CBO Updates Budget Projections Before Coronavirus Impact

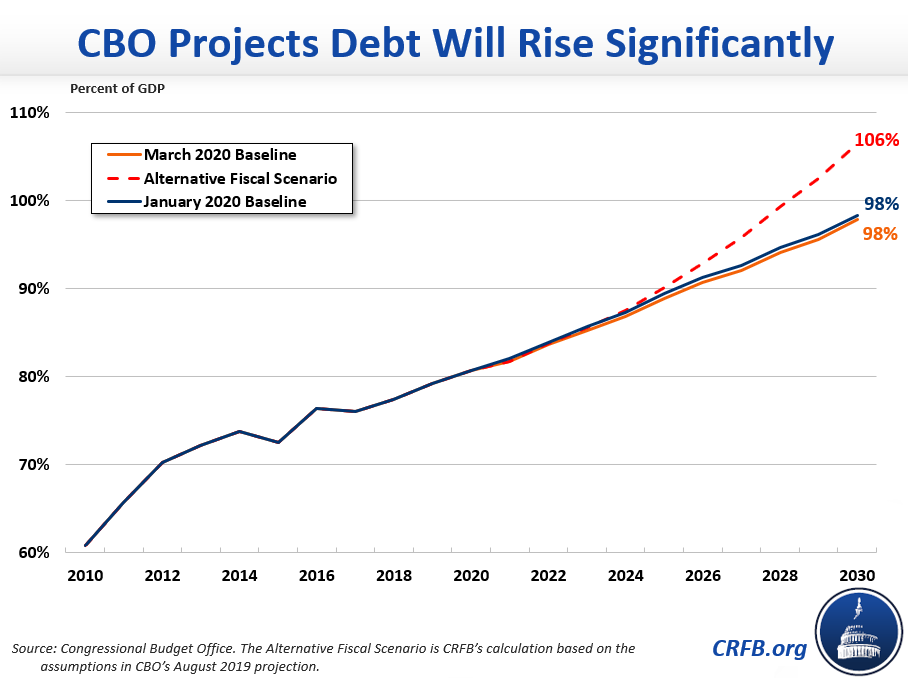

Today, the Congressional Budget Office (CBO) released its updated budget projections, showing the national debt is on an unsustainable path. Under CBO’s baseline, debt will reach 98 percent of Gross Domestic Product (GDP) by 2030, and deficits will exceed $1 trillion this year and every year over the next decade.

While these projections show high levels of borrowing, actual deficits and debt are likely to be far higher. Today's figures do not account for the dramatic economic downturn the U.S. appears to be experiencing as a result of the novel coronavirus (COVID-19) outbreak nor measures working their way through the legislative process to address this crisis. Whereas CBO projects the deficit this year to total $1.1 trillion (4.9 percent of GDP), actual deficits could ultimately end up being twice as high.

Below, we provide a brief analysis of CBO’s latest projections, which are relatively similar to those released in January.

Debt and Deficits

CBO projects debt will grow by $13.8 trillion, from $17.5 trillion today to $31.3 trillion, by 2030. As a share of the economy, debt will rise from 80 percent of GDP today to 98 percent by 2030. These projections are virtually identical to those CBO put forward in January.

Rising debt levels are the result of large and growing budget deficits. CBO projects deficits will total $14.2 trillion over the next decade, growing steadily from $1.1 trillion (4.9 percent of GDP) in 2020 to $1.8 trillion (5.5 percent of GDP) by 2030. CBO projected a similar path for deficits in January.

While CBO did not produce an Alternative Fiscal Scenario (AFS), we estimate that extending expiring tax cuts and growing discretionary spending with GDP would cause debt to reach 106 percent of GDP by 2030, tying the record set just after World War II, while deficits would grow to $2.4 trillion (7.5 percent of GDP).

Spending and Revenue

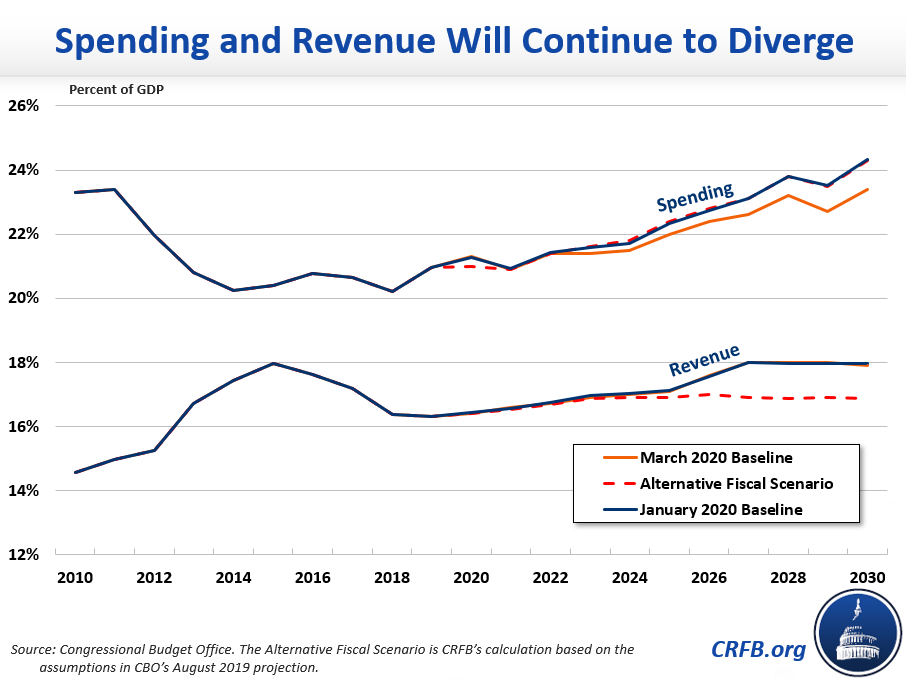

Rising debt and deficits are driven by the disconnect between spending and revenue. CBO projects annual spending will grow by $2.8 trillion, from $4.7 trillion (21.3 percent of GDP) in 2020 to $7.5 trillion (23.4 percent of GDP) by 2030. Revenue, meanwhile, will remain between 16.4 percent and 17.1 percent of GDP through 2025 and then rise to 17.9 percent of GDP by 2030 as a result of the expiration of most individual income tax provisions in the Tax Cuts and Jobs Act.

The projected growth in spending is driven by rising retirement, health, and interest costs. Taken together, Social Security, health care, and interest on the national debt comprise 84 percent of projected spending growth in dollars over the next decade. CBO expects Social Security to grow from 4.9 percent of GDP this year to 6.0 percent by 2030, spending on the major health care programs to rise from 5.3 percent of GDP to 7.0 percent, and interest costs to increase from 1.7 percent of GDP to 2.6 percent.

On the revenue side, individual income taxes will rise slightly, from 8.1 percent of GDP in 2020 to 8.5 percent in 2025, when the 2017 tax cuts expire, and then climb to 9.5 percent of GDP by 2030. Other sources of revenue – including payroll, corporate income, and excise taxes – will increase more gradually from 8.3 percent of GDP this year to 8.4 percent by 2030.

Comparing CBO's March 2020 and January 2020 Budgett Projections

| Fiscal Year | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | Ten-Year* |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| REVENUES (Percent of GDP) | ||||||||||||

| March 2020 Baseline | 16.4% | 16.6% | 16.7% | 16.9% | 17.0% | 17.1% | 17.6% | 18.0% | 18.0% | 18.0% | 17.9% | 17.4% |

| January 2020 Baseline | 16.4% | 16.6% | 16.7% | 17.0% | 17.0% | 17.1% | 17.6% | 18.0% | 18.0% | 18.0% | 18.0% | 17.4% |

| OUTLAYS (Percent of GDP) | ||||||||||||

| March 2020 Baseline | 21.3% | 20.9% | 21.4% | 21.4% | 21.5% | 22.0% | 22.4% | 22.6% | 23.2% | 22.7% | 23.4% | 22.2% |

| January 2020 Baseline | 21.0% | 20.9% | 21.4% | 21.5% | 21.5% | 22.1% | 22.4% | 22.6% | 23.1% | 22.7% | 23.4% | 22.2% |

| DEFICITS (Percent of GDP) | ||||||||||||

| March 2020 Baseline | 4.9% | 4.3% | 4.7% | 4.5% | 4.4% | 4.9% | 4.8% | 4.6% | 5.2% | 4.8% | 5.5% | 4.8% |

| January 2020 Baseline | 4.6% | 4.3% | 4.7% | 4.5% | 4.5% | 4.9% | 4.8% | 4.6% | 5.2% | 4.8% | 5.4% | 4.8% |

| DEBT (Percent of GDP) | ||||||||||||

| March 2020 Baseline | 80.7% | 81.7% | 83.6% | 85.2% | 86.8% | 88.9% | 90.7% | 92.1% | 94.1% | 95.6% | 97.8% | N/A |

| January 2020 Baseline | 80.8% | 82.0% | 83.9% | 85.6% | 87.3% | 89.4% | 91.2% | 92.6% | 94.7% | 96.2% | 98.3% | N/A |

| DEFICITS (In Billions of Dollars) | ||||||||||||

| March 2020 Baseline | $1,073 | $1,002 | $1,118 | $1,114 | $1,141 | $1,306 | $1,325 | $1,311 | $1,543 | $1,472 | $1,760 | $13,091 |

| January 2020 Baseline | $1,015 | $1,000 | $1,116 | $1,119 | $1,152 | $1,315 | $1,333 | $1,313 | $1,538 | $1,466 | $1,742 | $13,095 |

| DEBT (In Trillions of Dollars) | ||||||||||||

| March 2020 Baseline | $17.8 | $18.8 | $20.0 | $21.1 | $22.3 | $23.7 | $25.1 | $26.4 | $28.0 | $29.5 | $31.3 | N/A |

| January 2020 Baseline | $17.9 | $18.9 | $20.1 | $21.2 | $22.4 | $23.8 | $25.2 | $26.5 | $28.2 | $29.7 | $31.4 | N/A |

Source: Congressional Budget Office. *Ten-year figures reflect the 2021-2030 budget window.

Changes in the Budget Outlook

CBO's budget projections have changed only slightly since its last baseline in January – though they will likely change dramatically this summer once CBO incorporates the effects of the current crisis. CBO projects deficits through 2030 will total $14.2 trillion, just $54 billion over ten years above its previous estimate.

On net, more than the entire of the $54 billion increase in deficit projections takes place in 2020; more than the entirety of that increase – $83 billion – can be explained by a re-estimate of the net present value cost of student loans.

Other factors from 2021 to 2030 almost entirely cancel each other out. Legislatively, CBO estimates deficits will be roughly $70 billlion higher as a result of the first COVID-19 response bill. While the bill itself cost only $8.3 billion, scoring conventions assume that spending is contineud year after year, adjusted for inflation.

This increase is offset by reductions in projected deficits from technical changes. Most significantly, CBO now believes there will be slightly fewer Social Security beneficiaries and has observed lower-than-expected Medicare spending. Its estimates reduce projected Social Security and Medicare costs by roughly $200 billion. On the other hand, CBO finds interest payments (for a given level of debt) and Affordable Care Act subsidies are higher than estimated in January.

| Source of Change | 2020-2030 Deficit Increase/Decrease (-) |

|---|---|

| Deficits in CBO's January 2020 Baseline | $14,110 billion |

| Legislative Changes | $74 billion |

| Coronavirus Preparedness and Response Supplemental Appropriations Act | $8 billion |

| Assume emergency spending grows with inflation in future years | $61 billion |

| United States-Mexico-Canada Agreement Implementation Act | -$3 billion |

| Debt Service | $8 billion |

| Technical Changes | -$20 billion |

| Lower Social Security spending | -$138 billion |

| Lower Medicare spending | -$69 billion |

| Lower Medicaid spending | -$13 billion |

| Higher premium tax credits and related spending | $61 billion |

| Re-estimate of student loan costs | $92 billion |

| Higher spending on veterans services and benefits | $13 billion |

| Debt Service | -$38 billion |

| Other Interest costs | $72 billion |

| Total Change in Deficits | $54 billion |

| Deficits in CBO's March 2020 Baseline | $14,164 billion |

Notably, CBO did not update its economic projections from January, so it does not account for major economic disruptions from COVID-19. Therefore, CBO's current projections almost certainly understate deficits and debt, especially in the short term.

The Bottom Line

CBO's latest projections confirm that the country remains on an unsustainable fiscal path, with trillion-dollar deficits the new normal and debt projected to grow indefinitely as a share of the economy, even before accounting for the economic and fiscal impacts of the coronavirus. These projections make it clear why policymakers should work to put debt on a more sustainable path during economic expansions rather than doubling deficits as they have over the last five years. As we explained in our press release, "the irresponsibility, partisanship, and brokenness in Washington has left us weaker and less prepared for a moment like this." Short-term borrowing is responsible for economic stimulus, but plans should offset the costs over a reasonable period of time once the economy has recovered.