Trust Fund Deadlines Are Closing In

In addition to updating budget projections, CBO's baseline also looks at the state of various government trust funds over the next ten years. Two of the trust funds – the Highway Trust Fund (HTF) and Social Security Disability Insurance (DI) will have to be dealt with this year or next. The other two with later exhaustion dates – Social Security Old Age and Survivors' Insurance (OASI) and Medicare Hospital Insurance (HI) – have both seen a drop in the size of reserves. Here's a rundown of each of these four trust funds.

Highway Trust Fund

The last time lawmakers dealt with highway financing, they intended that the expiration of the highway bill and the exhaustion of the HTF both happen at the end of May. Now, it looks like there may be a little time between the two as the general revenue transfer to the HTF may last longer.

Previously, CBO expected there to be a $2 billion shortfall in FY 2015, but that gap has been wiped out in the newest projections by two developments: slightly higher gas tax revenue (from lower gas prices increasing demand) and slightly lower spending from lawmakers freezing spending in 2015 rather than letting it grow with inflation. These developments mean that lawmakers may be able to wait until the summer to deal with the HTF, thus theoretically allowing them to write a new highway bill without dealing with the financing gap for a little bit. These two developments also make a long-term solution slightly easier, reducing the trust fund shortfall by about $10 billion.

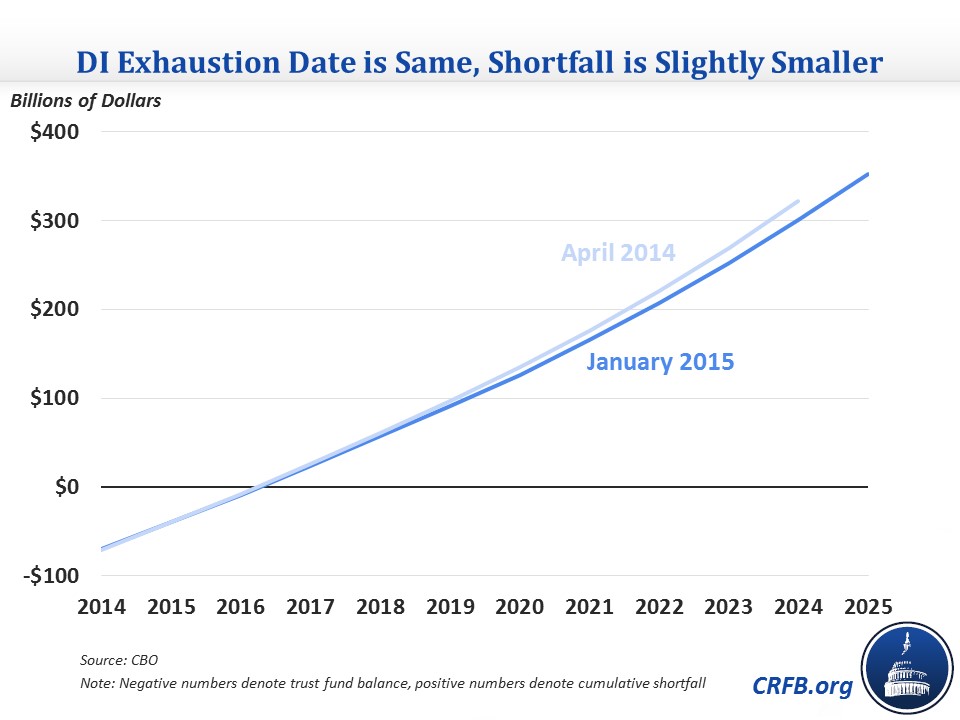

Disability Insurance Trust Fund

The exhaustion of the DI Trust Fund is one of the Fiscal Speed Bumps lawmakers should address this year. Although CBO slightly reduced its forecast for both Social Security spending and revenue, it still foresees an exhaustion date in FY 2017, likely by the end of calendar year 2016. At this point, benefits would be cut by 20 percent.

Still, the reduced spending and revenue on net have slightly improved DI's shortfall through 2024, reducing it from $322 billion in the last projection to $300 billion in the current one. A solution may be slightly easier because of the smaller shortfall, but there is no reason to delay: lawmakers should address the DI fund this year.

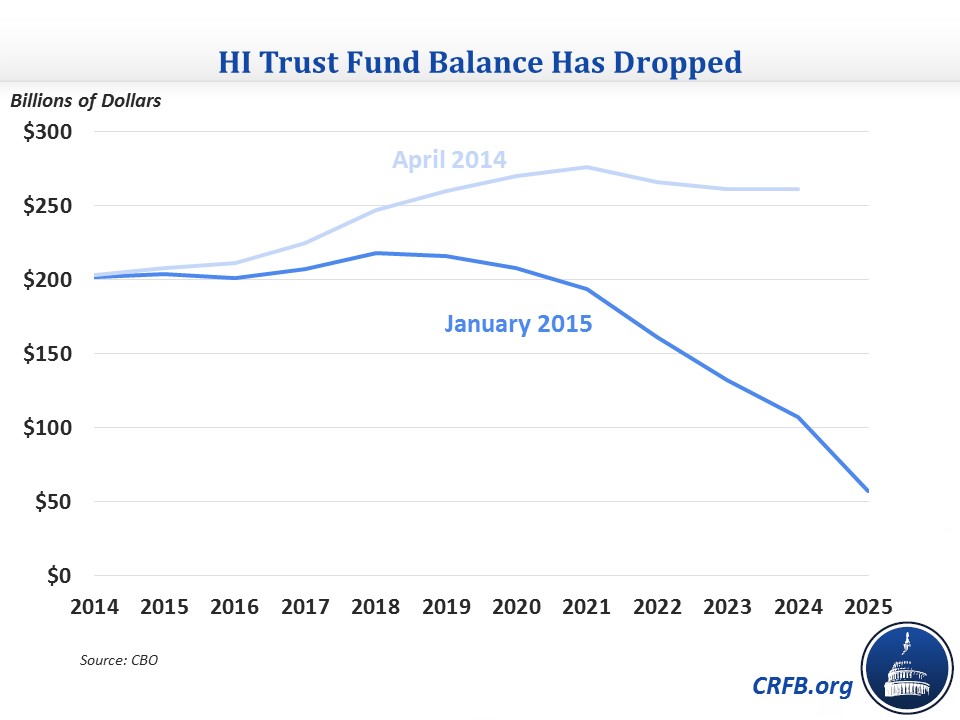

Hospital Insurance Trust Fund

The HI Trust Fund, which finances Part A of Medicare, had an exhaustion date of 2030 in CBO's long-term outlook. However, revising revenue downward because of lower salaries and wages has pushed that exhaustion date up a few years.

HI will return to a very small cash flow surplus for one year (2018), but it will quickly go into deficit after that.

The revenue drop results in the trust fund's 2024 balance falling by more than half from $261 billion in the last forecast to $107 billion. It appears that the trust fund exhaustion date is now just outside the ten-year window in either 2026 or 2027.

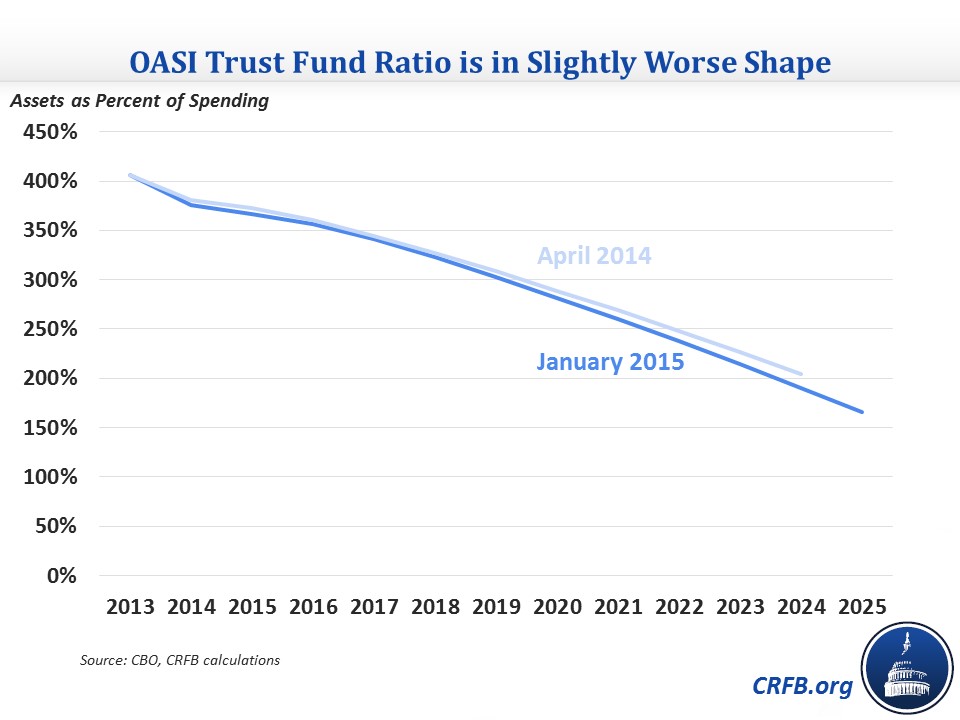

Old Age and Survivors' Insurance Trust Fund

The much larger OASI trust fund was last expected to be exhausted in 2032, or 2030 if lawmakers reallocated revenue from OASI to DI to avert its earlier insolvency. In this projection, the same changes that slightly helped DI will hurt OASI, in part because there is a longer lag between the effects of lower revenue on spending.

In the last ten-year projection, the OASI Trust Fund was projected to have a declining balance starting in 2020 that would be at $2.47 trillion by 2024. Now, the balance is projected to decline in 2019 and be $230 billion lower at $2.23 trillion. The ratio of trust fund assets to spending, a common measure of trust fund health, in 2024 would be 190 percent instead of the previous 205 percent. CBO does not say whether the insolvency date is closer, but it is possible it has been moved up with these more pessimistic numbers.

*****

CBO's estimates make it clear that lawmakers will still have to act quickly to make the Highway and Disability Insurance Trust Funds solvent. And the longer they wait on changing the entitlement or funding to Social Security's Old Age Program and Medicare, the more lawmakers risk being forced to scramble at the last minute with drastic changes. Further, in addition to the benefit of making these programs solvent, doing so would dramatically improve the long-term debt situation. Clearly, shoring up trust funds would be good for the federal government's fiscal health.