CBO Releases Budget Projections Under Three Scenarios

Last week, the Congressional Budget Office (CBO) released a letter outlining how enacted legislation and certain amounts of additional spending would change its February 2021 baseline projections under three different scenarios. Under each scenario, deficits and debt would be higher than CBO previously projected.

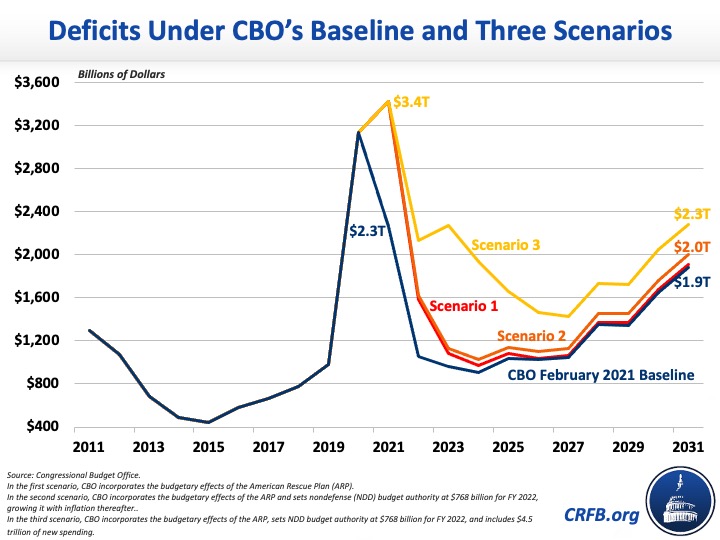

In February, CBO projected the budget deficit would total $2.3 trillion (10.3 percent of Gross Domestic Product, or GDP) in Fiscal Year (FY) 2021, fall to $1.1 trillion (4.6 percent of GDP) in FY 2022, and then grow to $1.9 trillion (5.7 percent of GDP) by the end of FY 2031. Over the 2021-2031 budget window, annual deficits would total $14.5 trillion (4.9 percent of GDP). All three of CBO's updated scenarios show higher deficits than previously projected.

In the first scenario, CBO incorporated the budgetary effects of the American Rescue Plan (ARP) into its baseline projections (since the ARP is now public law, this scenario likely reflects current law). Under this scenario, the budget deficit will total $3.4 trillion (15.6 percent of GDP) in FY 2021, fall to $1.6 trillion (6.9 percent of GDP) in FY 2022, and then rise to $1.9 trillion (5.8 percent of GDP) by the end of FY 2031. Over the 2021-2031 budget window, annual deficits will total $16.6 trillion (5.7 percent of GDP), a $2.1 trillion (0.8 percent of GDP) increase over CBO’s February projection. These estimates match our projections put out in March.

In the second scenario, CBO incorporated the budgetary effects of the American Rescue Plan and set non-defense discretionary (NDD) budget authority at $768 billion for FY 2022. Starting in FY 2023, NDD budget authority would grow with inflation from the FY 2022 level. Under this scenario, the budget deficit would total $3.4 trillion (15.6 percent of GDP) in 2021, fall to $1.6 trillion (7.0 percent of GDP) in FY 2022, and then rise to $2.0 trillion (6.1 percent of GDP) by the end of FY 2031. Over the 2021-2031 budget window, annual deficits would total $17.2 trillion (5.9 percent of GDP), a $2.7 trillion (1.0 percent of GDP) increase over CBO’s February estimate.

In the third scenario, CBO incorporated the budgetary effects of the American Rescue Plan, set NDD budget authority at $768 billion for FY 2022, added $2.7 trillion of funding for new and existing programs in FY 2022, and increased non-interest mandatory spending by $180 billion in each year starting in FY 2022. Under this scenario, the budget deficit would total $3.4 trillion (15.6 percent of GDP) in FY 2021, fall to $2.1 trillion (9.2 percent of GDP) in FY 2022, and then rise to $2.3 trillion (9.4 percent of GDP) in FY 2023. The deficit would fall below $2.0 trillion starting in FY 2024 and remain there through FY 2029, before rising back to $2.3 trillion (6.9 percent of GDP) by the end of FY 2031. Over the 2021-2031 budget window, budget deficits would total $22.1 trillion (7.6 percent of GDP), a $7.6 trillion (2.7 percent of GDP) increase over CBO’s February projection.

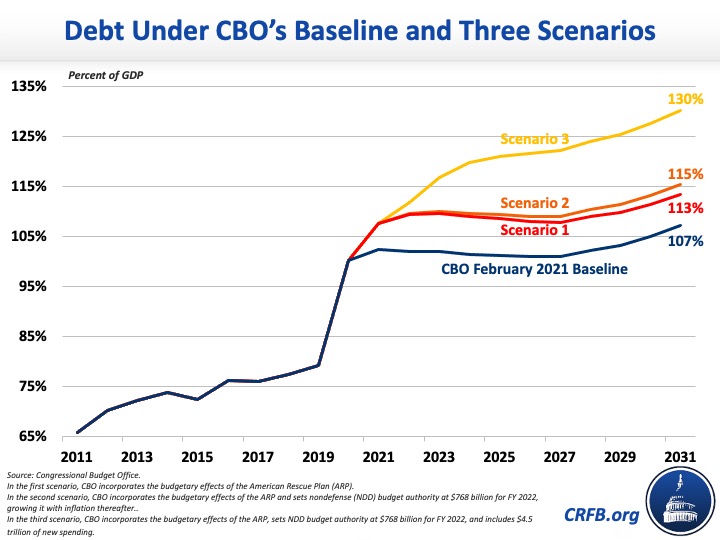

Likewise, debt would be higher under all three scenarios. In February, CBO estimated federal debt held by the public would total 102 percent of GDP by the end of FY 2021 and grow to more than 107 percent of GDP by the end of FY 2031. In nominal dollars, debt would increase by $12.8 trillion, from $22.5 trillion to $35.3 trillion.

Under the first scenario, debt will total 108 percent of GDP this year, surpassing the prior record of 106 percent of GDP set just after World War II. By the end of FY 2031, debt will be over 113 percent of GDP. In nominal dollars, debt will increase by $13.7 trillion, from $23.6 trillion at the end of FY 2021 to $37.4 trillion by the end of FY 2031. Under the second scenario, debt would grow to over 115 percent of GDP by the end of FY 2031. In nominal dollars, debt would increase by $14.4 trillion, from $23.6 trillion at the end of FY 2021 to $38.0 trillion by the end of FY 2031. Under the third scenario, debt would grow to over 130 percent of GDP by the end of FY 2031. In nominal dollars, debt would increase by $19.3 trillion, from $23.6 trillion at the end of FY 2021 to $42.9 trillion by the end of FY 2031.

Under all three scenarios, the country would be in worse fiscal shape than it already is. Policymakers should work to get our fiscal house in order.