"A Sacred Trust" Would Weaken Social Security

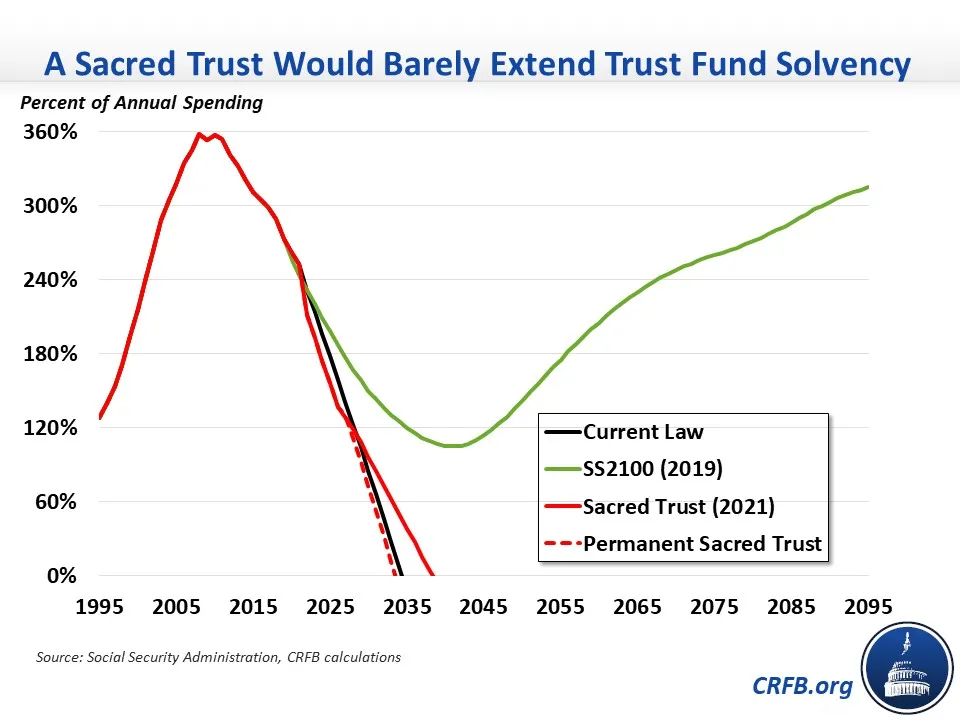

Lawmakers may soon consider Social Security Subcommittee Chairman John Larson's (D-CT) Social Security 2100: A Sacred Trust (A Sacred Trust), a bill designed to expand Social Security benefits and prevent trust fund insolvency in 2034. Unfortunately, the bill is a substantial downgrade from 2019's Social Security 2100 Act (SS2100), which we've praised as a responsible solution to Social Security's financial troubles. Whereas SS2100 would have restored the program to sustainable solvency, A Sacred Trust would close half the solvency gap on paper and would actually worsen solvency once gimmicks are removed.

The previous version of Social Security 2100, introduced in 2019, would generate enough new revenue to restore solvency and expand benefits. The legislation would subject earnings over $400,000 to the payroll tax while also gradually raising the payroll tax rate from 12.4 percent to 14.8 percent. In addition to closing the program's financial shortfall, the funds would finance a stronger minimum benefit, larger cost-of-living adjustments, and reduced taxation of benefits. We praised the bill at the time as "the only legislation introduced this Congress that would assure a lasting fix to Social Security by restoring the program to sustainable solvency” and described it as "an important and responsible starting point for discussion."

Unfortunately, A Sacred Trust is not worthy of similar praise. The new legislation removes nearly half of the solvency-improving revenue from the original bill, while dramatically expanding new spending -- but making that spending temporary to cover up the costs. Specifically, the new legislation removes adjustments to the payroll tax rate -- which were responsible for closing two-thirds of the solvency gap -- while adding eight new benefit expansions that would further increase benefits for disabled workers, spouses, young adults, and the very old. To obscure the cost of its benefit expansions, the legislation would set them all to expire after five years.

On paper, A Sacred Trust would close half of the solvency gap, while SS2100 closed the full solvency gap. Assuming the five-year benefit expansions are made permanent, as clearly intended, we estimate they would consume more than all of the revenue increases. In fact, a permanent version of A Sacred Trust would actually worsen solvency. Accounting for interactions with the income tax, it would also increase the national debt.

Comparing Social Security 2100 to Social Security 2100: A Sacred Trust

| Policy | SS2100 (2019) | A Sacred Trust (2021) | Permanent Sacred Trust |

|---|---|---|---|

| Tax earnings above $400,000 | 69% | 55% | 55% |

| Gradually raise payroll tax by 2.4 points | 67% | N/A | N/A |

| Index COLAs to CPI-E | -15% | <-1% | -12% |

| Other benefit expansions & interactions | -8% | -3% | -50%* |

| Percent of Solvency Gap Closed | 114% | 52% | -5%* |

| Additional Years of Solvency | +>75 years | +4 years | -1 year |

| Year of Insolvency Under Proposal | Beyond 2100 | 2038 | 2033 |

Source: Social Security Administration and Committee for a Responsible Federal Budget. Numbers may not add due to rounding.

Solvency gap estimates for SS2100 are based on the 2019 Trustees report, which estimated a 75-year shortfall of 2.78 percent of payroll, and for A Sacred Trust are based on the 2021 report, which had a 3.54 percent of payroll shortfall.

*Rough estimate since this has not been formally scored

A Sacred Trust would also do little to extend the solvency of Social Security. While SS2100 would keep Social Security solvent through at least 2100 (as per its name), A Sacred Trust would extend solvency by only 4 years, until 2038. A permanent version of A Sacred Trust might actually advance the solvency date so that Social Security runs out of reserves one year earlier.

In our praise of the 2019 version of Social Security 2100, we explained that "a plan should not be considered comprehensive unless it addresses the large imbalances between the program’s future revenues and costs.” While older versions of Social Security 2100 passed this test, A Sacred Trust does not. Even on paper, it only gets halfway to solvency; and when removing gimmicks and arbitrary expirations, it would actually worsen Social Security's finances. Meanwhile, it would remove one of the most popular solvency measures -- raising the cap on taxable income -- making the program's remaining challenges more difficult.

Rather than relying on gimmicks and half measures, policymakers should stick to honest and comprehensive trust fund solutions for Social Security. Many options remain available, and our Social Security Reformer allows users to design their own reform plan.