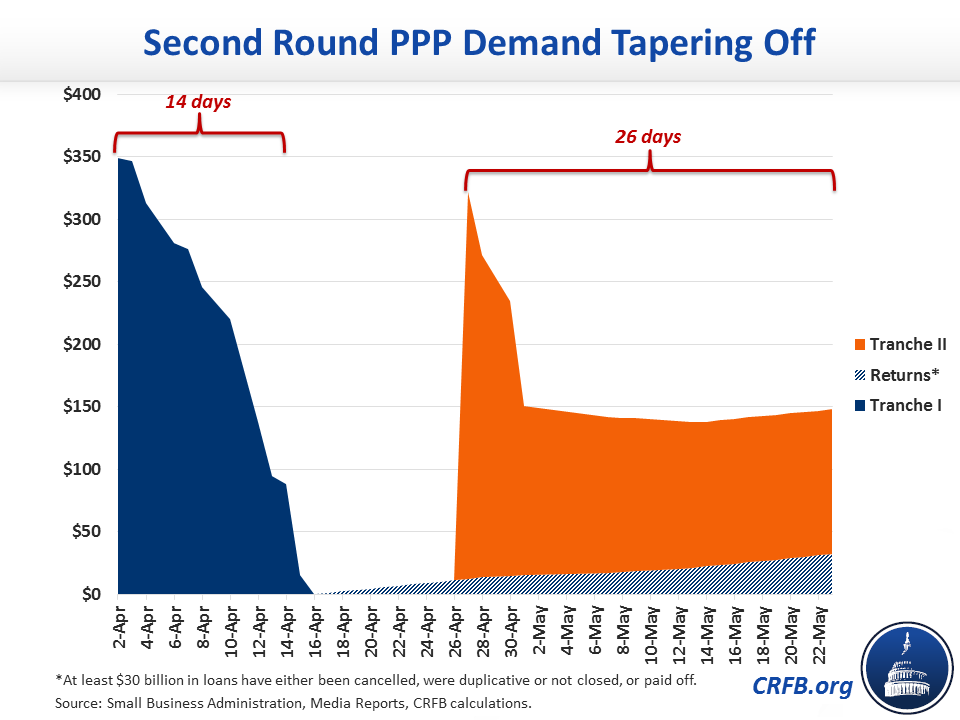

The first round of PPP funding quickly depleted, with all of the available funds exhausted within just two weeks. Despite a fast start, the second round drawdown has plateaued in recent days, with some speculating that frequent guidance changes, censuring of companies receiving the loans, and Treasury-imposed rules that restrict use of the funds are potentially to blame.

Beginning on May 18, the Small Business Administration (SBA) released new data that showed combined PPP loan and total dollar amount approvals for both tranche I (authorized under the CARES Act) and tranche II (authorized under PPPHCEA). Importantly, this data included loan cancellations, which the SBA say includes “duplicative loans, loans not closed for any reason, and loans that have been paid off." The data showed that just over 4.3 million loans had been approved, totaling $513 billion through May 16.

Updated numbers through May 23 show that over 4.4 million loans have been approved, totaling $511 billion. Previous SBA data on the separate tranches showed $194 billion in loans approved in tranche II and the entirety of the $349 billion available in tranche I depleted, so the updated information from SBA suggests that at least $30 billion in loans have either been cancelled, were duplicative or not closed, or paid off.

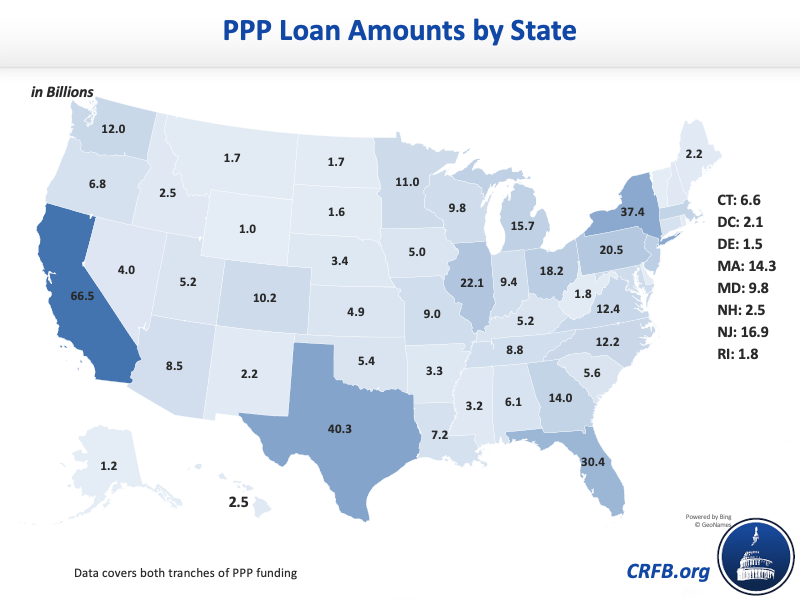

The largest states unsurprisingly continue to be the largest recipients of PPP loans, with California topping the list with $66.5 billion in approved loans, followed by Texas with $40.3 billion, New York with $37.4 billion, Florida with $30.4 billion, and Illinois with $22.1 billion. In terms of the dollar amount of loans per capita, the District of Columbia tops the list, followed by North Dakota, Massachusetts, Minnesota, and New York.

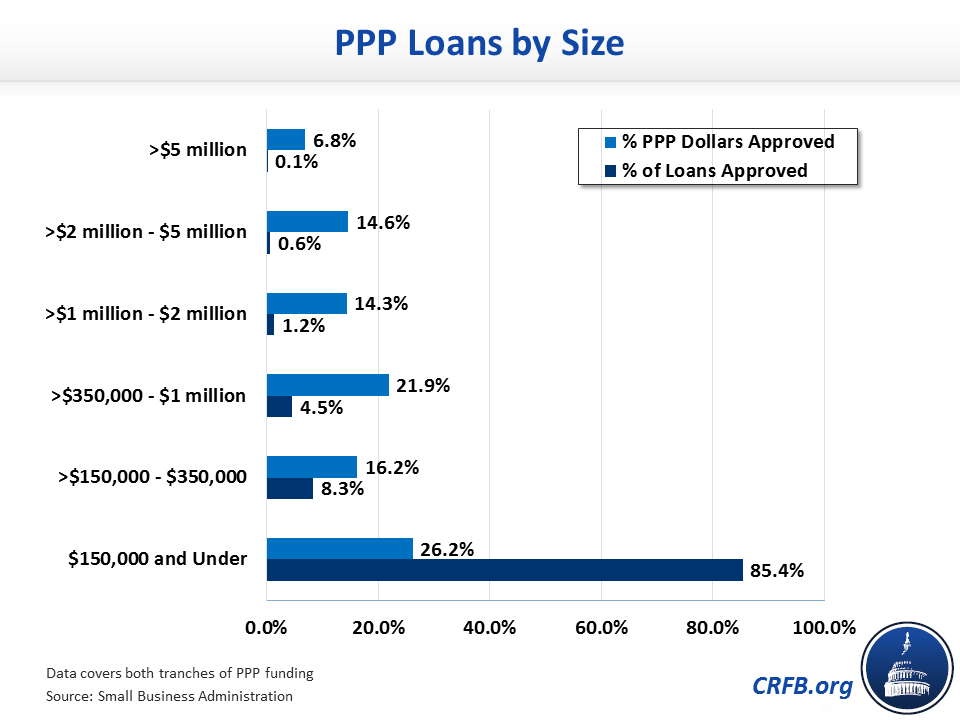

As of May 23, the average loan size is $116,000, and 85.4 percent of the loans approved so far are under $150,000, representing just over one-quarter of the total amount of dollars approved. Loans between $150,000 and $1 million account for 12.8 percent of approved loans, but 38.1 percent of the total amount of dollars approved. Loans above $1 million represent just 1.9 percent of approved loans but an outsized 35.7 percent of the overall dollar total.

From the data, it appears that most companies who wanted a PPP loan may have applied in the first round. Since the replenished funding for the program cleared the backlog in applications from the first round, new applications have been slow and it isn't clear all the money authorized for the second tranche will be spent. We will continue to provide regular updates on the Paycheck Protection Program and other disbursements and commitments in the coming weeks as part of our COVID Money Tracker initiative.