Quantifying the Cost of Waiting to Address Debt

The Congressional Budget Office's (CBO) Long-Term Budget Outlook shows a clearly unsustainable debt path over the long term, one that policymakers will have to address to avoid economic damage. While lawmakers may see the projections and think that getting debt under control is a daunting task, they should keep in mind that the longer they wait, the more difficult it will be to do so. This is true for both the Social Security program and the broader budget. CBO points out in the report that "waiting for some time before reducing federal spending or increasing taxes would result in a greater accumulation of debt ... and would increase the size of the policy changes needed to reach any chosen target for debt."

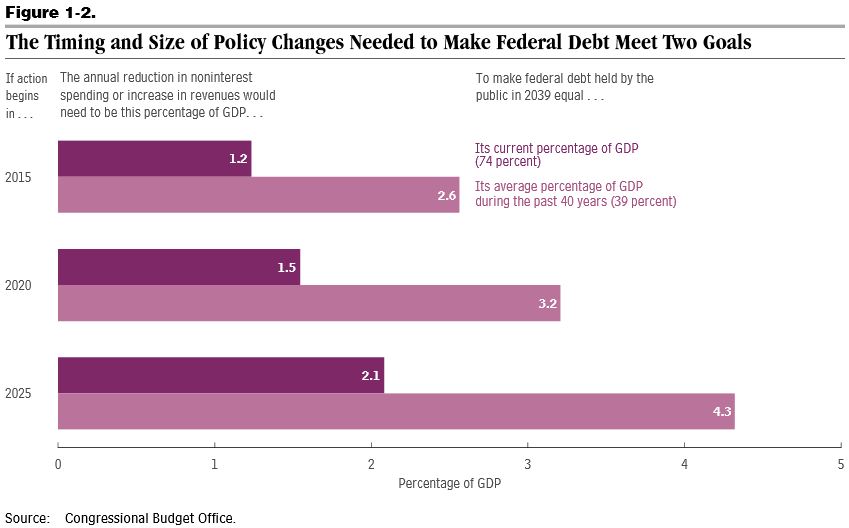

Quantifying the cost of waiting can be done by estimating the fiscal gap, or the amount of non-interest spending and revenue changes necessary to keep debt stable (or reduce it to some other level) over a period of time. In the report, CBO shows that closing the 25-year fiscal gap, either by keeping debt stable or reducing it to its 40-year historical average share of 39 percent of GDP, would require a reduction in non-interest spending and/or an increase in revenues of 1.2 and 2.6 percent of GDP, respectively, if implemented today. Those changes would grow considerably larger if policymakers waited five or ten years to take action.

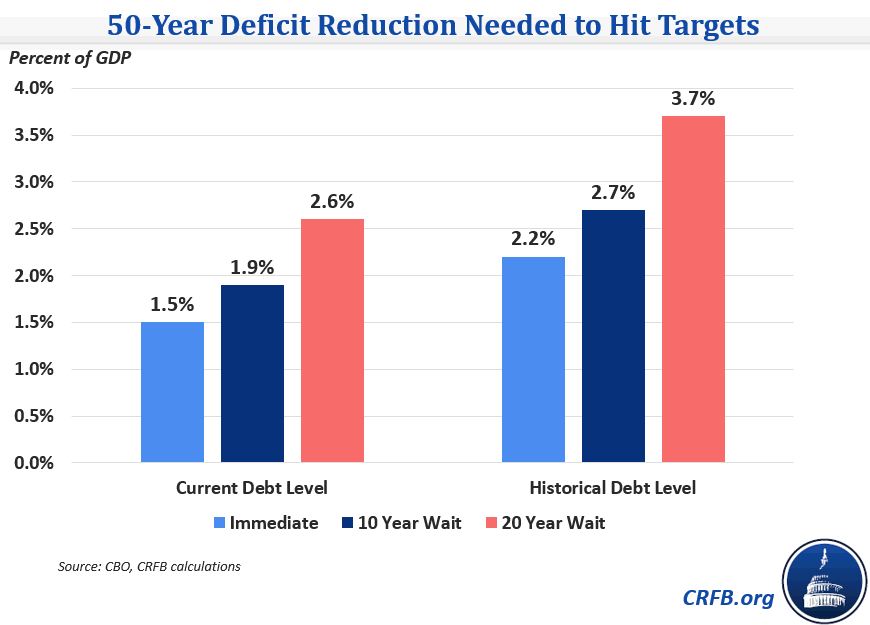

Stretching out the timeframe to 50 years reveals a similar story. By our estimates, keeping debt at its current level or reducing it to the historical share of 39 percent of GDP 50 years from now would require debt reduction of 1.3 and 2.1 percent of GDP, respectively. Waiting ten years to act would increase those totals to 1.9 and 2.7 percent, while a twenty year delay would push them up to 2.6 and 3.7 percent.

These numbers, to some extent, can also understate the needed changes since debt reduction plans would likely phase in many of the provisions to give beneficiaries and taxpayers time to plan for them. That means that savings once the plan is fully phased in would need to be larger than the stated amount to make up for the smaller savings in the early years.

It is abundantly clear that lawmakers need to enact a plan to control the growth of long-term debt. While it is not imperative that they actually put these policies into effect right away, enacting a plan now will give them more leeway to phase in changes to give individuals and businesses time to adjust. If policymakers delay too long, they will ultimately have to enact more severe and abrupt spending cuts and tax increases.