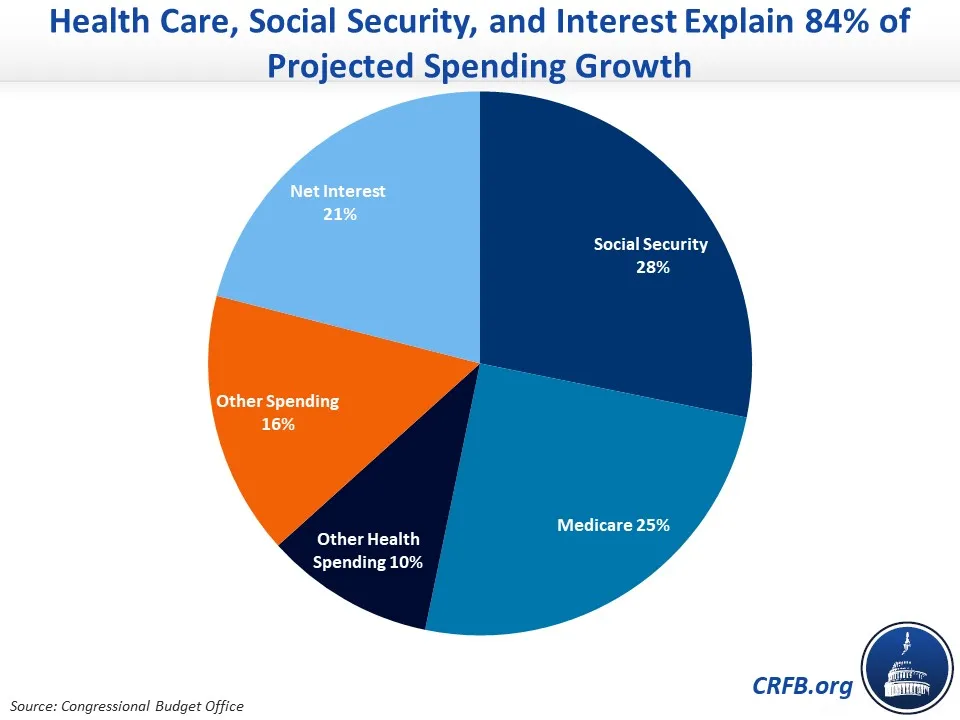

84 Percent of Spending Growth Will Come from Health, Social Security, and Interest

Budget deficits are projected to grow from $1.7 trillion in Fiscal Year (FY) 2023 to $2.6 trillion by 2034 according to the Congressional Budget Office’s (CBO) latest projections. Nominal spending will rise from $6.4 trillion this year to $10.1 trillion by FY 2034, and 84 percent of this growth can be explained by increased spending on health, Social Security, and net interest.

Spending on Social Security will grow from $1.5 trillion this year to $2.5 trillion by 2034, while spending on health care will grow from $1.6 trillion to $2.8 trillion. Net interest costs will more than double from $870 billion this year to $1.6 trillion by 2034, after costs nearly doubled between 2020 and 2023. Interest on the debt is the fastest growing part of the budget and will be the second largest government expenditure this year, surpassing both defense and Medicare.

Of the projected increase in nominal spending this decade, interest alone will make up 21 percent ($758 billion), Social Security will make up 28 percent ($1.0 trillion), and health care will make up 35 percent ($1.3 trillion). The remaining 16 percent is split between defense, nondefense discretionary spending, and all other mandatory spending such as the Supplemental Nutrition Assistance Program, Supplemental Security Income, and veterans' benefits.

Spending is projected to total 22.9 percent of Gross Domestic Product (GDP) in FY 2024, rising to 23.3 percent by 2028 and 24.1 percent of GDP by 2034. Health, retirement, and net interest explain over 200 percent of total spending growth as a share of GDP while other mandatory, defense and nondefense discretionary spending will shrink relative to the economy.

Net interest outlays will grow to 3.9 percent of GDP by 2034, an increase of 0.8 percentage points of GDP from 2024 and eclipsing its record of 3.2 percent set in 1991. Social Security will grow by 0.8 percentage points of GDP and health care will grow by 1.3 percentage points of GDP over the decade.

As a result of this rapid spending growth alongside revenue that fails to keep up, the national debt will exceed its record as a share of the economy in just four years. Policymakers should address this growing divide between spending and revenue to put the debt on a sustainable downward path.