Tariffs Won’t Cover OBBBA’s Costs

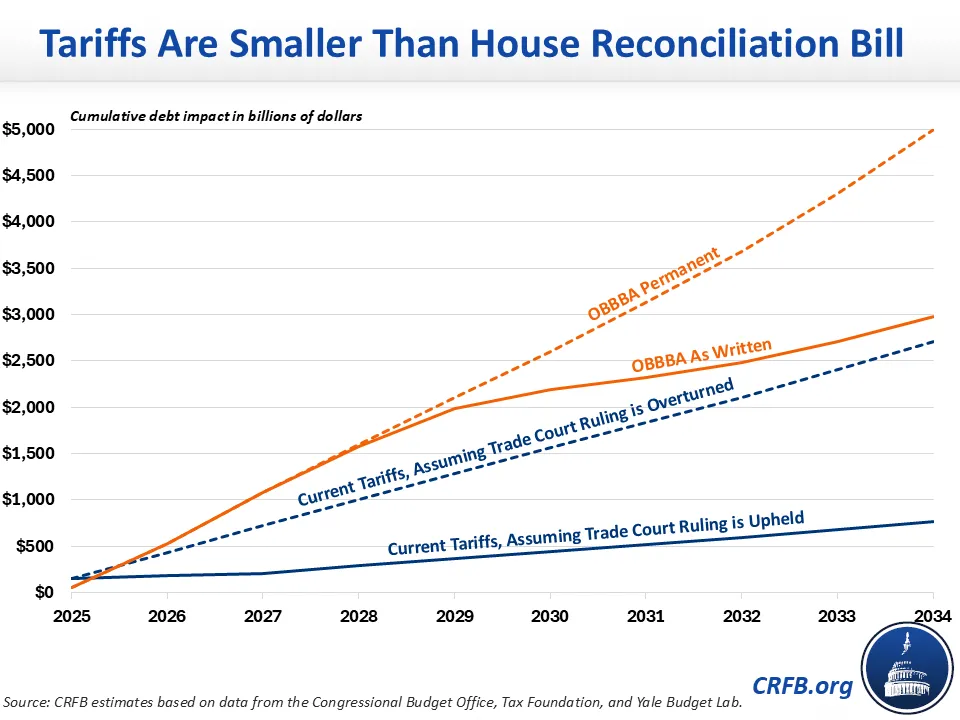

Yesterday, the Congressional Budget Office (CBO) estimated that recent tariff policies would reduce deficits by $2.5 to $3 trillion through 2035, leading some to conclude that the tariffs could pay for the $3 trillion of borrowing under the House-passed reconciliation bill – the One Big Beautiful Bill Act (OBBBA). But when measured on a comparable basis and incorporating the recent court ruling, the current tariffs would cover as little as one-sixth of OBBBA’s costs.

Assuming the recent trade court decision ruling many of the tariffs illegal is upheld, the remaining tariffs would raise $80 billion in 2027, while OBBBA would increase primary deficits by $540 billion. Over a decade, those tariffs would reduce debt by $850 billion, while OBBBA would increase debt by $3 trillion as written and $5 trillion if extended. If the trade court's decision is overturned, the tariffs could cover about half of OBBBA's near-term or permanent costs. These estimates assume that the tariffs are not reversed or adjusted (and no exemptions are added) by the current Administration or future ones.

Importantly, Congress must enact policy to count it as an offset – they cannot count Administrative policy changes – and OBBBA does not include any major increase in or codification of tariffs. Moreover, the savings from tariffs currently in effect – including those recently ruled illegal (pending appeal) – would fall well short of the cost of OBBBA on an annual basis. Incorporating that court ruling, the tariffs will only make up for a much smaller portion of OBBBA’s costs.

Through 2034, the tariffs currently in effect would reduce debt by about $2.7 trillion based on CBO’s conventional (non-dynamic) analysis. But most of those tariffs were ruled illegal by the U.S. Court of International Trade, who ruled the President exceeded his authority under the International Emergency Economic Powers Act. Although the tariffs remain in effect pending an appeal, we estimate the remaining tariffs would reduce debt by closer to $850 billion through 2034.1

Regardless, the tariff revenue would fall well short of the new borrowing under the House-passed reconciliation bill over the next few years. In 2027, for example, OBBBA will increase the primary deficit (which excludes interest) by about $540 billion per year – while the tariffs will raise about $80 billion assuming the trade court decision is upheld, and $270 billon if it is reversed on appeal.2

Over the full decade, the tariffs appear to cover a larger share of OBBBA’s costs – but this assumes lawmakers allow $2 trillion of arbitrary expirations for allegedly temporary provisions in the reconciliation bill.

If all tariffs remain in place through 2034 without any removals, adjustments, exemptions, or trade deals, the tariffs currently in place would reduce the debt (including interest) by $2.7 trillion, while the tariffs currently deemed legal would reduce debt by $850 billion.

That $850 billion would cover more than one-quarter of the $3 trillion cost of the House-passed bill as written, but only one-sixth of the cost of the bill if made permanent. Assuming the trade court ruling is reversed, the tariffs would cover just over half of the cost of OBBBA, if made permanent.

Debt and Deficit Impact of Tariffs and Reconciliation Bill, excluding dynamic effects

| 2027 Primary Deficit Impact | 2034 Debt Impact | |

|---|---|---|

| Current Tariffs (Court Ruling Overruled) | -$270 billion | -$2.7 trillion |

| Current Tariffs (Court Ruling Upheld) | -$80 billion | -$850 billion |

| House Reconciliation Bill (OBBBA) | $540 billion | $3.0 trillion |

| OBBBA if Permanent | $540 billion | $5.0 trillion |

The actual gap may worsen when taking into account economic feedback effects, as economists have found tariffs would reduce economic output despite the positive effects of the deficit reduction. For example, CBO estimates that the tariffs currently in place could increase deficits by nearly $300 billion through 2035 due to dynamic effects (JCT estimates the dynamic effects of the tax title of OBBBA would reduce deficits by $100 billion). This estimate may not incorporate the bond market reaction to tariff announcements, which likely boosted interest costs.

And importantly, these analyses all assume current tariffs not ruled illegal by the courts could remain in effect as written. Tariffs put in place by executive action can easily be removed or modified by executive actions – including through unilateral adjustments, trade deals, new exemptions, or other changes. There may also be additional court challenges on the horizon.

While the tariffs could generate significant revenue, there is great uncertainty as to what tariffs will remain over the long term – and the recent ruling by the U.S. Court of International Trade brings further into question their long-term viability. Yet even if all current tariffs remain in place, they would not be enough to cover the cost of the reconciliation bill.

If lawmakers want to use tariffs to finance tax cuts or spending, they should enact or codify them into law. Otherwise it would be inappropriate and imprudent to use them as an offset – particularly when our fiscal outlook is already so dismal.

[1] These estimates are based on data and findings from CBO, Yale Budget Lab, and Tax Foundation.

[2] If the court decision is upheld, it may result in refunds for those who paid the illegal tariffs. We include these refunds in our ten-year numbers but not our annual figures.