Now's Not the Time to Raid the Pell Surplus

With 2020 college enrollment down as a result of the COVID-19 pandemic, the Pell Grant program may add more to its reserves than previously estimated. Policymakers may be tempted to spend these additional reserves in the end-of-year omnibus bill by expanding Pell Grants, for example, to cover short-term educational or training programs. They should avoid this temptation. As recent experience from the Great Recession shows, economic downturns can quickly increase the costs of the Pell program and lead to large shortfalls. Spending funds now on low-priority, questionable initiatives will leave less room to weather the economic downturn or target future funds where they are truly needed.

The Pell Grant program, which provides financial aid to low- and middle-income college students, has a unique budgeting structure. Program costs are based on the number of eligible applicants, and all eligible applicants automatically receive their award based on a formula. It is mostly funded, however, through the annual appropriations process. When appropriations exceed costs, the program can essentially save the unspent dollars to expand its reserves. This has been the case in recent years, leading to an $11 billion reserve in 2020. Prior to the COVID-19 pandemic, CBO projected reserves would continue to grow to $18 billion by 2030.[1]

CBO previously projected the Pell program would generate $850 million of extra funds in 2021; the actual amount is likely to be higher. As a result of the pandemic, college enrollment for the 2020-2021 academic year is down 4 percent for all students and 16 percent for freshmen. Meanwhile, financial aid applications from this year’s high school seniors are down 17 percent compared to the same time last year. If Pell costs fell just 5 percent as a result, the Pell reserve would grow an additional $1 billion per year; if they fell 10 percent, it would expand by more than $2 billion per year.

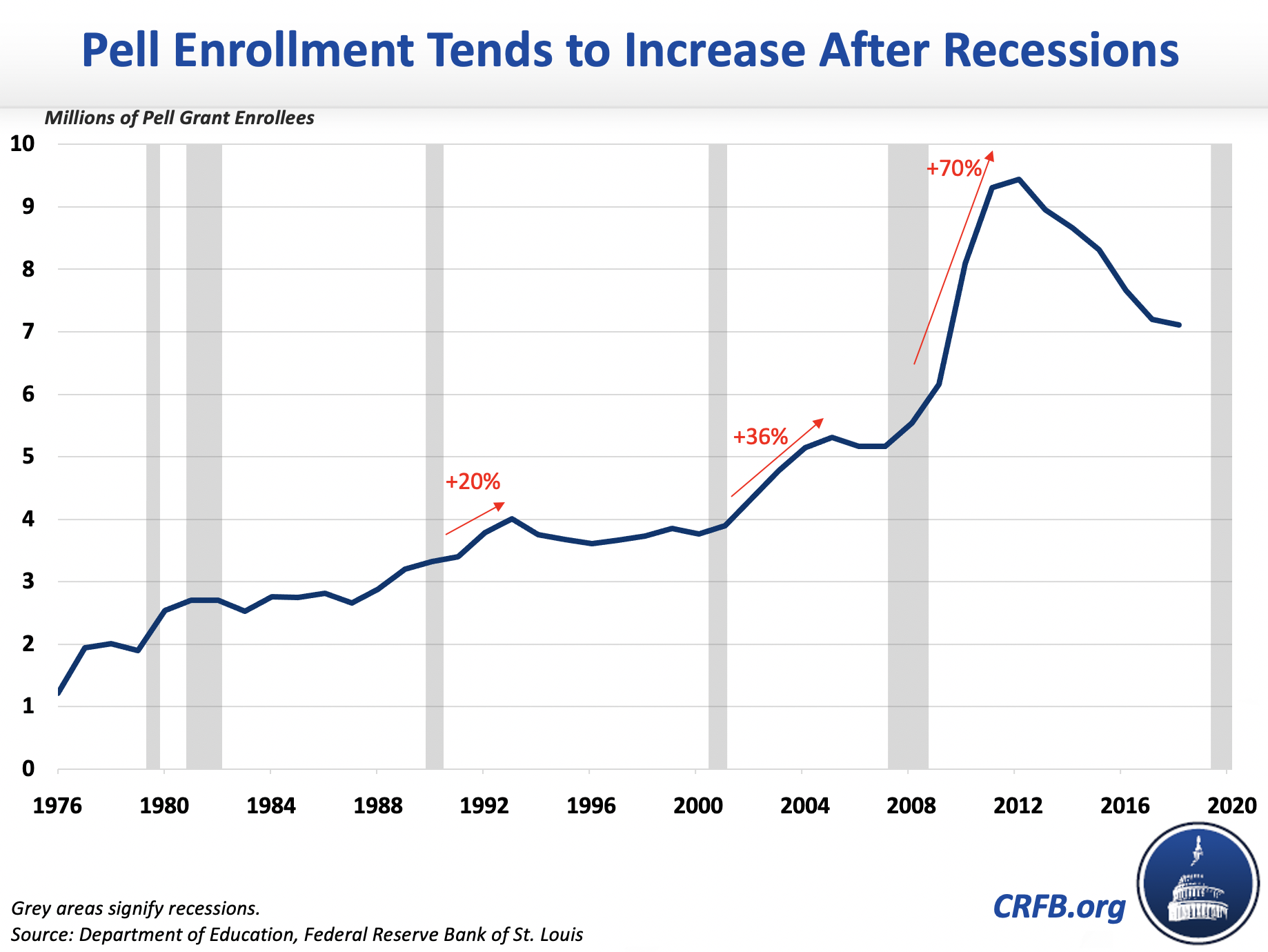

Politicians may view these extra reserves as an opportunity to expand the Pell program. Given current economic uncertainty, however, this would be a mistake. While pandemics tend to reduce college enrollment, recessions often boost enrollment substantially. During every recession since the 1960s, college enrollment has increased as unemployed workers looked to learn new skills and saw college as a more attractive option given the lack of available jobs. This was particularly evident during the Great Recession, when the number of people collecting Pell Grants jumped 70 percent from 5.5 million in 2008 to 9.4 million in 2012.

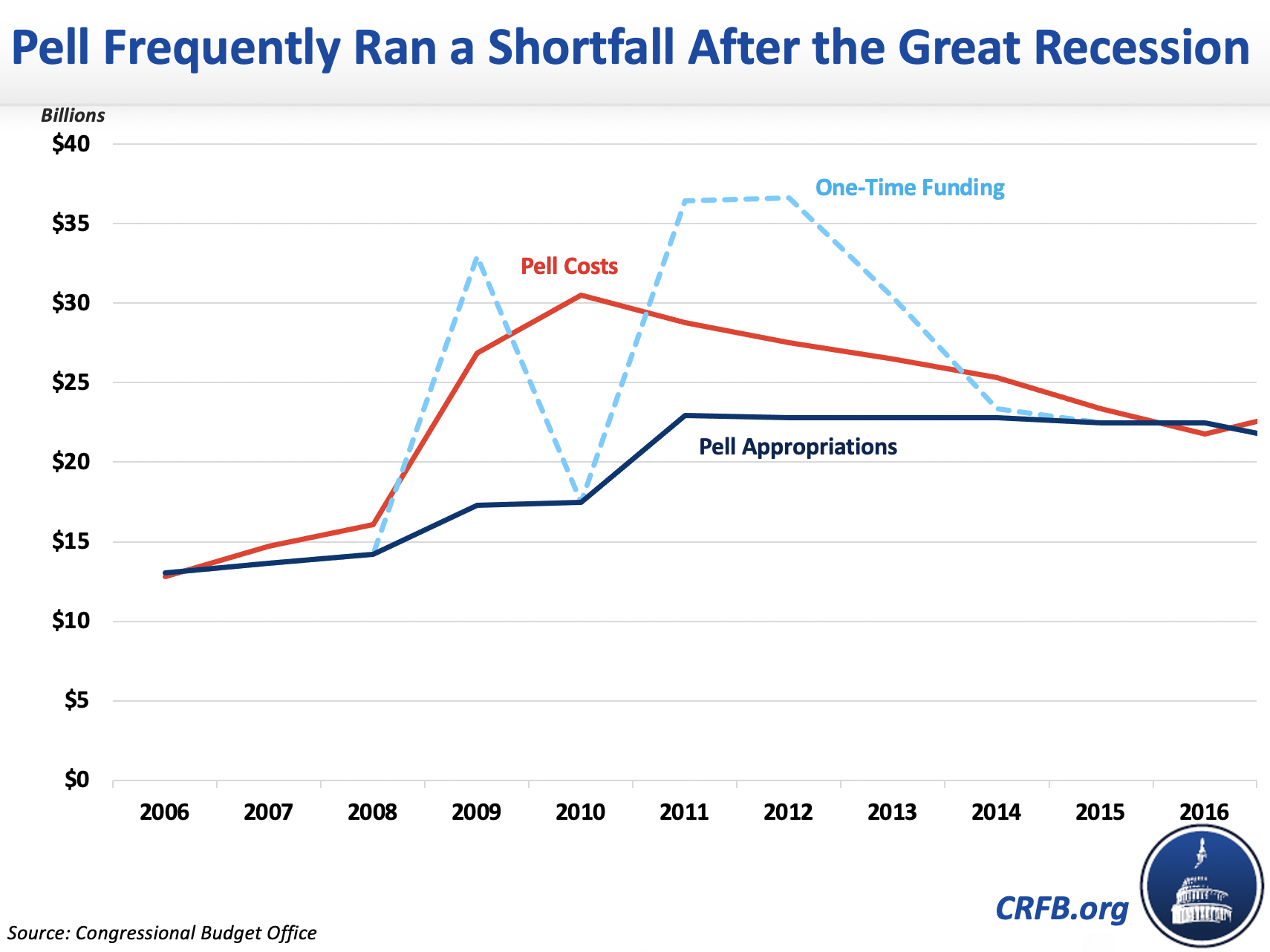

Over this period, the Pell finances took a turn for the worse. In 2007, CBO’s projected future Pell costs would roughly match funding levels. By 2012, the agency projected a ten-year shortfall of nearly $60 billion. The expansions to the Pell program at the beginning of the Great Recession and subsequent rise in enrollment and average award meant Congress had to inject more than $50 billion above regular appropriations between 2009 and 2014 and cut eligibility and benefits in the latter years.

The same deterioration could occur again once an effective vaccine is distributed throughout the population and people are no longer avoiding in-person schooling. This time enrollment could increase for several reasons - including from enrollment of those who delayed schooling through the pandemic, those who suffered job losses or business closures, and those who continue to enroll in newly expanded online programs.

Until these enrollment pressures are better understood, policymakers should avoid spending what is likely a very temporary source of excess funding. One popular idea to allow Pell grants to cover very short-term training and educational programs, for example, could prove to be a costly mistake. Some of programs that would be eligible for this expansion last only 8 weeks and would do little to boost earnings or provide educational value. CBO and the Office of Management and Budget (OMB) have estimated this particular expansion would cost $1 to $2 billion over 10 years, but some experts believe it could be much more expensive.

Instead of expending a temporary Pell surplus on a questionable new policy, policymakers should save it for rainy days that could be soon to come. As we monitor enrollment in the post-pandemic portion of the recovery, we will have a better sense of what resources are available and more time to deliberate on how to use them effectively to best achieve the goal of ensuring higher education access and affordability for low-income students.

[1] This assumes Congress doesn’t rescind any excess Pell funding to use for other priorities, which it has done in recent years.