An Overview of the President's FY 2025 Budget

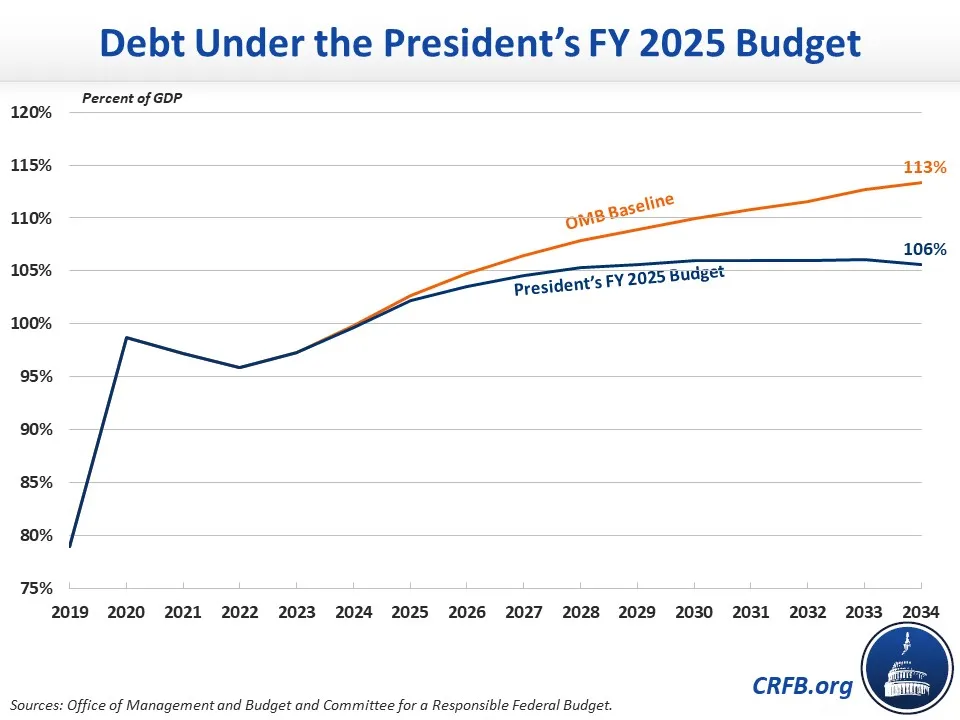

The Biden Administration just released its Fiscal Year (FY) 2025 budget proposal, outlining some of the President's tax and spending priorities for the next decade. Under the President's budget, which incorporates the Administration's own economic assumptions and scores, debt would rise at a slower rate than projected under current law. Specifically, federal debt held by the public would rise from 97 percent of Gross Domestic Product (GDP) at the end of FY 2023 to 106 percent of GDP by the end of 2034. Debt in 2034 would be 8 percentage points of GDP lower than under the Office of Management and Budget's (OMB) 113 percent of GDP baseline projection and 10 percentage points lower than CBO's baseline estimate of 116 percent of GDP.

Budget deficits would remain high under the President's budget, rising from $1.7 trillion (6.3 percent of GDP) in FY 2023 to $1.9 trillion (6.6 percent of GDP) in 2024, falling to a low of $1.5 trillion (4.3 percent of GDP) in 2029, and then rising to $1.7 trillion (3.9 percent of GDP) by 2034. Deficits would total $16.3 trillion (4.6 percent of GDP) from FY 2025 through FY 2034, $3.2 trillion (0.9 percent of GDP) less than OMB's baseline projection of $19.5 trillion (5.5 percent of GDP).

The projected growth in debt and deficits under the President's budget is driven by a persistent gap between spending and revenue. Under the budget, spending would rise from 22.7 percent of GDP in FY 2023 to 24.6 percent of GDP in 2024 and to 24.8 percent of GDP in 2025, and then fall slightly to 24.2 percent of GDP by 2034. Revenue, which fell to 16.5 percent of GDP in 2023, would rise to 18.0 percent of GDP in 2024 and continue to grow to 20.3 percent of GDP by 2034.

Over the FY 2025 through 2034 budget window, spending under the President's budget would total $86.6 trillion (24.4 percent of GDP) and revenue would total $70.3 trillion (19.7 percent of GDP).

Key Figures in the President's FY 2025 Budget

| Trillions | Percent of GDP | |

|---|---|---|

| Revenue | $70.3 trillion | 19.7% |

| Mandatory Spending | $54.7 trillion | 15.3% |

| Discretionary Spending | $19.7 trillion | 5.6% |

| Net Interest | $12.2 trillion | 3.4% |

| Total Spending | $86.6 trillion | 24.4% |

| Deficits | $16.3 trillion | 4.6% |

| Debt (Final Year) | $45.1 trillion | 106% |

Source: Office of Management and Budget. Figures are over the FY 2025 to 2034 period.

While the level of borrowing under the President's budget would be unprecedented outside a war or national emergency, it would be $3.3 trillion lower than under OMB's baseline over the FY 2024 through 2034 budget window. The budget proposes to generate about $6 trillion of new revenue and spending reductions, which would more than offset the budget's $3 trillion of new spending and tax breaks (the figures below largely but not fully separate gross costs and savings). Coupled with $389 billion of net interest savings, the President's budget proposes $3.3 trillion of net deficit reduction through FY 2034.

Proposals in the President's FY 2025 Budget, As Summarized in the Budget

| Policy | 2024-2034 |

|---|---|

| Deficits Projected in OMB's Baseline | $21.4 trillion |

| Expand access to child care and education and training | $890 billion |

| Expand EITC and Child Tax Credit | $478 billion |

| Expand health coverage subsidies | $470 billion |

| Provide paid family and medical leave | $325 billion |

| Expand housing subsidies and supports | $183 billion |

| Other spending and tax breaks* | $653 billion |

| Subtotal, New Initiatives | $3.0 trillion |

| Raise corporate income tax rate from 21 percent to 28 percent | -$1.4 trillion |

| Other corporate tax increases | -$836 billion |

| Raise top individual income tax rate from 37 percent to 39.6 percent | -$256 billion |

| Other individual income tax increases | -$658 billion |

| Impose minimum tax on unrealized income from wealthiest taxpayers | -$503 billion |

| Increase Medicare tax and Net Investment Income Tax | -$814 billion |

| Reduce prescription drug costs | -$205 billion |

| Other revenue and savings* | -$1.2 trillion |

| Subtotal, Offsets | -$5.9 trillion |

| Subtotal, Proposals in the FY 2025 Budget | -$2.9 trillion |

| Interest | -$389 billion |

| Total, Proposals in FY 2025 Budget | -$3.3 trillion |

| Deficits Projected in FY 2025 Budget | $18.2 trillion |

Sources: Office of Management and Budget and Committee for a Responsible Federal Budget. Numbers may not sum due to rounding. *The line-item "Additional Investments and Reforms" includes deficit-increasing and deficit-reducing policies. For this table, we counted the first three years as fully deficit increasing and the subsequent eight years as fully deficit reducing. In our full analysis, we will further separate costs from savings.

The President's budget incorporates OMB's ten-year economic forecast, which is in line with that of other forecasters. In particular, real GDP growth on a fourth-quarter over fourth-quarter basis would average 2.1 percent per year over the next decade under the President's budget, which is in line with CBO's 2.1 percent annual growth projection. By 2034, OMB assumes somewhat faster growth - 2.2 percent compared to CBO's 1.8 percent. Ten-year Treasury yields would average 3.8 percent per year over the next decade under the the President's budget, compared to 4.0 percent under CBO's baseline. In 2034, OMB assumes higher interest rates - 3.7 percent compared to CBO's 4.1 percent.

*****

The Committee for a Responsible Federal Budget will publish our full analysis of the President's FY 2025 budget later today. Our press release on the President's budget can be found here.