Two-Thirds of the “One Percent” Get a Tax Cut Under Build Back Better, Due to SALT Relief

Last month, we showed that the House-passed Build Back Better Act would cut taxes for roughly two-thirds of those earning more than $1 million per year in 2022. This is true despite the fact that Build Back Better would raise taxes substantially for the extremely rich (mainly those making over $10 million per year), and remains true in light of recent corrections to an analysis of the Build Back Better Act published by the Joint Committee on Taxation (JCT). In the analysis below, we show the Build Back Better Act would also cut taxes for two-thirds of those in the top 1 percent of the income spectrum.

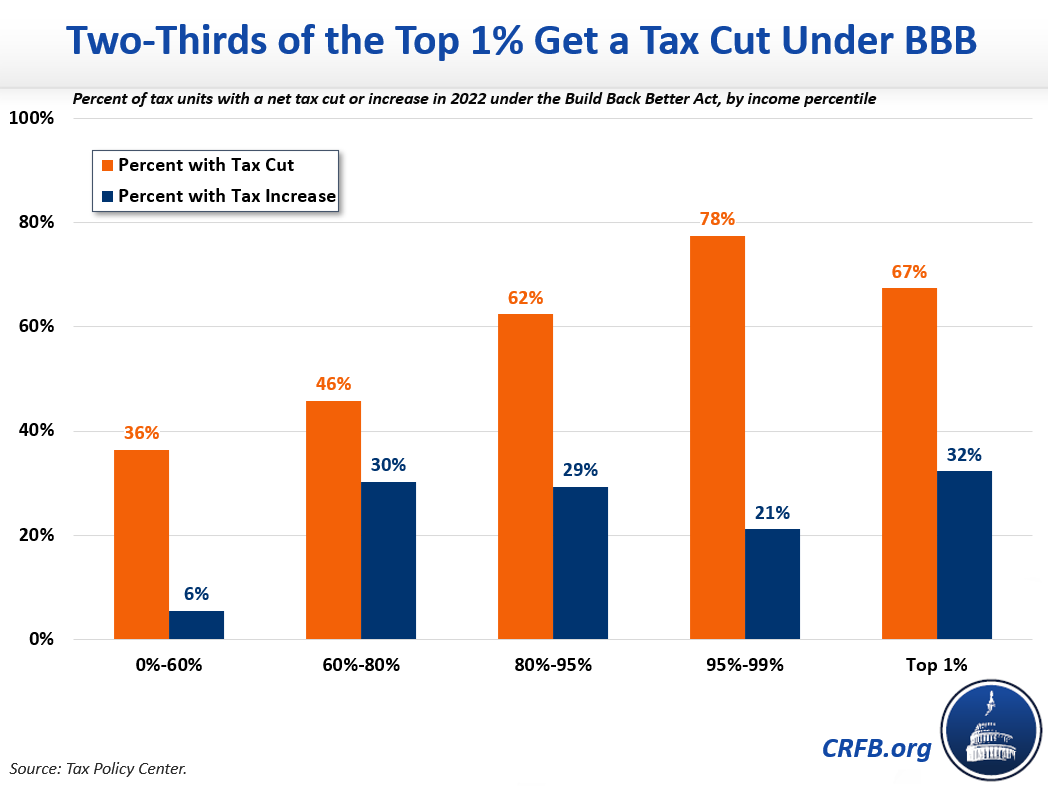

According to the Tax Policy Center (TPC), two-thirds of households in the top 1 percent – making over $885,000 per year – would receive an average tax cut of $16,090 in 2022. This includes more than one-third of taxpayers in the top 0.1 percent of the income spectrum. Meanwhile, more than three-quarters of households within the 95th to 99th income percentiles will receive a tax cut. These tax cuts are entirely driven by the House proposal to increase the cap on the State and Local Tax (SALT) deduction, which would deliver large tax cuts to the very highest income households.

By comparison, only about one-third of those in the top 1 percent of earners and one-fifth of those within the 95th and 99th income percentiles would face a higher tax burden. While the bill does not directly increase taxes on anyone earning less than $400,000 per year, some percentage of households in every income group would end up with higher indirect tax burdens because of higher corporate taxes. TPC and other estimators believe corporate tax increases ultimately flow through to retirement accounts, wages, and other sources of income across the income spectrum.

When the indirect effects of corporate tax increases are excluded, the bill only increases taxes on 3.3 percent of those within the 95th and 99th income percentiles, and 20.5 percent of those within the top 1 percent of earners. All other taxpayers – including more than 71 percent of those among the top 1 percent – will receive a net tax cut from the individual and payroll tax provisions in the bill.

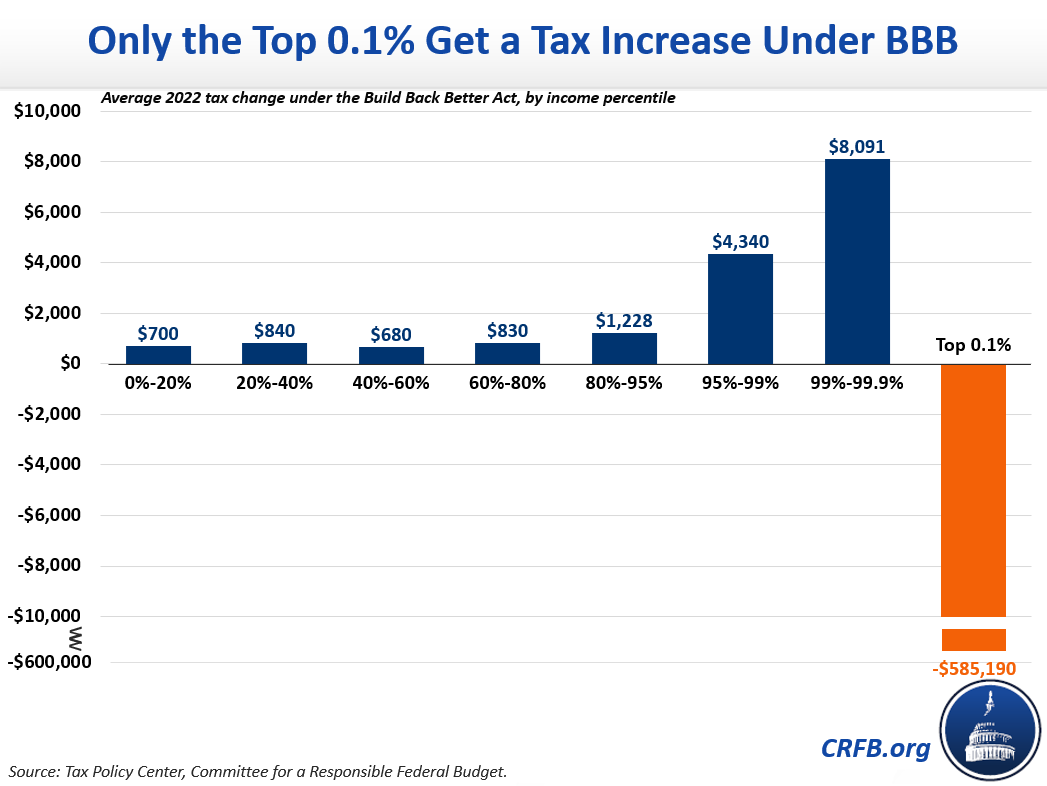

The nominal size of that tax cut rises steadily with income, even past the 99th income percentile. Including the effects of the corporate tax changes, households in the bottom 80 percent of the income spectrum will receive an average tax cut of roughly$750 in 2022 from the Build Back Better Act, while households within the 80th and 95th income percentiles will receive over $1,200 of tax cuts. Meanwhile, households within the 95th and 99th income percentiles would receive an average tax cut of $4,340, and households within the top 1 percent of earners but outside the top 0.1 percent would receive the largest tax cut – totally nearly $8,100.

In other words, the largest tax cuts in dollars in Build Back Better would go to households in the top 5 percent and especially the top 1 percent. Many make millions of dollars of annual income and tens of millions of dollars in assets.

Only households within the top 0.1 percent would, on average, face a net tax increase in 2022 – and even one-third of those households would enjoy a tax cut. As a result of the income surtax applied above $10 million in annual income, the average tax increase for that group will be $585,190.

Importantly, a recent correction made to JCT’s analysis of the Build Back Better Act has led some to incorrectly conclude it does not cut taxes for high earners. Our analysis above is based on data from the Tax Policy Center, which included no such error and demonstrates clearly that most high-income households would see their taxes cut.

JCT, unlike most other estimators, incorporates the effects of income-shifting into its distributional analysis. Largely because wealthy taxpayers will sell assets early to avoid a large surtax on their capital gains in 2022, JCT finds the highest earners will report less income and pay less in taxes in 2022. As a result, all households making over $1 million per year will face a 5.4 percent reduction in taxes paid and a 3.2 percent increase in their average tax rate.

This seemingly contradictory result is an artifact of a one-time tax planning move and is not a useful way to understand changes to tax burden. Data from the Tax Policy Center and others account for this timing shift in a way that better shows distribution of tax cuts and increases. Even still, the JCT continues to find that about 70 percent of households making over $1 million will pay less in taxes in 2022 under Build Back better than under current law.

Overall, the Build Back Better Act is progressive at the very top. It would raise taxes for most households in the top 0.1 percent of the income spectrum, and particularly for those earning over $10 million per year. Yet, because the legislation lifts the SALT deduction cap to $80,000, it is in many ways regressive, particularly when looking at households making less than $10 million per year. In 2022, over two-thirds of those within the top 1 percent of earners and roughly three-quarters of those within the top 5 percent would get a tax cut. That tax cut only gets larger as income gets higher.

To prevent tax cuts for high earners, policymakers should remove or at least dramatically scale back the SALT cap relief from the House version of the bill. Otherwise, the Build Back Better Act will deliver more tax relief to high-income households than to the middle class.

Read more options and analyses on our Reconciliation Resources page and our SALT Deduction Resources page.