CBO's Updated Baseline Shows Grim Outlook

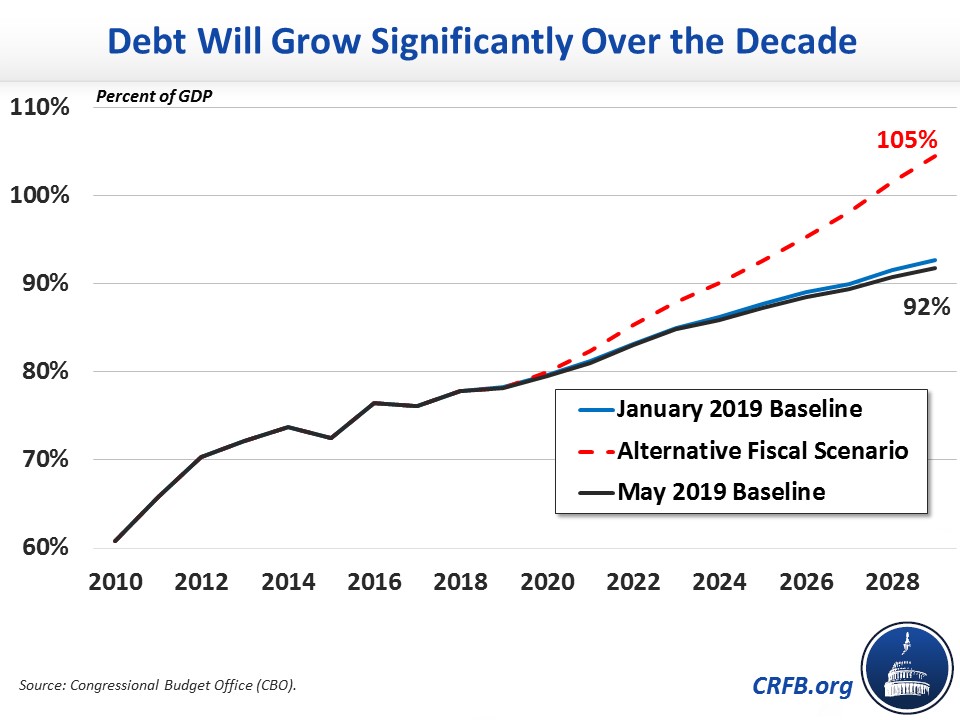

Today, the Congressional Budget Office (CBO) released its updated budget projections. The projections are relatively similar to January and continue to show an unsustainable fiscal situation. Under CBO's baseline, deficits will pass the trillion-dollar mark by 2022 and debt will reach 92 percent of Gross Domestic Product (GDP) by the end of the decade. If expiring tax cuts and spending increases are continued, the situation will be far worse.

Below, we summarize CBO's findings.

Deficits and Debt

Under current law, CBO projects debt will grow from $16.2 trillion today to $28.5 trillion by the end of 2029. As a share of the economy, debt will rise from 78 percent this year to 92 percent by 2029; in January, CBO projected debt would reach 93 percent by 2029. Under CBO's Alternative Fiscal Scenario (AFS), which assumes various expiring tax cuts and spending hikes are continued, debt will rise to 105 percent of GDP by 2029.

This rising debt is the result of large and growing deficits. CBO projects the deficit will total $896 billion (4.2 percent of GDP) in 2019, hit the trillion-dollar mark in 2022, rise to 4.5 percent of the economy by 2025, and remain relatively flat at that high level through 2029. CBO projected a similar path for deficits in January.

Spending and Revenue

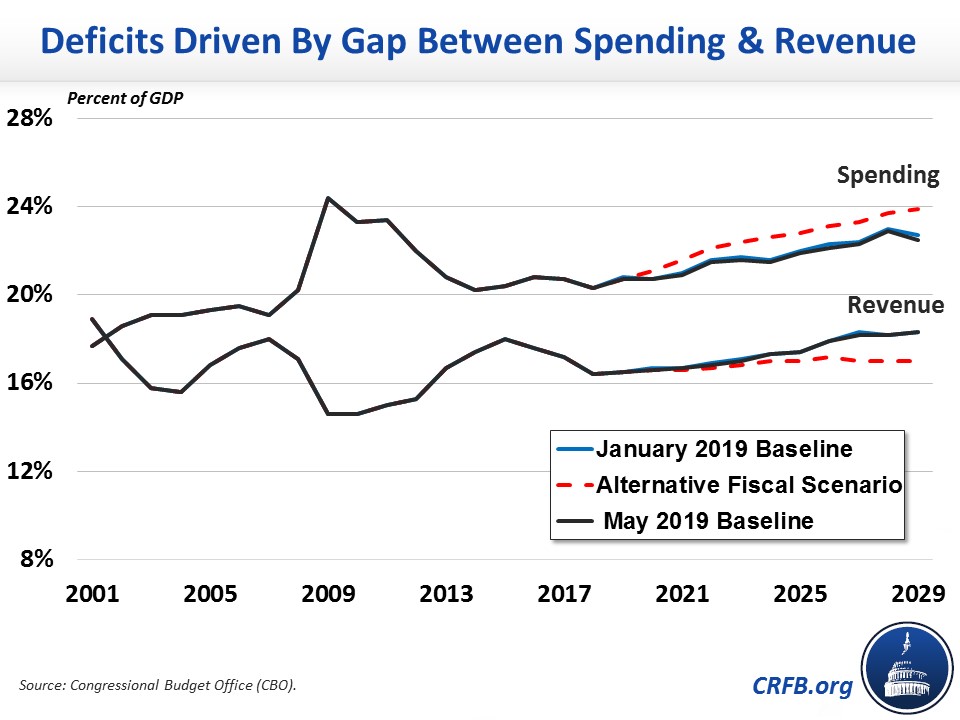

Rising deficits are driven by a disconnect between spending and revenue. Spending will increase from 20.7 percent of GDP in 2019 to 21.9 percent by 2025 and 22.5 percent by 2029. Revenue will remain between 16.5 percent and 17.4 percent of GDP through 2025 and rise to 18.3 percent by 2029 as a result of the expiration of most of the individual income tax provisions of the 2017 tax cuts. Spending is lower than in the January projection, when CBO expected it to increase to 22.7 percent of GDP by 2029. In contrast, revenue is the about the same as projected in January.

Future spending growth is driven largely by rising health, retirement, and interest costs. Social Security, health care, and interest spending are expected to account for 87 percent of spending growth over the next decade.

CBO expects Social Security to grow from 4.9 percent of GDP this year to 5.9 percent by 2029, federal health spending to grow from 5.2 percent of GDP to 6.5 percent, and interest to climb from 1.8 percent of GDP to 3 percent.

On the revenue side, individual income taxes will rise slightly from 8.2 percent of GDP this year to 8.6 percent in 2025, when the 2017 tax cuts expire, and then jump to 9.6 percent in 2029. Other sources of revenue will increase more gradually from 8.3 percent of GDP this year to 8.7 percent by 2029.

Comparing CBO's May 2019 and January 2019 Budget Projections (Percent of GDP)

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | Ten-Year | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| REVENUES (Percent of GDP) | ||||||||||||

| May 2019 Baseline | 16.5% | 16.6% | 16.7% | 16.8% | 17.0% | 17.3% | 17.4% | 17.9% | 18.2% | 18.2% | 18.3% | 17.5% |

| January 2019 Baseline | 16.5% | 16.7% | 16.7% | 16.9% | 17.1% | 17.3% | 17.4% | 17.9% | 18.3% | 18.2% | 18.3% | 17.5% |

| OUTLAYS (Percent of GDP) | ||||||||||||

| May 2019 Baseline | 20.7% | 20.7% | 20.9% | 21.5% | 21.6% | 21.5% | 21.9% | 22.1% | 22.3% | 22.9% | 22.5% | 21.9% |

| January 2019 Baseline | 20.8% | 20.7% | 21.0% | 21.6% | 21.7% | 21.6% | 22.0% | 22.3% | 22.4% | 23.0% | 22.7% | 21.9% |

| DEFICITS (Percent of GDP) | ||||||||||||

| May 2019 Baseline | 4.2% | 4.0% | 4.2% | 4.7% | 4.5% | 4.2% | 4.5% | 4.3% | 4.0% | 4.7% | 4.2% | 4.3% |

| January 2019 Baseline | 4.2% | 4.1% | 4.2% | 4.7% | 4.6% | 4.3% | 4.5% | 4.4% | 4.1% | 4.8% | 4.4% | 4.4% |

| DEBT (Percent of GDP) | ||||||||||||

| May 2019 Baseline | 78.2% | 79.5% | 81.0% | 83.0% | 84.8% | 85.9% | 87.2% | 88.5% | 89.4% | 90.8% | 91.8% | N/A |

| January 2019 Baseline | 78.3% | 79.6% | 81.2% | 83.2% | 85.0% | 86.2% | 87.7% | 89.0% | 90.0% | 91.5% | 92.7% | N/A |

| DEFICITS (Billions of Dollars) | ||||||||||||

| May 2019 Baseline | $896 | $892 | $962 | $1,116 | $1,122 | $1,071 | $1,189 | $1,179 | $1,162 | $1,399 | $1,310 | $11,399 |

| January 2019 Baseline | $897 | $903 | $974 | $1,128 | $1,139 | $1,091 | $1,212 | $1,204 | $1,192 | $1,435 | $1,370 | $11,648 |

| DEBT (Trillions of Dollars) | ||||||||||||

| May 2019 Baseline | $16.6 | $17.6 | $18.6 | $19.7 | $20.9 | $22.0 | $23.3 | $24.5 | $25.7 | $27.1 | $28.5 | N/A |

| January 2019 Baseline | $16.6 | $17.6 | $18.6 | $19.8 | $21.0 | $22.1 | $23.4 | $24.6 | $25.9 | $27.3 | $28.7 | N/A |

Source: Congressional Budget Office (CBO). *Throughout this blog, ten-year figures reflect the 2020-2029 window.

In its January baseline, CBO projected revenue would average 17.5 percent of GDP; the re-estimated baseline projects the same average, compared to a 50-year average of 17.4 percent. CBO projected spending would average 21.9 percent of GDP both now and in January, compared to a 20.3 percent historic average.

Changes in the Budget Outlook

CBO’s budget projections have changed slightly since its last baseline in January. In total, CBO projects deficits through 2029 will be roughly $250 billion lower than previously projected. As (little) fiscally significant legislation has passed yet this year, almost all the changes are technical as a result of updated assumptions using the most recent data. Changes in technical assumptions reduce projected deficits by $271 billion, while legislative changes increase deficits by $21 billion. Taken together, deficits are $250 billion lower than projected in January.

Changes in CBO's Budget Projections

| Source of Change | 2019-2029 Increase/Decrease (-) |

|---|---|

| January 2019 Baseline Projections | $12.5 trillion |

| Legislative Changes | $21 billion |

| Revenues | $0 billion |

| Outlays | $21 billion |

| Technical Changes | -$271 billion |

| Revenues | $88 billion |

| Outlays | -$359 billion |

| May 2019 Baseline Projections | $12.3 trillion |

| Change in Baseline Deficits (2020-2029) | -$250 billion |

Source: Congressional Budget Office (CBO). Numbers may not sum due to rounding.

The Bottom Line

CBO’s updated budget projections confirm that our country remains on an unsustainable fiscal path. Under current law, trillion-dollar deficits will become the norm and debt will grow indefinitely as a share of the economy. Under CBO's more realistic AFS, debt will grow far faster – exceeding the size of the economy within in a decade.

As we've explained recently, the consequences of high and rising debt are severe and include slower income growth, higher interest payments that crowd out other priorities, rising interest rates, a weakened ability to respond to the next recession or emergency, a larger burden on future generations, and heightened risk of a fiscal crisis.

To avoid these consequences, lawmakers must offset any new spending or tax cuts and then pursue an aggressive agenda to put the debt on a downward path as a share of the economy by securing the Social Security and Medicare trust funds, reducing spending, and raising new revenue. The sooner they act, the better.