Two-Thirds of Millionaires Get a Tax Cut Under Build Back Better, Due to SALT Relief

This week, the Tax Policy Center (TPC) released new estimates for how the Build Back Better Act will affect the tax burden of individuals at various points along the income spectrum. When including tax credits, the bill delivers a tax cut to low- and middle-class families as expected, while raising revenue from the very highest earners. Most of the revenue, and nearly all of the non-corporate revenue, comes from households making over $500,000 per year.

However, because Build Back Better would raise the $10,000 cap on the state and local tax (SALT) deduction, it would cut taxes for the majority of very wealthy families as well. According to TPC, two-thirds of households making over $1 million per year would receive a tax cut under the Build Back Better Act. More than three-quarters of households earning between $500,000 and $1 million would also receive a tax cut, as would two-thirds of those earning between $200,000 and $500,000.

By comparison, about one-third of those earning more than $1 million per year and one-fifth of those earning between $500,000 and $1 million per year would face a higher tax burden. While the bill does not directly increase taxes on anyone earning less than $400,000 per year, some percentage of households in every income group would end up with higher indirect tax burdens as a result of higher corporate taxes. TPC and other estimators believe corporate tax increases ultimately flow through to retirement accounts, wages, and other sources of income across the income spectrum.

When the indirect effects of corporate tax increases are excluded, the bill only increases taxes on 0.1 percent of households earning between $200,000 and $500,000 per year, 8 percent of those earning between $500,000 and $1 million per year, and 22 percent of those earning more than $1 million per year. All other taxpayers – including more than 70 percent of those making more than $1 million per year – will receive a net tax cut from the individual and payroll tax provisions in the bill.

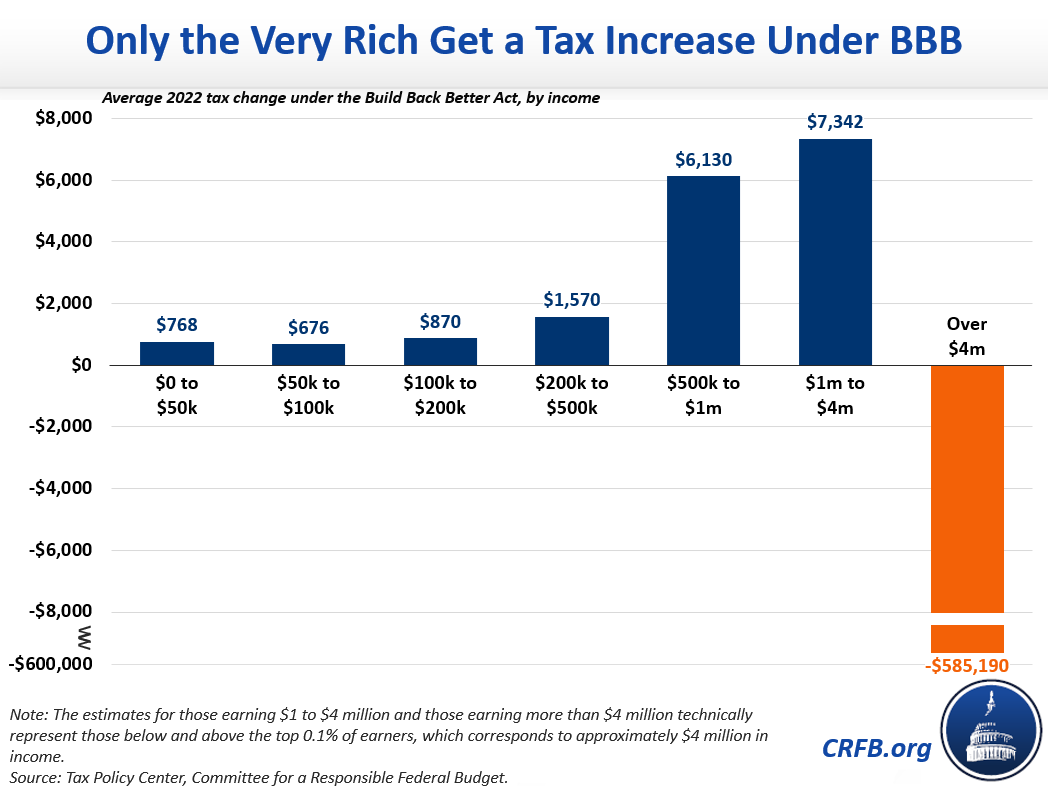

The nominal size of that tax cut rises steadily with income, even after the $1 million income mark. Including the effects of the corporate tax changes, households earning less than $50,000 per year will receive an average tax cut of less than $800 in 2022 from the Build Back Better Act, while households earning between $200,000 and $500,000 per year will receive nearly $1,600 tax cuts. Meanwhile, households earning between $500,000 and $1 million per year would receive an average tax cut of more than $6,100, and households earning between $1 million and $4 million per year would receive an even larger tax cut of more than $7,300. In other words, the largest tax cuts in Build Back Better would go to households with millions of dollars of income, and likely tens of millions in wealth.

It’s only very-high earners who would ultimately receive a tax increase from the bill. Those earning more than $4 million per year would receive an average tax increase of more than $585,000, driven mainly by the 5 and 8 percent surtaxes on income paid by those who earn tens or hundreds of millions per year. It is likely that most households earning less than $10 million per year would receive a tax cut under the bill, although the data is not broken out that way.

That households so high on the income spectrum can expect a net tax cut from the Build Back Better Act is entirely due to the increase in the SALT deduction cap from $10,000 to $80,000.1 As we have pointed out many times, any proposal to increase or repeal the SALT deduction cap unavoidably represents a massive giveaway to the wealthy. Using households in Washington, DC as an example, we estimate the House SALT proposal would deliver no tax cut to a typical family making less than $100,000 per year, a $3,000 tax cut to families making $200,000 per year, and a $25,900 cut to families making $1 million or more per year.

Policymakers could reduce the regressivity of the House SALT cap proposal, but there is no way to make SALT relief progressive. If policymakers don't want to deliver a tax cut to very high earners, they should remove changes to the SALT cap from Build Back Better.

Read more options and analyses on our Reconciliation Resources page and our SALT Deduction Resources page.

1 The SALT deduction cap, which is scheduled to expire in 2026 along with much of the rest of the Tax Cuts and Jobs Act, would also be extended under the Build Back Better Act through 2030 at the $80,000 level, then through 2031 at the $10,000 level.