Pell Program Faces Funding Cliff in 2026

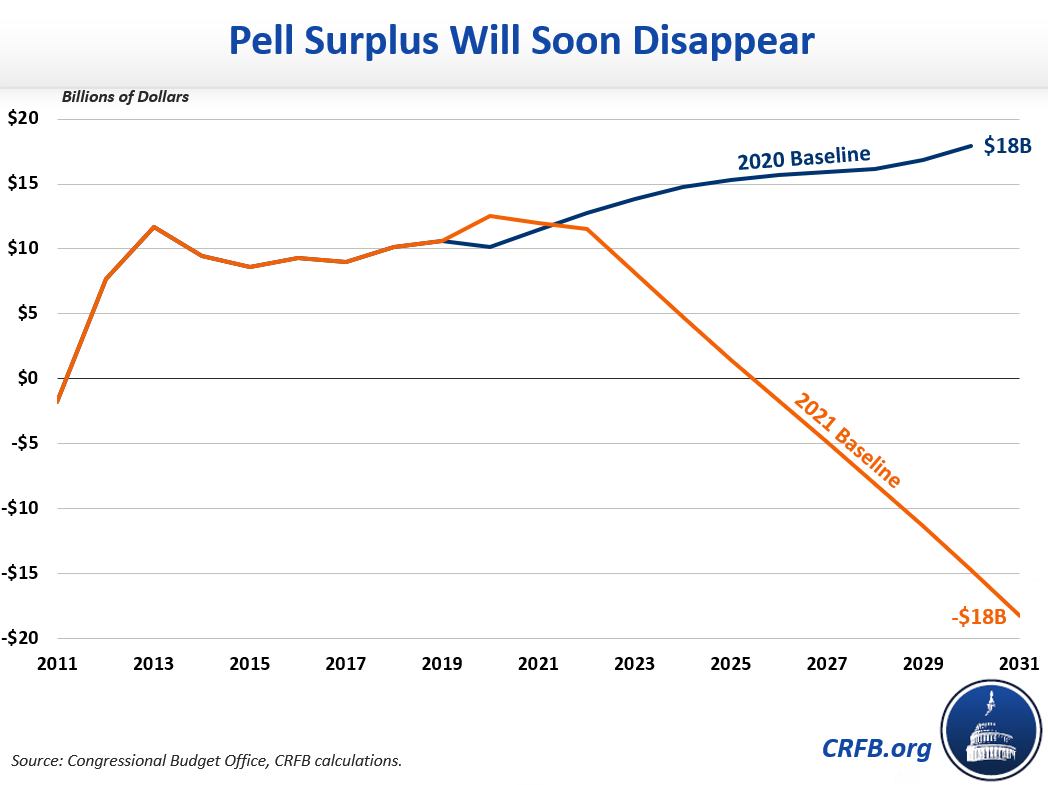

The Congressional Budget Office projects the Pell program will deplete its reserve fund by 2026 and face cumulative deficits of $18 billion by 2031, reversing the previous estimate of a surplus in the Pell reserve.1 This matches our previous warning that the surplus was in danger from further expansions to the program.

Understanding the Pell Surplus

The Pell Grant program supports low-income students pursuing an undergraduate education by helping to fund their tuition and other costs. Benefits themselves are issued on an entitlement basis – meaning anyone who is eligible per the formula can apply for benefits. However, most funding to support these benefits is appropriated annually.2

Over the past several years, appropriations to the Pell Grant program have exceeded program costs. These extra dollars are put aside in a “reserve fund” available to pay future benefits. Currently that fund has $12 billion in reserves, and prior to the COVID crisis, CBO estimated that that surplus would reach $18 billion by the end of the decade.3

From Surplus to Deficit

In stark contrast to the $18 billion cumulative surplus projected prior to the pandemic, CBO’s latest projections now show an $18 billion cumulative deficit by the end of the budget window in 2031 ($15 billion in 2030).4

Whereas CBO previously projected appropriations to exceed costs by nearly $1 billion per year, they now project appropriations to fall more than $3 billion annually. The $31 billion ten-year gap would exhaust the program’s current reserves by 2026 and leave the Pell Grant program with an $18 billion cumulative deficit by 2031.

If the fund goes negative in 2026, Congress would need to find a way to backfill that shortfall in 2027 and address the gap in future years. They could do so by increasing annual appropriations, identifying new sources of funding, or reducing the costs of the program. In the last recession, when Pell costs spiked, Congress used a combination of eligibility cuts and one-time infusions of cash to keep the program solvent.

What’s Driving the Deficit?

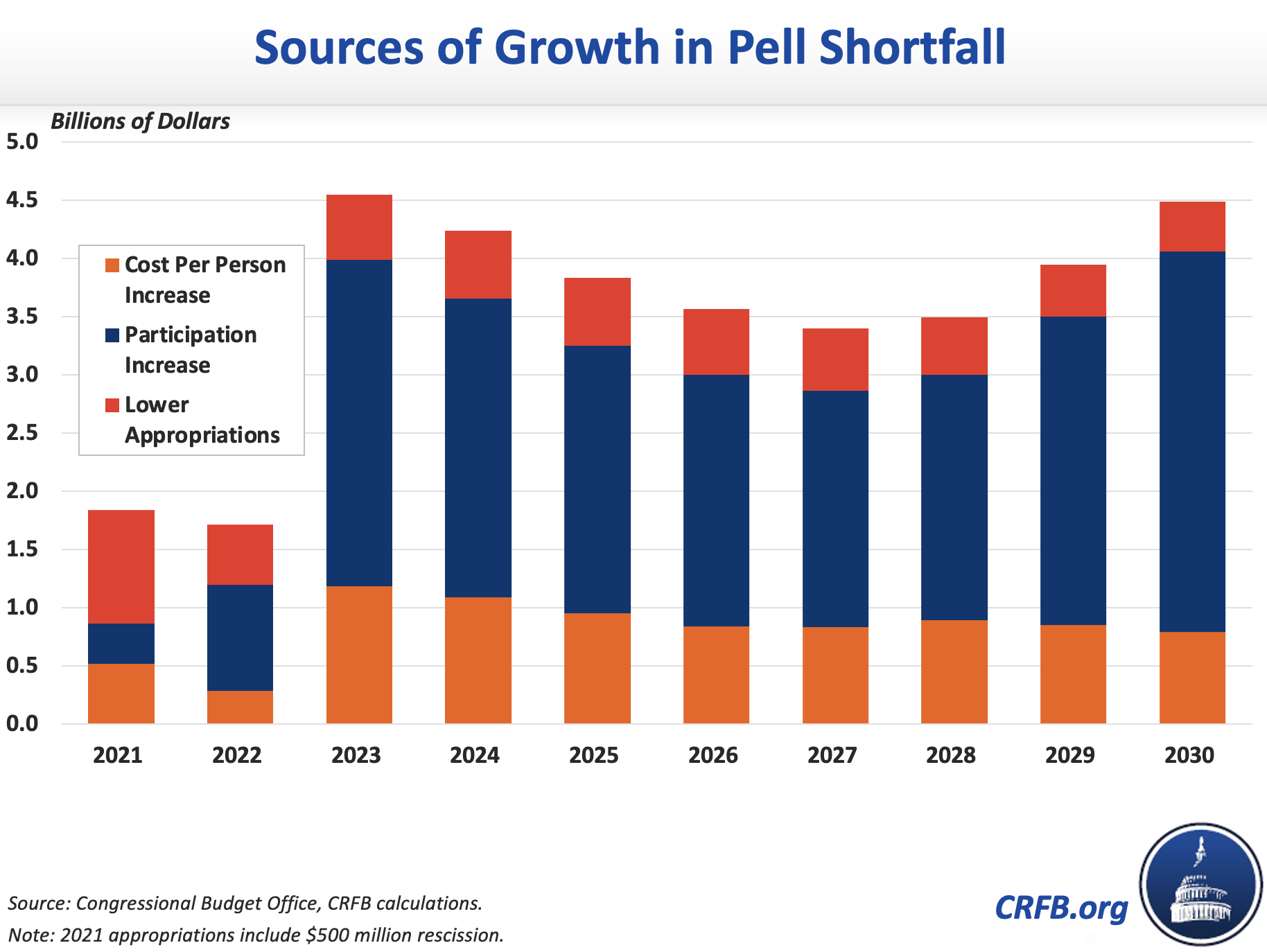

Since its last baseline, CBO has increased its estimates of annual costs by $29 billion, while projected appropriations levels have fallen modestly.

These increased costs are due to a combination of an increased number of Pell recipients and higher costs per recipient. CBO projects a spike in Pell recipients in 2023. That coincides with a revamped federal student aid application and numerous eligibility changes to Pell, including the addition of incarcerated students and certain drug offenders by no later than July 2023.

We estimate that higher per person benefits will increase Pell expenditures by $8 billion through 2030. This increase is driven by policies in last year’s omnibus spending bill that increased the maximum award by $150 and made roughly 1.7 million more students eligible to receive the maximum award.

The remaining $21 billion cost increase is due to more Pell recipeints. Overall, CBO projects 8.6 million recipients by 2030, up from 7.7 million in their prior estimates. Most of this difference materializes in 2023.

This enrollment boost is likely driven in large part by the omnibus bill as well. Expanded eligibility, including to incarcerated students and certain drug offenders, was estimated to open up the program to 550,000 additional students.

Policymakers Must Not Spend the Temporary Pell Surplus

Even though the Pell Grant program is facing an $18 billion deficit by 2031, it currently holds $12 billion in reserves. It was a mistake to spend those reserves when there was uncertainty over the program, and especially so now when the program is facing large annual deficits.

After the many increases and eligibility changes to Pell in December, Congress should not consider raiding the surplus for any reason. Proposed expansions such as short-term Pell are questionable policies to begin with, and funding that kind of expansion during this moment could put the rest of the program in even more jeopardy than CBO projections presently predict.

Rather than expand the program, lawmakers will need to identify reforms to reduce the cost of Pell Grants or make space to adequately fund current benefit levels. Lawmakers will also need to monitor the surplus carefully to avoid a Pell funding cliff that could have significant consequences for Pell-eligible students.

Updated on 3/17/21 to clarify that there will be an increase in Pell recipients, but not total college enrollment, under CBO's baseline.

1 In the context of the Pell Grant program, the terms deficit and surplus are used to describe the total (positive or negative) size of the reserve fund, rather than annual differences between resources and spending.

2 The actual budgetary treatment of the Pell program is more complicated. A portion of the Pell Grants program is a “mandatory add-on.” Additionally, some of the appropriated funds come from previously-enacted spending authority, rather than annual appropriations. In FY 2021, $22.5 billion was appropriated, $1.1 billion was made available from previously-enacted spending authority, $500 million was rescinded, and $5.3 billion was paid out through the mandatory add-on.

3 Though Congress has taken small amounts of the surplus to fund other priorities, for our projections we assume they will not continue to do that moving forward.

4 Because Pell must be funded the year after it is in deficit, the Pell shortfall would never get to $18 billion. This is merely to illustrate the cumulative deficit if no changes were made.