Spending and Revenue in the Ryan Budget

Earlier today, Chairman Ryan released his FY 2014 budget, proposing a number of bold changes that would put debt on a downward path as a share of the economy. In addition to our initial analysis this morning, we also put out a press release reacting to it.

Ryan achieves his deficit reduction entirely through cuts to spending. Examples of some of the larger cuts include repealing the spending increases in the Affordable Care Act, block granting and reducing Medicaid and food stamps, increasing federal employee retirement contributions, means-testing Medicare premiums, and enacting tort reform. As a result, outlays would fall from just over 22 percent of GDP in 2013 to just over 19 percent by 2023. Since the budget makes no current policy adjustments to taxes and has revenue-neutral tax reform, his revenue levels are in line with current law, projected to rise from 17 percent of GDP in 2013 to just over 19 percent in 2023, primarily due to the economic recovery.

| House Budget Committee FY 2014 Proposal (Percent of GDP) |

||||||||||

| Ryan Budget | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Outlays | 21.2% | 19.8% | 19.5% | 19.1% | 19.1% | 19.2% | 19.3% | 19.2% | 19.4% | 19.1% |

| Revenues | 18.0% | 19.1% | 19.1% | 18.9% | 18.8% | 18.7% | 18.7% | 18.9% | 19.0% | 19.1% |

| Deficit | 3.2% | 0.7% | 0.4% | 0.3% | 0.3% | 0.4% | 0.5% | 0.4% | 0.4% | 0.0% |

| Debt | 77.2% | 74.1% | 70.4% | 66.9% | 64.4% | 62.4% | 60.5% | 58.7% | 56.9% | 54.8% |

| Current Law | ||||||||||

| Outlays | 21.7% | 21.6% | 21.6% | 21.5% | 21.7% | 22.0% | 22.2% | 22.4% | 22.9% | 22.9% |

| Revenues | 18.0% | 19.1% | 19.1% | 18.9% | 18.8% | 18.7% | 18.7% | 18.9% | 19.0% | 19.1% |

| Deficit | 3.7% | 2.4% | 2.5% | 2.7% | 2.9% | 3.2% | 3.5% | 3.6% | 3.8% | 3.8% |

| Debt | 77.7% | 76.3% | 74.6% | 73.4% | 73.1% | 73.5% | 74.2% | 75.0% | 76.0% | 77.0% |

Source: House Budget Committee

It is interesting to note that while Ryan finds his savings entirely on the spending side, by maintaining current law revenue levels, revenue under the Ryan budget will still be projected to be higher than the 40-year historical average of 17.9 percent. This shows that it is unlikely that a sustainable budget would be able to keep revenues at the historical level.

Compared to last year's budget, revenue levels are higher and spending levels are lower due to a number of legislative and technical changes since last March, as well as a few additional proposals in this year's version. Revenues are higher primarily due to Ryan enacting revenue-neutral tax reform at a higher revenue baseline relative to last year, due to the tax increases in ATRA. Spending is lower due to some baseline changes, particularly lower estimates of health care spending in CBO's baseline.

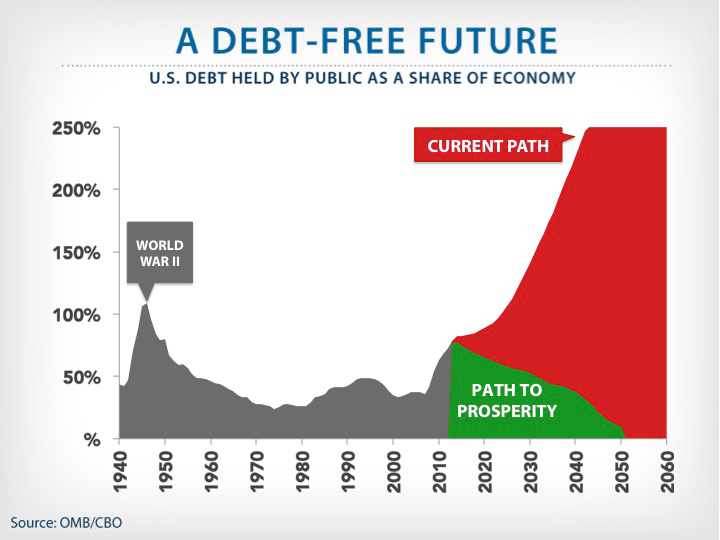

While the CBO was unable to give a long-term projection for the Ryan budget given the many legislative changes since their last long-term baseline, the House Budget Committee provided their own projection of the what the budget would do to debt in the long run. Compared to our current path, where debt is clearly unsustainable, it is estimated that the budget would keep debt on a downward path and pay it off entirely sometime in the 2050s.

Source: House Budget Committee