How Much COVID Relief Have Public and Private Schools Received?

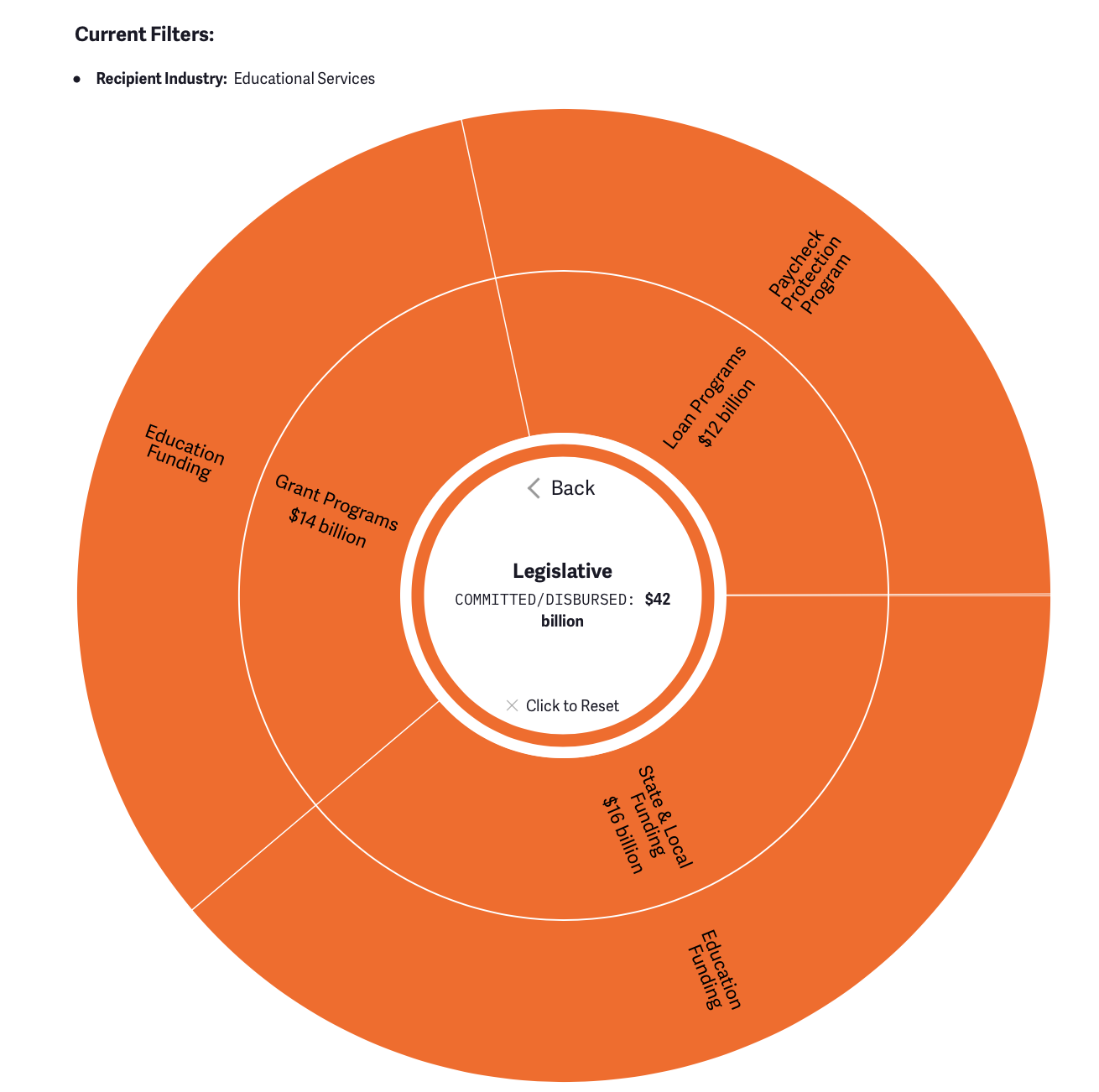

At least $42 billion has been committed or disbursed to the education sector from COVID relief legislation. We estimate:

- About 55 percent of those funds went to public schools

- 35 percent went to private for-profit and nonprofit schools, charter schools, and training programs

- Over 5 percent went to a fund that could be used for either public or private schools

- Another 5 percent went to businesses providing other educational services

Among the money made available for K-12 education, over 70 percent went to public schools and 30 percent went to private or charter schools. By comparison, roughly 85 percent of K-12 students attend public school, compared to 15 percent in private or charter schools. Our new COVID Money Tracker allows users to explore education funding data in more detail.

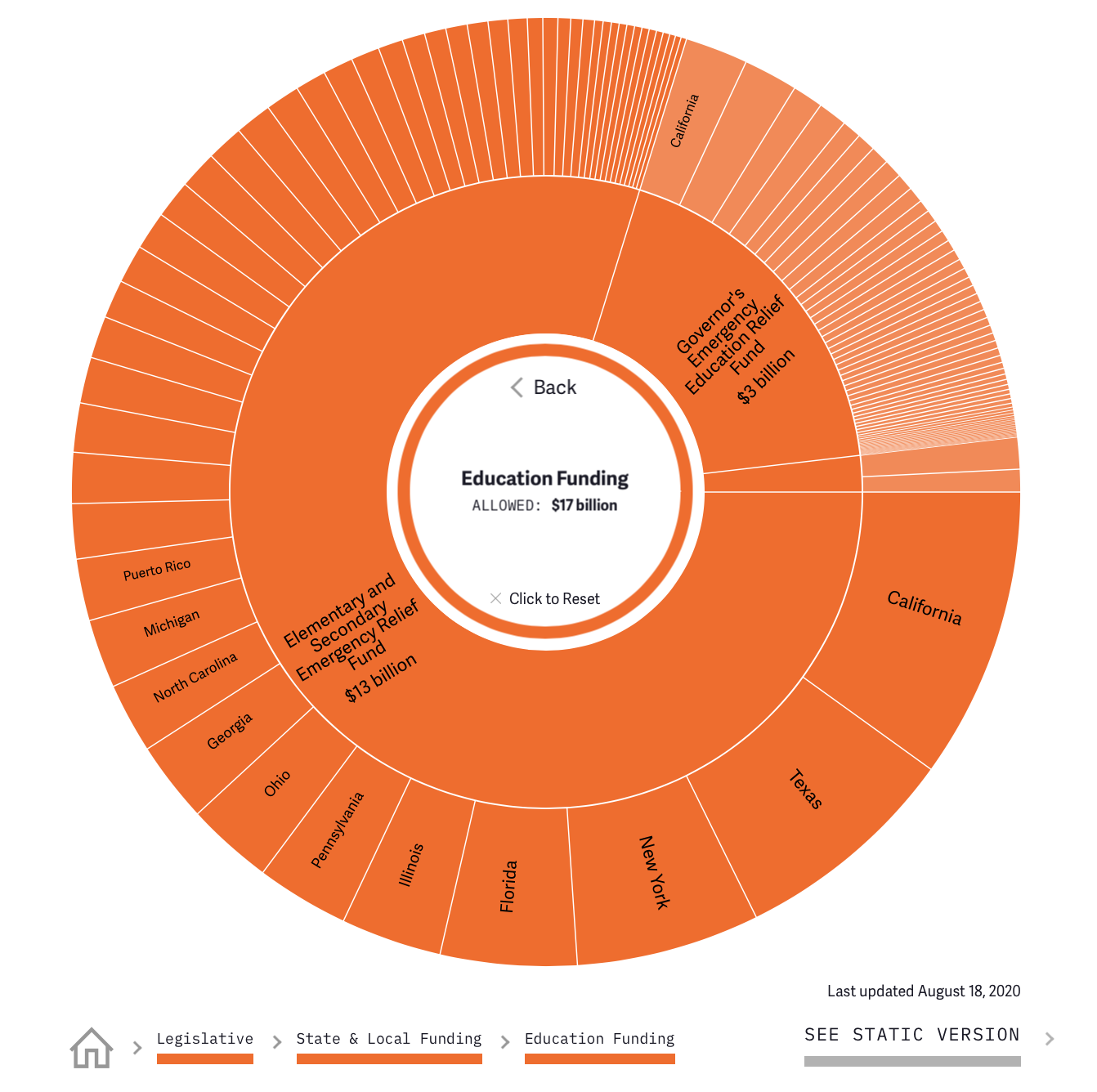

Education funding in COVID relief legislation comes from three main sources: the Paycheck Protection Program, the Elementary and Secondary Emergency Relief Fund (categorized by Educational Services - State & Local Funding), and the Higher Education Emergency Relief Fund (categorized by Educational Services - Grant Programs). The first funding source mainly goes to private schools (including for-profit and nonprofit institutions), the second to public schools, and the third to some combination.

Of the $42 billion of funds committed from these programs, we estimate roughly $23 billion has been provided for public schools, nearly $6 billion for private and charter K-12 schools, $9 billion for private higher education institutions and training programs, $3 billion for state governors to spend on K-12 and higher education (both public and private) at their discretion, and $2 billion for other educational services. There may be additional education relief through the Coronavirus Relief Fund to states, the Paycheck Protection Program, Economic Injury Disaster Loans, and other sources that are not specifically earmarked for education.

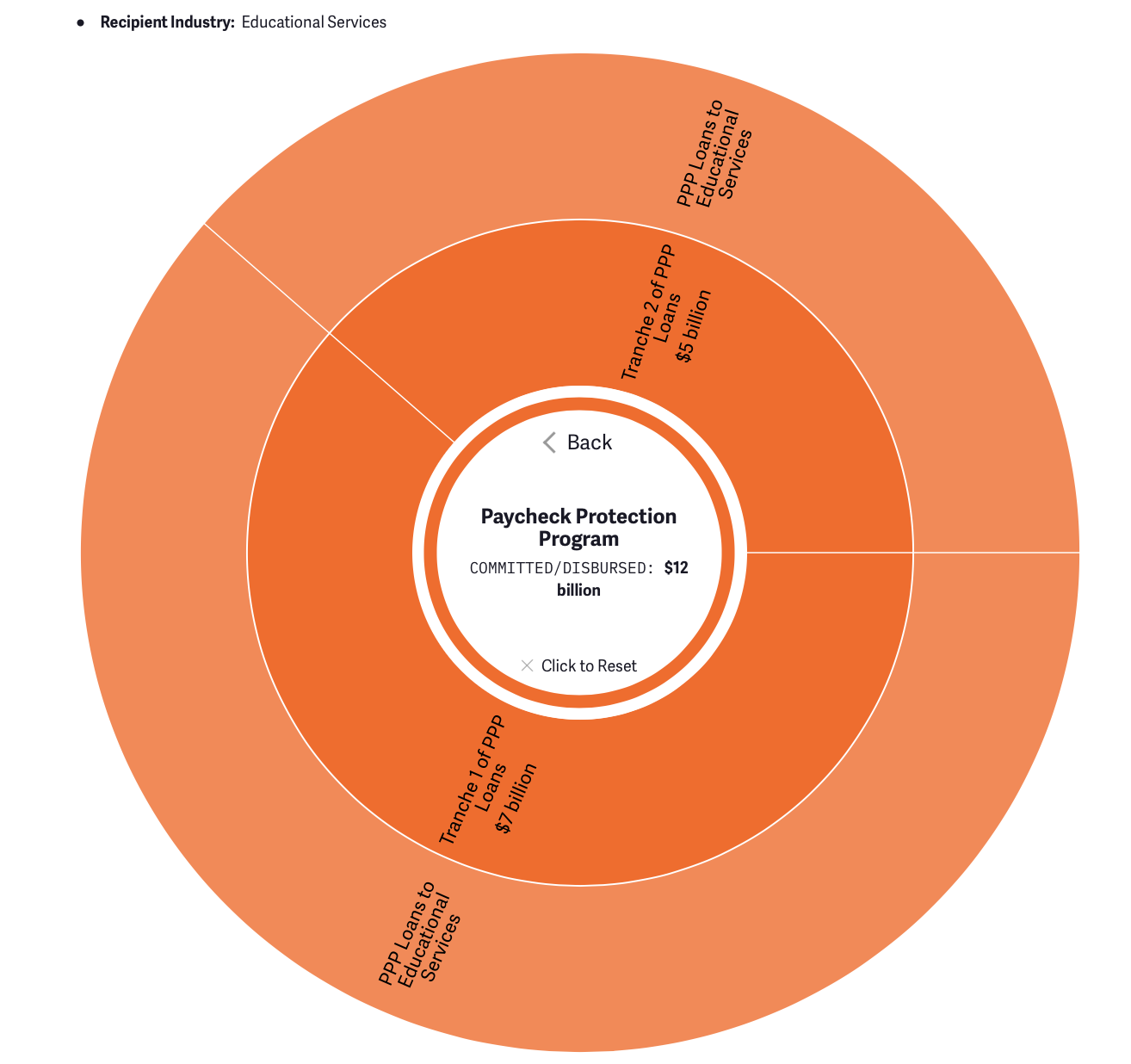

Private school funding comes mainly from the Paycheck Protection Program, which provided forgivable loans — up to 2.5 times monthly payroll capped at $10 million — for small businesses and nonprofits to maintain payroll and certain operating expenses during the most restrictive period of the nationwide economic lockdowns. We estimate forgivable loans to the educational services industry totaled $7 billion in Tranche 1 (CARES Act) and $5 billion in Tranche 2 (Paycheck Protection Program and Health Care Enhancement Act). Of that $12 billion, roughly $6 billion went to K-12 schools, $2 billion went to colleges and junior colleges, $3 billion went to other schools and training programs, and $2 billion went to other educational services (numbers do not add due to rounding). Importantly, the PPP data includes forgivable loans to charter schools, which were eligible to participate in the program owing to their quasi-public-private structure, but it excludes many forgivable loans paid to churches and other institutions that may have schools as part of their organization. (Some portion of the $7 billon of PPP loans that went to religious institutions may have effectively gone to private schools.)

Public K-12 funding comes from the $13 billion Elementary and Secondary Emergency Relief Fund, formula CARES Act funding for states to spend on K-12 education. This funding is more than twice as much as the $6 billion of forgivable PPP loans going to private and charter schools. These numbers imply that at least 70 percent of K-12 spending from COVID relief legislation went to public schools and 30 percent went to private or charter schools.

An additional $3 billion from the Governor’s Emergency Education Relief Fund (GEERF) is also available for public K-12 spending, though governors can also use it for public or private colleges. At least 36 states so far have said they will split their funding between both K-12 and higher education, though the ratios are still largely unknown.

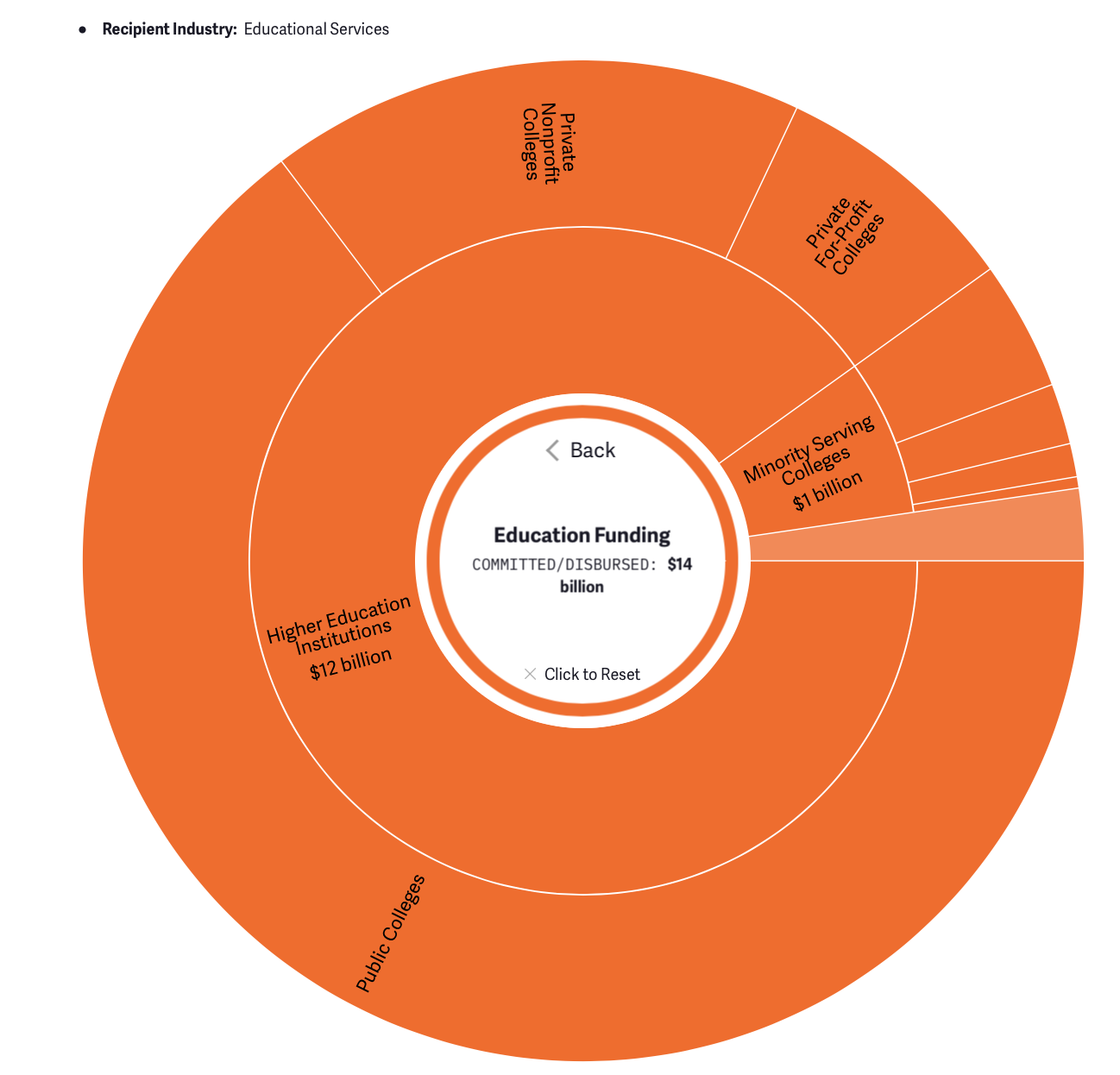

In terms of higher education, the CARES Act provided $13 billion of Higher Education Emergency Relief Fund (HEERF) grants. $8.9 billion of these grants were for public colleges, $2.5 billion for private nonprofit colleges, and $1.1 billion for private for-profit colleges. An additional $1 billion was allocated for Historically Black Colleges & Universities (HBCUs), minority-serving institutions, low-income serving colleges, and tribal colleges. These institutions include both public and private nonprofit institutions, but a significant majority are public. The grants are designed to cover institutional costs related to the pandemic and half of the money colleges receive must be reserved for student aid.

Including the $2 billion of PPP loans to colleges, we estimate $15 billion of total support for higher education institutions under various COVID bills. Of that funding, roughly $5 billion (33 percent) will go to private colleges and $10 billion (66 percent) to state and other public colleges. For reference, roughly 25 percent of higher education students attend a private college and 75 percent attend public college.

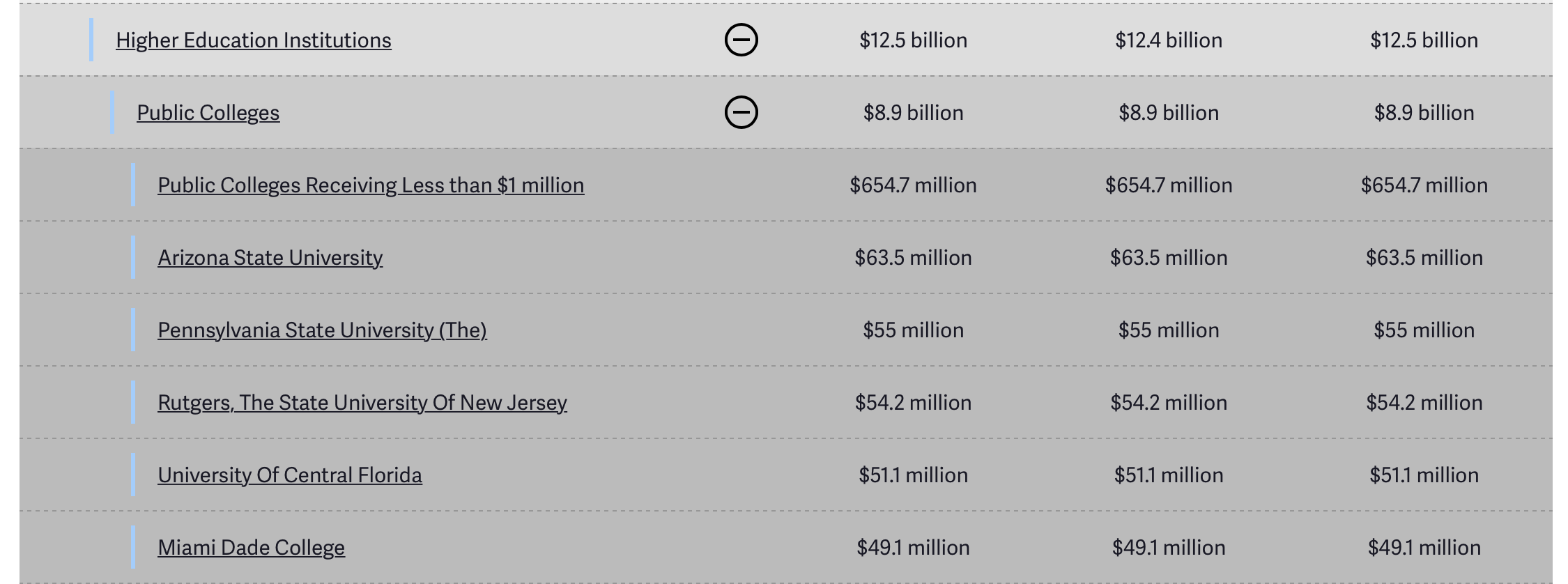

Using the interactive table on our COVID Money Tracker website, you can take a deep dive into the data to see exactly where some of this education funding is going. For example, you can see that the top five HEERF allocations by public college were Arizona State University ($63.5 million), Pennsylvania State University ($55 million), Rutgers ($54.2 million), the University of Central Florida ($51.1 million), and Miami Dade College ($49.1 million).

Our new site provides much needed clarity on federal COVID spending to date, including on education, both public and private. As negotiations continue on Capitol Hill over further fiscal support, our new tool serves as a resource for seeing where the money has been spent, and helps identify gaps in support that can guide lawmakers’ decisions over how much more might be necessary. Find more insights, including state-level spending, support for different industries, and much more, at www.COVIDmoneytracker.org.

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.