Policymakers Shouldn't Weaken Build Back Better Surtax

To help finance new spending and tax breaks, the House-passed Build Back Better Act (and the Senate Finance Committee’s version) includes a high-income surtax. Specifically, the legislation would impose an additional 5 percent tax on income above $10 million per taxpayer and 8 percent on income above $25 million per taxpayer. According to the Congressional Budget Office (CBO), the proposal would raise an estimated $228 billion over a decade.

As currently proposed, the surtax would apply to all Adjusted Gross Income (AGI). However, some have recently suggested carving out an exemption for pass-through business income and investment income. While these exemptions might marginally improve investment incentives in the federal tax code, they would undermine revenue generation, reduce progressivity and equity, and spur new economically inefficient tax-avoidance behavior. We estimate these exemptions would shrink revenue collections by 50 to 75 percent.

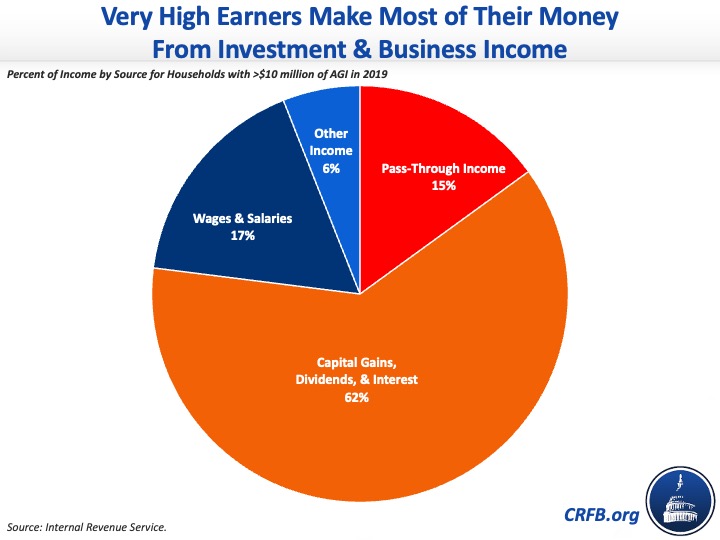

Based on Internal Revenue Service (IRS) data for tax year 2019, income earners earning over $10 million per year earned 77 percent of their overall income from capital gains, dividends, taxable interest, and pass-through business income. Only 17 percent of their income came from wages and salaries.

By comparison, income earners earning less than $10 million per year faced almost the opposite situation; only 15 percent of their income came from investments and pass-through business income, while 71 percent was wages and salaries.

When considering behavioral effects – especially capital gains realization – and the distribution of income types by income, we estimate exempting all pass-through and net investment income from the proposed surtax would reduce its revenue impact by one-half to three-quarters. That means it would likely raise less than $100 billion of new revenue over ten years, perhaps much less.

Excluding pass-through and net investment income would also reduce the progressivity and equity of the surtax (though it would remain progressive overall), since the wealthiest and highest-income Americans make most of their money from investment and business income. Based on public data, it’s likely the majority of the very richest Americans would pay nothing under a surtax that exempts business and investment income. Many do not collect a salary, and many who do earn less than $10 million of wage income per year.

Exempting business and investment income would not only benefit the very wealthiest households, it would also reduce the equity between similar taxpayers. High-income individuals who get most of their money from wages and salaries (for example, professional athletes) would pay more than high-earning business owners and stockholders.

Large exemptions to the surtax would also encourage high-income taxpayers to reclassify income, counting more wage income as business income and negotiating compensation packages with lower shares of wage and salary income. This kind of tax planning would further undermine federal revenue collection, reduce efficiencies in the federal tax code, and waste economic resources.

To be sure, the proposed surtax is far from perfect. Policymakers would be better off raising revenue by reducing tax expenditures, improving the treatment of capital gains, or reducing the tax gap. Nevertheless, any revenue generated from a surtax should be raised as efficiently and effectively as possible. That means it should have a broad base – perhaps one even broader than the current version which removes the exclusion for health care and tax free interest – not a narrow one.

Exempting pass-through and investment income from the Build Back Better Act’s proposed surtax would not only dramatically reduce the amount of new federal revenue raised but would also reduce progressivity, tax equity, and economic efficiency.

Read more options and analyses on our Reconciliation Resources page.