SALT Cap Repeal Would Be a Costly Mistake

Recent reports indicate Congress may repeal the $10,000 cap on the State and Local Tax (SALT) deduction in its $3.5 trillion reconciliation bill, with some members insisting on repeal in exchange for their vote.

Such a repeal would be costly, regressive, and bad tax policy. As we have shown before, there is really no way to enact progressive SALT cap relief or to design such a policy to support only middle-class taxpayers. Importantly, each dollar wasted on removing the SALT cap is unavailable for other more worthy priorities.

What is the SALT Cap?

Prior to 2018, state and local property and income (or sales) taxes were generally deductible from income at the federal level. Along with other changes to the tax code, the 2017 Tax Cuts and Jobs Act (TCJA) established a $10,000 cap on the amount of state and local taxes (SALT) an individual could deduct.

Currently, taxpayers can combine up to $10,000 of state and local taxes paid, mortgage interest payments, and charitable donations, to determine their total amount of itemized deductions on their federal income tax return. They can then deduct from taxable income the greater of their itemized deductions or a $12,550 ($25,100 per couple) standard deduction.

Importantly, repealing the SALT cap would not simply return taxpayers to 2017. Many taxpayers who benefited from the SALT deduction in 2017 would see no gains from SALT cap repeal due to the much larger standard deduction now in effect. And many taxpayers who would benefit from SALT cap repeal today were not eligible for the SALT deduction in 2017 because they paid the (now dramatically reduced) Alternative Minimum Tax. Finally, nearly all taxpayers today benefit from lower tax rates relative to 2017 law.

SALT Cap Repeal is Expensive

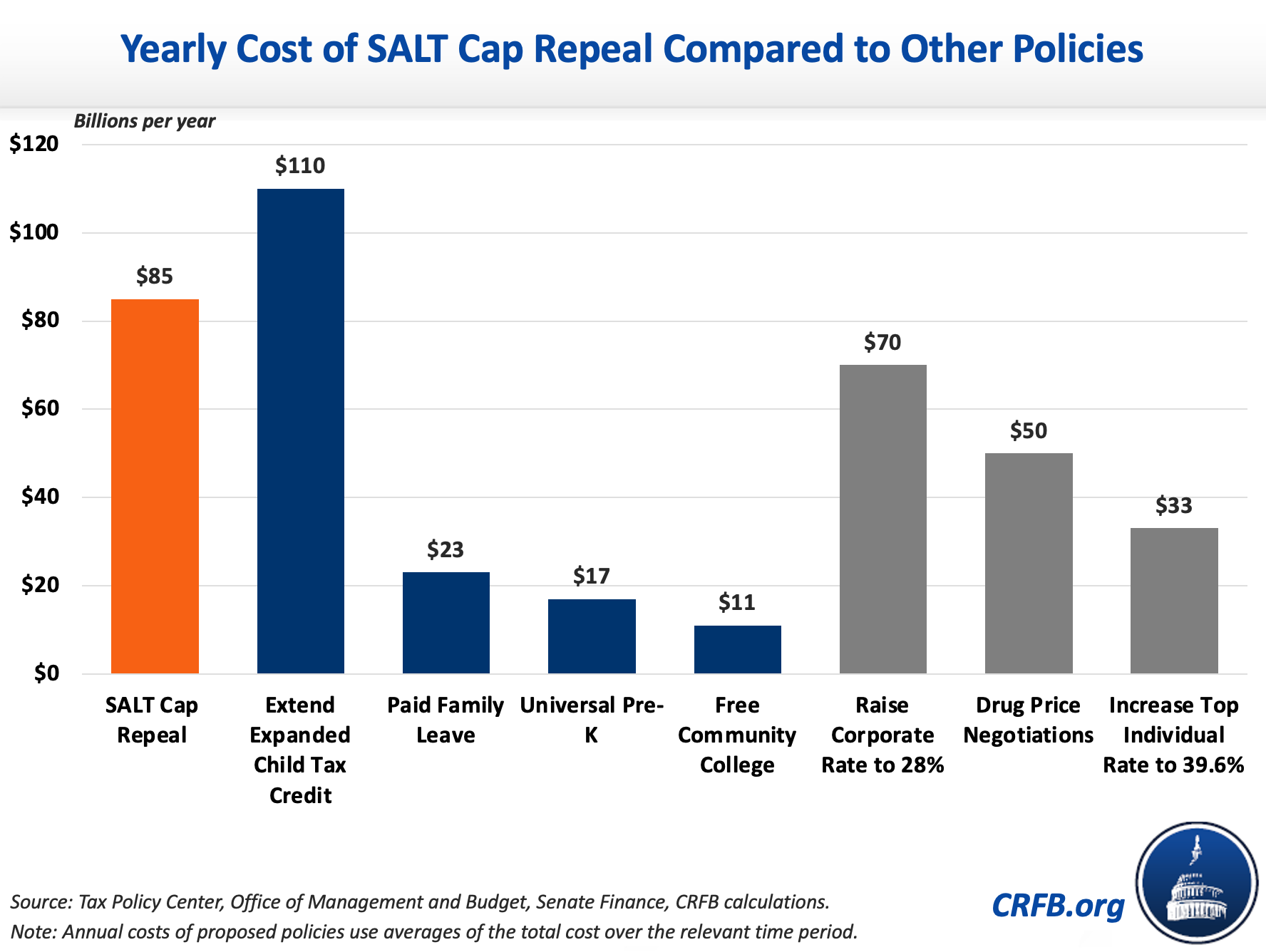

Repealing the SALT cap would cost the Treasury roughly $85 billion per year, and about $350 billion in total before the cap (along with other parts of the TCJA) expires in 2026. Each dollar spent on SALT cap repeal is either unavailable for other priorities in reconciliation or must be financed with additional tax increases or spending cuts.

The $85 billion annual cost of repeal is more than five times larger than the President’s universal pre-school plan, almost eight times as large as providing free community college, and over three-quarters as large as the cost of extending the expanded child tax credit. Meanwhile, the annual average cost of SALT cap repeal is two and a half times larger than the average annual revenue raised from increasing the top marginal income tax rate to 39.6 percent and 20 percent larger than the average annual revenue generated by raising the corporate tax rate to 28 percent.

The four-year (total) cost of repealing the SALT cap over twice as large as the ten-year cost of universal pre-school, more than three times as large as providing free community college over ten years, and 75 percent as large as the cost of extending the expanded child tax credit over ten years. The cost of SALT cap repeal costs is over two and a half times larger than the revenue raised from increasing the top marginal income tax rate to 39.6 percent over four years and half as large as raising the corporate tax rate to 28 percent over 10 years.

Repealing the SALT Cap is Regressive

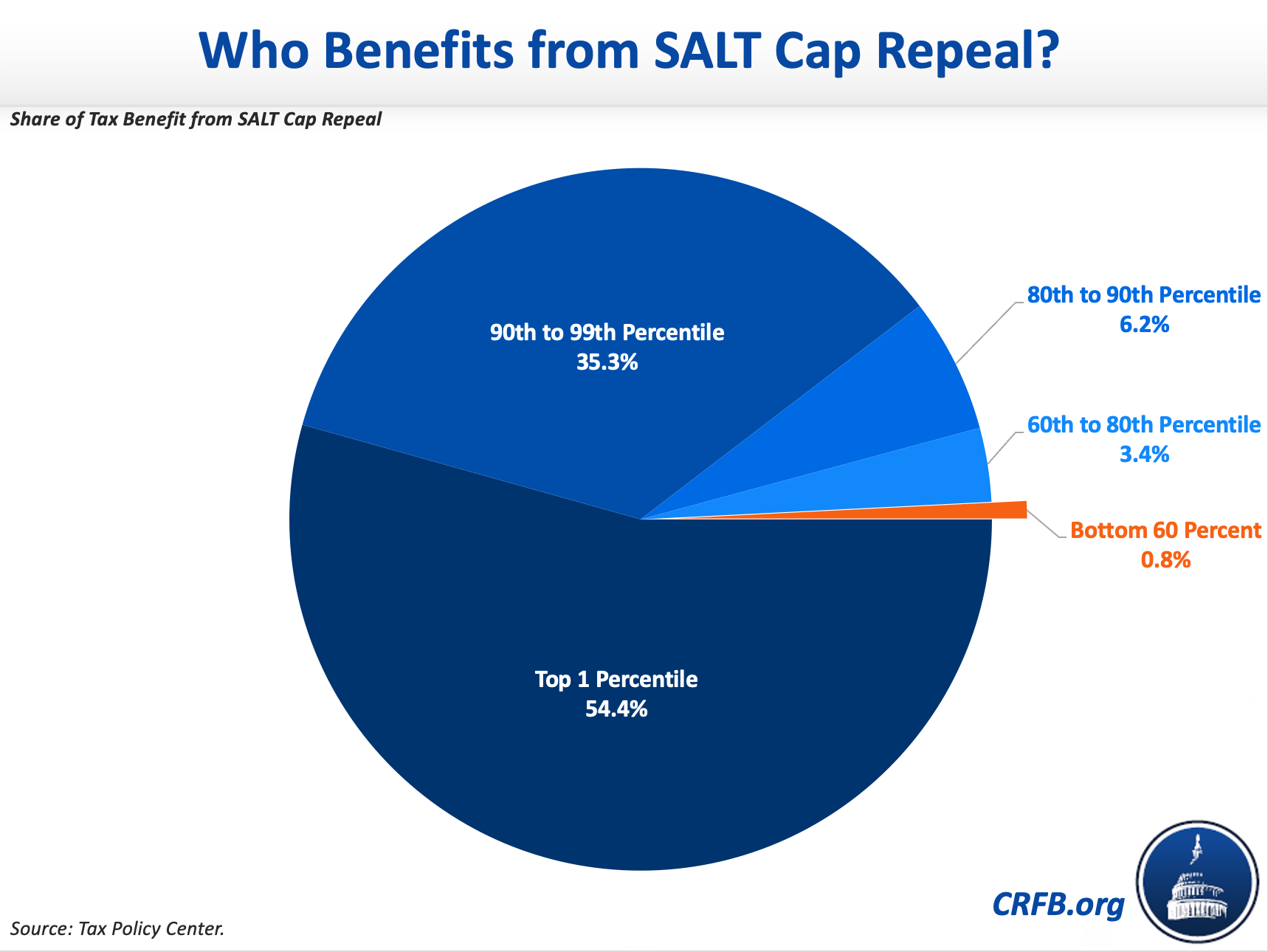

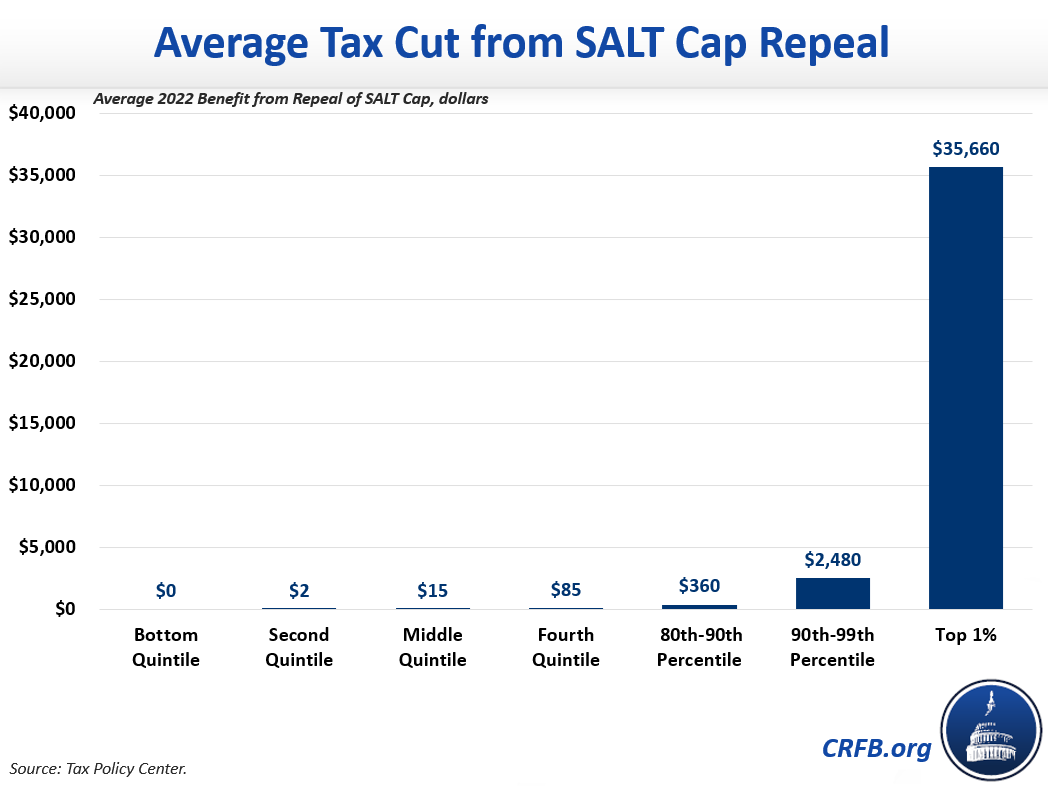

The benefits of SALT cap repeal go almost exclusively to high earners. Over half the benefit would go to the top 1 percent of earners, who would receive an average tax cut of $35,660 per household, according to data from the Tax Policy Center. Nearly 96 percent of the benefit would go to the top 20 percent of earners.

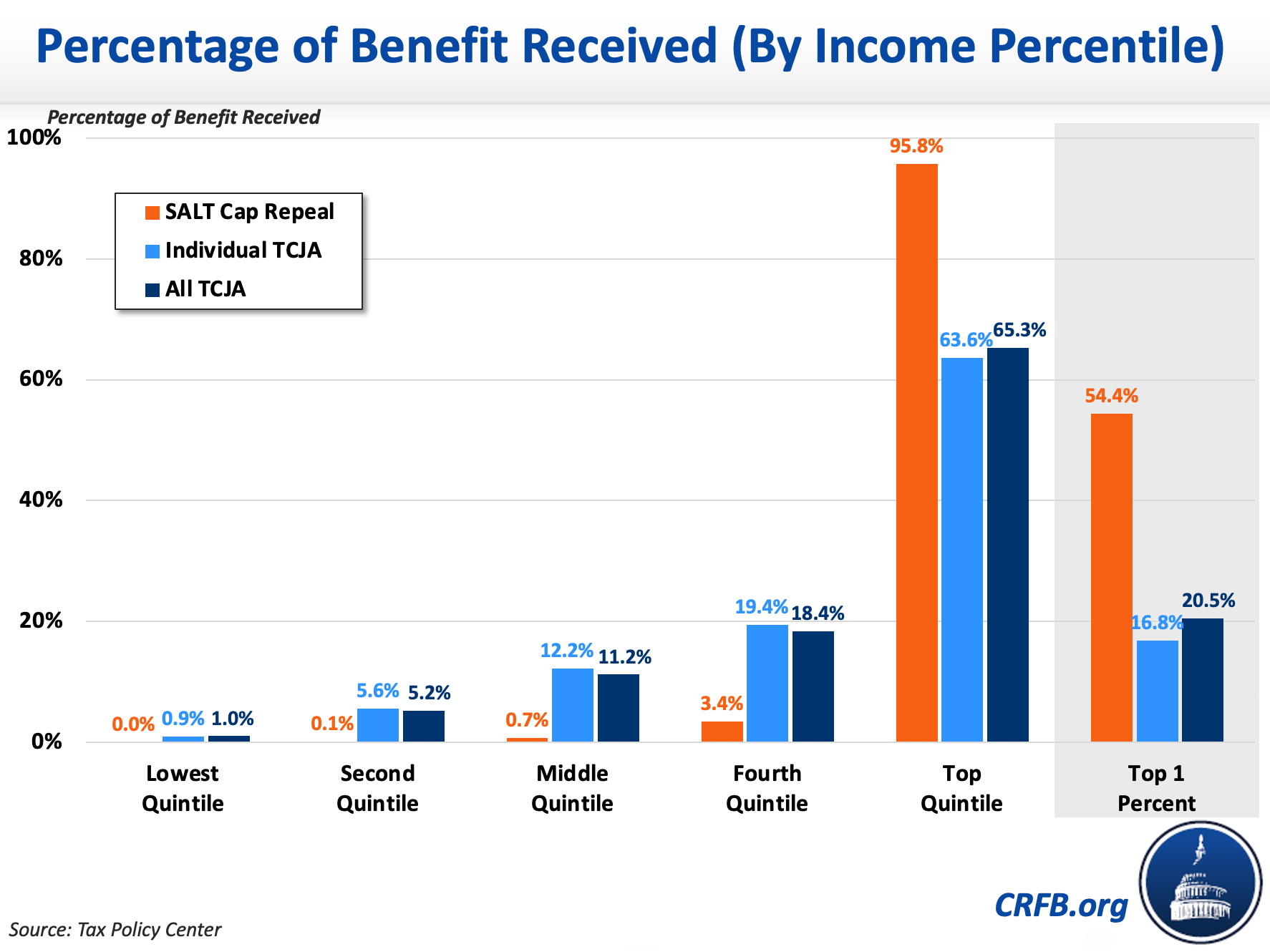

Indeed, SALT cap repeal would be significantly more regressive than the TCJA, which was criticized for its regressivity and described by some SALT cap repeal advocates as regressive "wealth-fare."

Whereas nearly 21 percent of the benefits of TCJA went to the top 1 percent, over 54 percent of the benefit of SALT cap repeal does. And while nearly 36 percent of the benefits of TCJA went to the bottom 80 percent of earners, just over 4 percent of the benefit of SALT cap repeal would.

While the effects of the SALT cap deduction differ by location, SALT cap repeal is highly regressive in every single state, according to the Institute on Taxation and Economic Policy (ITEP). In New York, for example, the top one percent would enjoy almost two-thirds of the benefit with an average tax cut of $93,600 per household ($146,790 inclusive of tax cuts form the TCJA). Meanwhile, those in the middle quintile would receive an average tax cut of only $20 from SALT cap repeal.

SALT Cap Repeal is Bad Tax Policy

Not only is SALT cap repeal expensive and regressive, but it would worsen the tax code. Whereas smart tax reform would broaden the tax base and reduces the $1.8 trillion of tax expenditures in the code, restoring the SALT deduction would do exactly the opposite.

And not only would repeal reduce tax efficiency, but it would also increase complexity by increasing the number of taxpayers who must itemize or calculate their taxes using the Alternative Minimum Tax.

Moreover, the argument for the SALT deduction – that it will help state and localities raise revenue to provide important services – is weak at best. While repealing the SALT cap would mean especially large tax cuts for high income households in high tax states, the indirect effect on states and local revenue collection appears from the literature to be minimal.

Indeed, SALT cap repeal is broadly opposed by tax experts on the left and right. This includes experts at Tax Foundation, the Center on Budget and Policy Priorities, ITEP, the American Enterprise Institute, the Heritage Foundation, the Manhattan Institute, the Progressive Policy Institute, the Brookings Institution, the Center for American Progress, the Committee for a Responsible Federal Budget, and others.

There’s no Such Thing as Progressive SALT Cap Relief

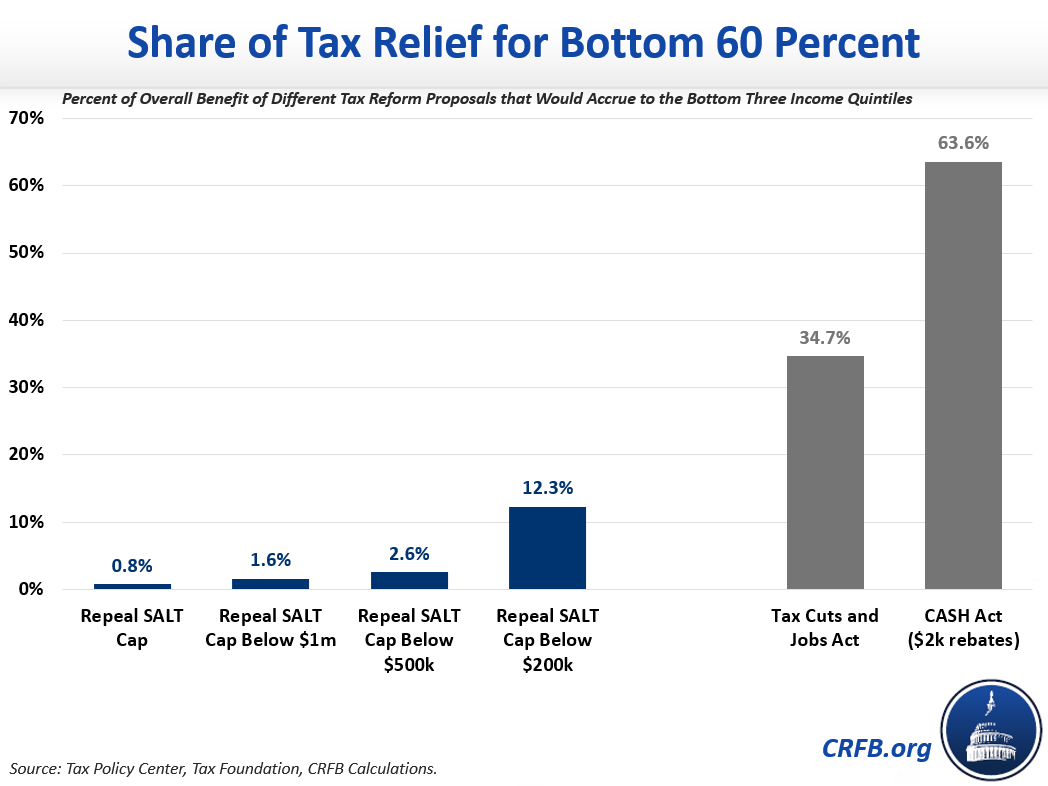

Rather than fully repeal the SALT cap, some lawmakers have considered ways to reform it to make it more progressive. But with the bottom 60 percent of earners only getting 0.8 percent of the benefit ($6 per household), it’s unclear how any version of SALT cap repeal could be progressive (see our analysis here).

For instance, if SALT cap repeal was limited to those making less than $1 million per year, it would only increase the share of the benefit going to the bottom 60 percent of earners to 1.6 percent. The share of the benefit going to the bottom 60 percent would increase to just 2.6 percent if the income cap was $500,000. The average benefit for these individuals would also be minimal because people with lower incomes don’t tend to itemize their deductions, especially given the much larger standard deduction from the TCJA. Lower income people also pay fewer state and local taxes, so the benefit isn’t particularly large for them under almost any circumstance. Even if the income limit were restricted to those just making under $200,000 a year, only 12.3 percent of the benefit would go to the bottom 60 percent of earners. That would still be more regressive than TCJA, where 35 percent of the benefit went to the bottom 60 percent.

Increasing the SALT cap higher than $10,000 is no better, with the Tax Foundation finding that if Congress were to increase the cap to $15,000 ($30,000 for couples), only 0.3 percent of the benefit would go to the bottom 60 percent of earners, while the top 10 percent of all earners would capture 85 percent of the benefit.

* * *

Reconciliation should not be allowed to add to the debt, and the country should not waste its scarce resources on policies that make little sense. SALT cap repeal would represent costly tax cuts for the wealthiest Americans that would worsen the tax code. It would be challenging (if not impossible) to design any form of SALT cap relief that makes fiscal sense.

In fact, the most progressive thing lawmakers could do is repeal the SALT deduction altogether, or at least phase it out with income. Another option would be to expand the SALT deduction cap to businesses. These changes would raise important new revenue to help pay for reconciliation.

Read more options and analyses on our Reconciliation Resources page and our SALT Deduction Resources page.