What Will CBO Say About the President’s Budget?

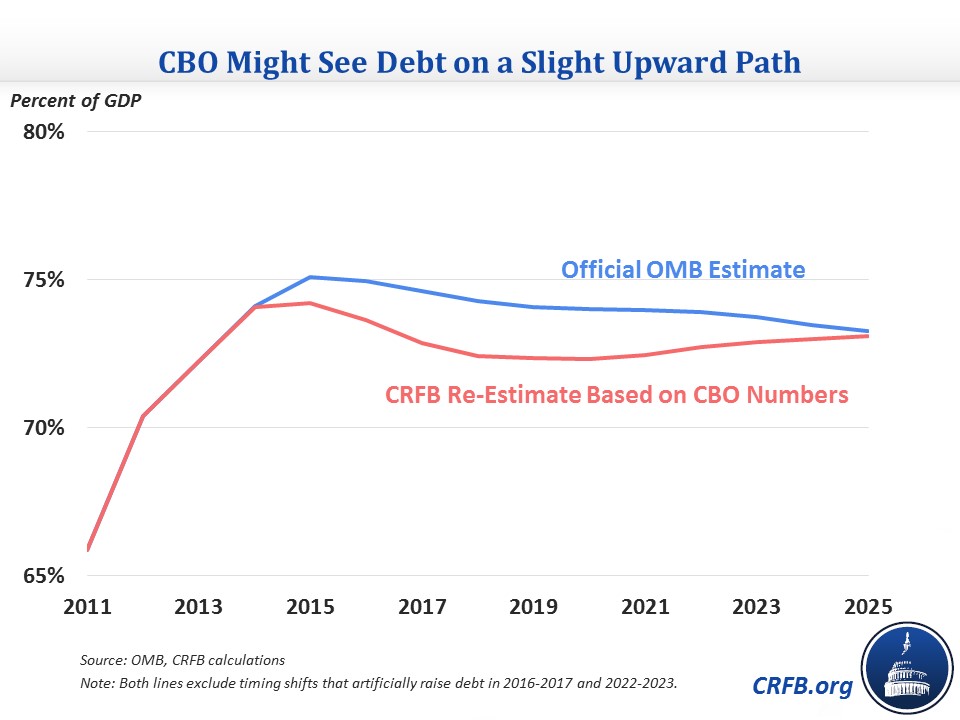

The President's budget would put debt on a very slight downward path over the next ten years, but that is by the Office of Management and Budget's own estimate. Usually about a month after the budget is released, the Congressional Budget Office weighs in, and it has often been less kind in its estimates than OMB (although sometimes it has actually shown a better estimate). While we can't say for sure how CBO would see the President's policies this time, we can get a good idea substituting CBO's baseline and a few policy estimates for OMB's; in past years, like last year and 2011, this method has worked pretty well. Our verdict this time? CBO could see a slight upward instead of slight downward debt path, although 2025 debt as a percent of GDP would be about the same.

OMB's estimate of the budget saw debt rise from 74 percent of GDP in 2014 to 75 percent this year before it would decline very gradually to 73 percent in ten years. Our estimate using CBO numbers shows a more complicated story. Debt would be stable between 2014 and 2015 and then decline to 72 percent by 2020. It would then start on a slight upward path which would moderate a bit by the end of the window. In short, the budget would not have sufficient savings to prevent an upward path, but the back-loaded nature of its savings would start to curtail that path in the last few years of the ten-year period. By 2025, deficits could be about $100 billion, or one-third of a percent of GDP, higher than OMB estimates.

To get these totals, we start by using a comparable CBO baseline, which has very similar debt in 2025 as OMB's but has a steeper upward path after 2018; as a result, the budget would need more savings to get a stable or downward path. We then substitute a few CBO policy estimates for OMB estimates where they are known, namely the extension of refundable tax credit expansions, the permanent "doc fix," and the repeal of the mandatory sequester. The first two policies cost somewhat more in CBO's view, while mandatory sequester repeal is somewhat less expensive; overall, incorporating CBO's estimates adds slightly to costs.

Of course, since these are not official CBO estimates, we are not evaluating whether they would see the President's other policies as saving more or less. Since OMB forecasts slightly faster economic growth, it is possible that incomes grow slower too, so the high-income tax increases would raise less and the low- and middle-income tax cuts would cost more. Other technical differences could change savings estimates significantly. CBO also releases a new baseline along with its estimate of the budget, so changes in there could improve or worsen the numbers.

We'll see in a month or so if we are right, but regardless, the story about the President's budget remains the same. It makes some progress on debt, but it does not put it on a clear downward path.

For more on this week's release of the President's budget read our President's FY 2016 Budget Series.