CBO Releases Its Own Estimate of the President's FY 2021 Budget

The Congressional Budget Office (CBO) just released its estimate of the President’s Fiscal Year (FY 2021) budget. CBO’s analysis shows that debt and deficits under the President’s budget would rise over the next decade, rather than fall as the Office of Management and Budget (OMB) projects. These estimates do not account for the economic and fiscal impact of COVID-19 or most of the policy response.

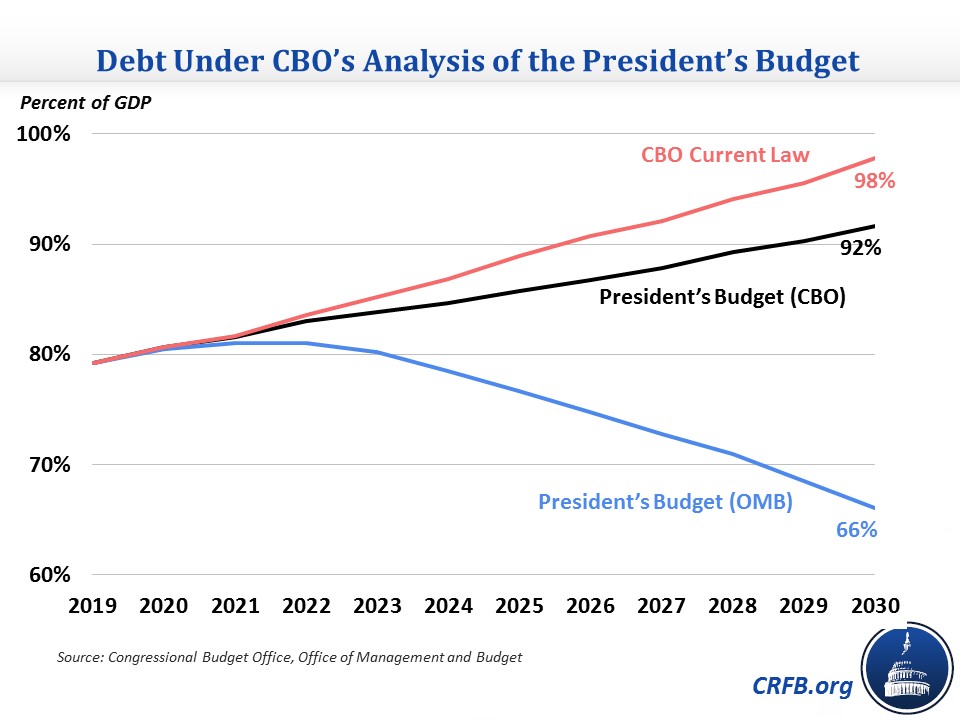

CBO estimates that under the President’s budget debt would rise from 79 percent of Gross Domestic Product (GDP) in 2019 to 92 percent of GDP in 2030. By contrast, OMB estimated debt would decline to 66 percent of GDP by 2030. Like OMB, however, CBO finds the budget would slow the growth of debt compared to current law, which has debt reaching 98 percent of GDP by 2030. CBO's estimate is in line with what we estimated last month based on CBO assumptions.

CBO expects deficits would total $11 trillion over the next decade under the President's budget, which is $5.4 trillion higher than OMB’s estimate of $5.6 trillion but $2.1 trillion less than current law. Specifically, CBO estimates deficits under the President's budget would decline from $1.1 trillion in 2020 to a low of $898 billion in 2024 before increasing gradually to $1.4 trillion by 2030. As a share of GDP, deficits would decline from 4.9 percent in 2020 to 3.5 percent in 2024 then increase to 4.4 percent of GDP by 2030. For comparison, OMB estimated deficits would decline from $984 billion in 2019 to $261 billion (0.7 percent of GDP) by 2030. Under (pre-COVID-19) current law, deficits will rise to $1.7 trillion (5.4 percent of GDP) by 2030.

The $5.4 trillion disconnect between CBO’s and OMB’s deficit estimates is driven largely by the latter’s use of overly optimistic economic assumptions. OMB expects real GDP growth to average 2.9 percent over the next decade compared to 1.7 percent in CBO’s forecast. In light of COVID-19, actual economic growth is likely to be even lower than CBO forecasts in the near term. The economic differences especially show up in revenue, which is $4.1 trillion lower in CBO's estimate compared to OMB's.

CBO's projections also exclude some of the unspecified savings assumed in the President's budget and finds that a number of the President's policy proposals would save less than OMB estimates. As a result, CBO finds nearly $850 billion more in primary spending than OMB.

Differences Between CBO's and OMB's Estimates of the President's Budget

| Difference | 2021-2030 Deficit Effect |

|---|---|

| OMB Estimate | $5.6 trillion |

| Revenue | +$4.1 trillion |

| Mandatory Spending | +$1.0 trillion |

| Discretionary Spending | -$174 billion |

| Interest | +$505 billion |

| CBO Estimate | $11.0 trillion |

Source: Congressional Budget Office, Office of Management and Budget. Positive numbers reflect deficit increases and vice versa.

The difference in debt-to-GDP is starker than the difference in deficits. CBO estimates nominal GDP will be one-eighth lower in 2030 than OMB does, making debt-to-GDP higher for any level of debt. For example, assuming OMB's debt projections with CBO's GDP would increase debt-to-GDP by 9 percentage points.

The analysis put forward by CBO shows that the President’s budget would slow the growth of debt as a share of GDP relative to current law but not stop the rise of debt all together. Nevertheless, as the U.S. faces a dramatic economic downturn as a result of the novel coronavirus (COVID-19) outbreak, the policies outlined in the President’s budget can serve as a starting point for policymakers to address structural deficits and ultimately put deficits and debt on a downward path after the current crisis passes.

The Committee for a Responsible Federal Budget will release its full analysis of CBO’s estimate later today.