Seven Reasons to Pay for Tax Extenders

By the end of the year, lawmakers will likely to try to revive the “tax extenders,” a set of more than 50 tax breaks that expired at the end of 2014 for individuals and businesses, ranging from broad breaks for research, renewable energy, and small businesses to narrower breaks for film production, teachers, and racehorses. Extending these tax provisions will further add to the debt if they are not offset, compounding the effects of the fiscally irresponsible budget deal that only offset half of its cost.

The House and Senate have taken two different approaches to tax extenders. The Senate Finance Committee approved a bill in July that would cost almost $100 billion to temporarily extend most of them for 2015 and 2016, while the House has passed bills to permanently expand and extend a small amount of provisions.

Newly appointed House Ways and Means Chairman Kevin Brady (R-TX) has said he wants to permanently extend certain tax provisions, and the House has been working to do so in a piece-meal fashion. In mid-September, the Ways & Means Committee approved tax breaks costing nearly $420 billion over ten years, or almost $520 billion with interest. Along with other proposals approved earlier in the year, the Committee’s tax cuts would add about $1 trillion to the debt.

No matter which of these provisions lawmakers chose to keep, they should all be paid for. At this point, neither side of Congress appears willing to stand up for fiscal responsibility, as each chamber has shown it wants to extend the tax breaks without offsets. If these bills are not paid for, here are some of the problems that may result.

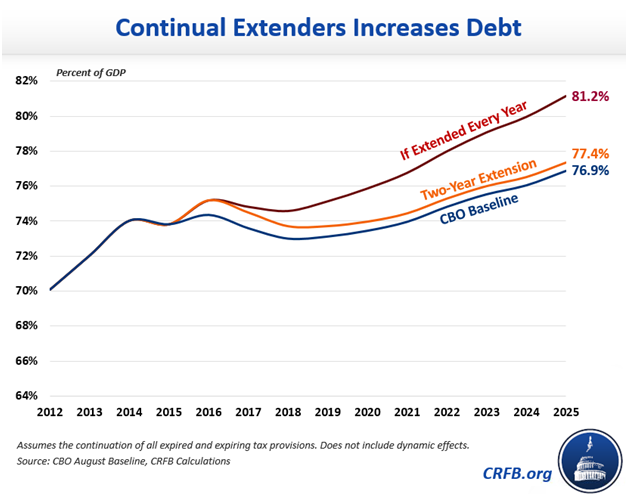

1. Increases an already unsustainable debt. Making permanent or continuously renewing all expired and expiring tax breaks would add $1.2 trillion to the debt – including $820 billion of lost revenue, about $160 billion of higher outlays on refundable credits, and $190 billion of interest costs. As a result, debt would rise from 74 percent of GDP today to over 81 percent by 2025 – more than four points higher than under baseline projections. A temporary extension would also be costly. The two-year Senate bill would lose nearly $100 billion in revenue, increasing interest costs by over $30 billion, and add half a percent of GDP to the debt by 2025.

2. Violates budget enforcement rules. Passing a tax extenders package without offsets undermines the budget process by violating budget enforcement rules. Because the tax extenders packages under consideration would increase the deficit this year and over the next decade, they violate the PAYGO rule. In addition, since tax extenders that aren't paid for will reduce revenues below the level called for in the FY 2016 budget agreement, these proposals would violate the Congressional Budget Act of 1974, which prohibits revenues from falling below levels proscribed in a budget bill.

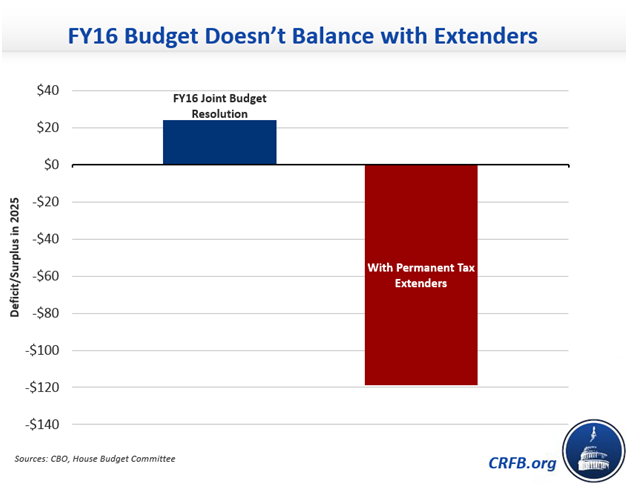

3. Contradicts every proposed budget this year, and undermines balanced budget targets. This year eight budget proposals were presented, and each one called for revenues at or above the Congressional Budget Office’s baseline, presupposing that temporary tax breaks either expire or are offset. By contrast, if tax extenders aren’t offset, revenue will decrease dramatically, to far below the revenue levels assumed in the House Budget Committee, the Senate Budget Committee, the President, the recently enacted Bipartisan Budget Act of 2015, as well as the Congressional Progressive Caucus, the Congressional Black Caucus, the Republican Study Committee, and the Democratic Caucus.

In each case, these revenue assumptions were necessary to achieve various fiscal goals – which in the case of the final FY 2016 congressional budget was achieving a balanced budget. Under its assumptions, the budget would run a $24 billion surplus in 2025. A permanent extenders package would reduce that surplus by $143 billion, wiping it out and turning it into a $119 billion deficit.

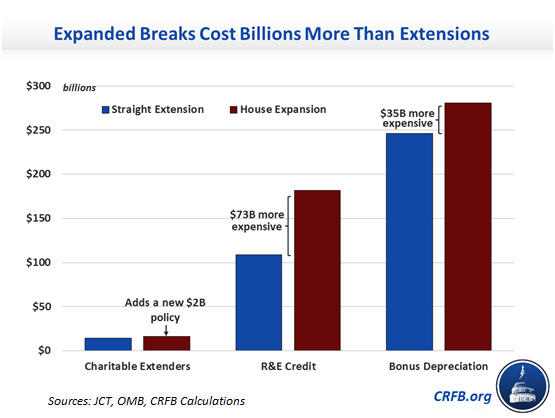

4. Invites policymakers to pile on legislative riders that increase the debt. Some argue that tax extenders simply continue existing policy, but when policymakers know that a bill will not be paid for, they are more likely to expand provisions and add new ones, opening the door to further debt increases. This year, the House has already voted to expand the Research and Experimentation Credit, and charitable extenders, as well as repeal the Cadillac tax. Other bills, such as one to expand bonus depreciation have been proposed. None of these bills been paid for. The expanded tax extenders would add more than a hundred billion dollars to the debt beyond the cost of extension, and repealing the Cadillac tax would cost another $91 billion, for a grand total of more than $200 billion in additional debt. Not paying for the tax extenders bill encourages policymakers to add provisions like these to the bill.

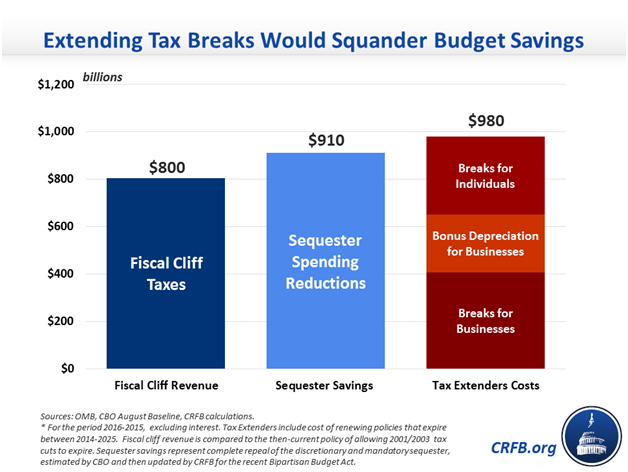

5. Squanders hard-earned savings and revenue from recent deficit reduction measures. Over the past several years, Congress has enacted significant deficit reduction measures, which would be undone if the extenders are continued permanently. Changes made in the 2013 fiscal cliff deal will raise about $800 billion in taxes over the next decade from the top 1 percent of earners. The sequester that went into effect in 2013 made significant cuts in defense and nondefense spending that will save about $910 billion over the next decade, even after the recent budget deal reduced the sequester for the next two years.. However, if Congress permanently extends tax breaks, most of which go to businesses, it will give away revenue more than all the additional revenue raised from high earners or more than all the budget savings in the sequester.

6. Moves in the opposite direction of tax reform. Comprehensive tax reform generally calls for broadening the tax base by reforming or repealing tax breaks in order to lower tax rates, reduce the deficits, or both. By contrast, a tax extenders package would re-instate or even expand tax breaks. This is contrary to the tax reform plans and frameworks put forward by Simpson-Bowles, former Ways & Means Chairman Dave Camp, President Obama, and nearly every Republican candidate for President.

In addition to the regular extenders, many policymakers have called for making “bonus depreciation” permanent so businesses can deduct half of their capital expenditures upfront rather than depreciating them over their economic lives. This moves in exactly the opposite direction of Chairman Camp’s Tax Reform Act and President Obama’s tax reform framework – both of which would lengthen rather than shorten depreciation schedules. For background on depreciation, see our Tax Break-Down on accelerated depreciation.

7. Ignores the fact that offsets are available. Many options are available for Congress to responsibly pay for the extenders. For example, Chairman Camp’s Tax Reform Act makes responsible choices on extenders by making some provisions permanent, allowing some to expire, and shrinking or reforming others; and paying for the full cost by reducing or repealing various current tax expenditures. On narrower basis, our PREP Plan would fully offset two years of extenders by improving tax reporting and enforcement, closing loopholes that promote tax avoidance, and restricting tax inversions. Dozens of other revenue options are also available.

***

Much more detail about the history, rationale, and cost of the extenders is available at our resources Tax Break-Down: Tax Extenders or Want to Understand the Tax Extenders? Here's a Few Charts.