OMB’s Mid-Session Review Confirms Growing Deficits Ahead

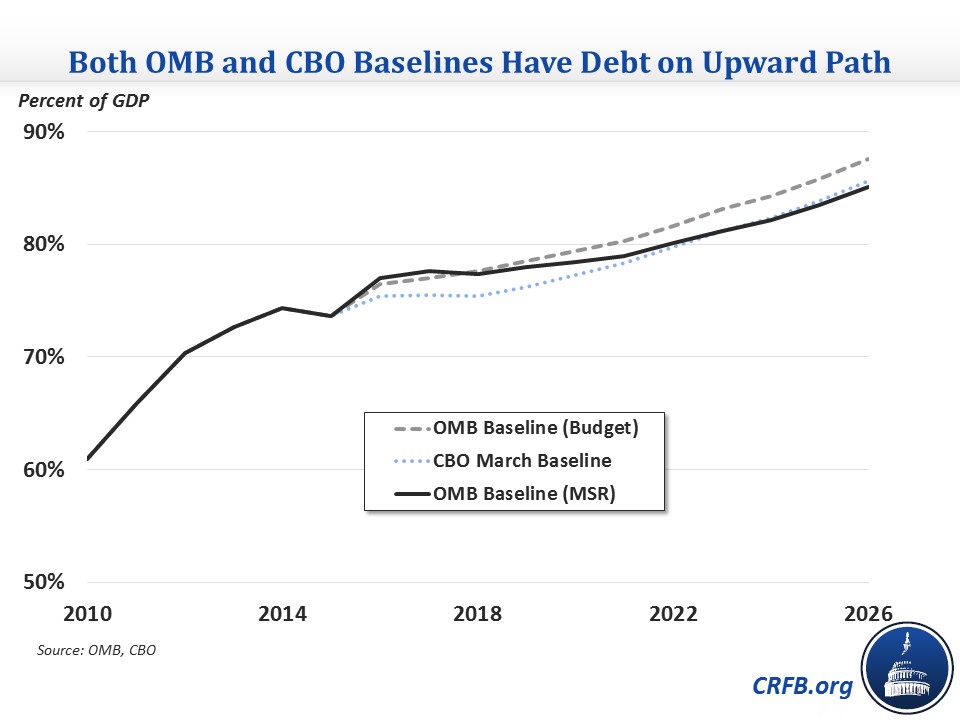

The Office of Management and Budget (OMB) released today the Fiscal Year (FY) 2017 Mid-Session Review (MSR), which updates both OMB’s budget baseline and the President's budget for new data and assumptions. OMB is currently projecting that the deficit by the end of this fiscal year will be $600 billion, which is $66 billion larger than the Congressional Budget Office (CBO) estimated in March and $162 billion larger than the FY 2015 deficit. Total deficits over the 2017-2026 budget window are projected to be $8.8 trillion according to OMB's new baseline. Previously, OMB projected 2026 debt held by the public as a share of the economy at 87.6 percent; the MSR baseline shows a slightly lower projection of 85.1 percent.

In general, a weaker projected economy in the short term and lower interest rates in the longer term are driving many of the changes from February's estimate. Worse economic assumptions will lower revenue and Gross Domestic Product (GDP), which pushes debt and deficits up as a share of the economy, but large changes to the baseline interest rate assumptions offset those changes over the next ten years. After 2017, OMB's annual economic growth projections both in the MSR and the original budget are more optimistic than CBO's projections, likely as a result of OMB's assumptions about the positive growth effects of immigration reform.

The Changes the Mid-Session Review Makes to Estimates of the President's Budget

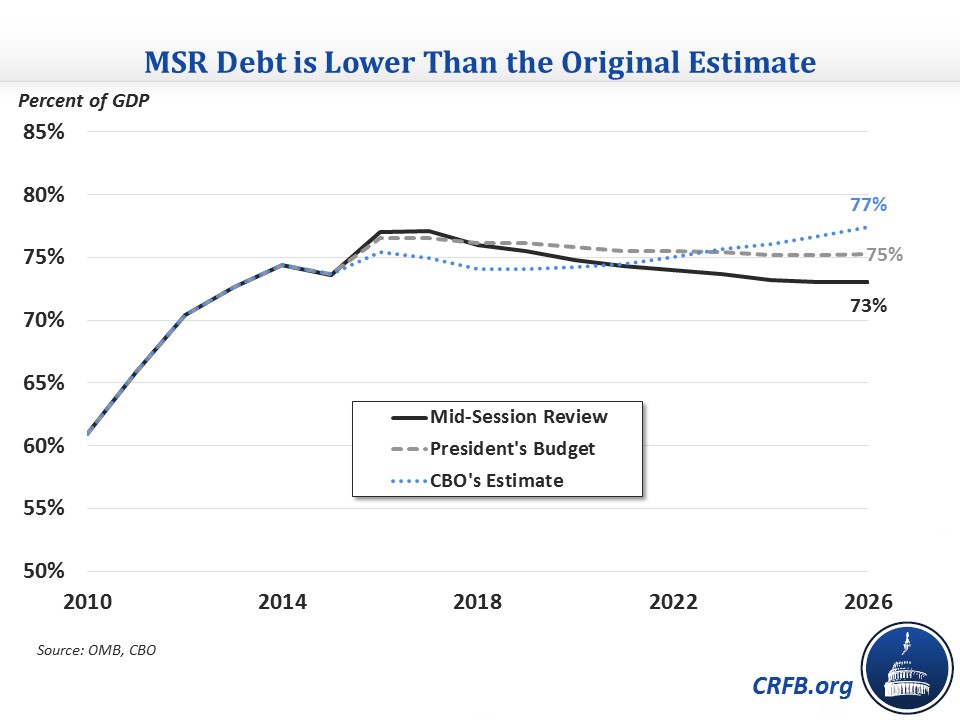

The MSR now shows the President's policies will put debt on a very slightly downward path by the end of the budget window to 73 percent of GDP by 2026, slightly better than the 75.3 percent that OMB projected earlier this year. This differs from CBO’s re-estimate of the President's budget in March – which found debt would rise to 77.4 percent of GDP by 2026 – because CBO used different economic assumptions and different methods to estimate the costs and savings of the President’s policies.

Under the MSR estimates of the President's budget, deficits would total $5.2 trillion over the 2017-2026 period, $881 billion lower than OMB previously projected. Deficits as a share of GDP over the next ten years would average 2.2 percent but climb to 2.6 percent by 2026. Debt would increase to 77 percent of GDP in 2016 and 2017 and start to drift down to 73 percent of GDP by 2025. This is in contrast to the February budget that had debt on a slowly decreasing path from 76.5 percent of GDP in 2016 to 75.3 percent by 2026.

The changes since February include $436 billion lower revenue, $549 billion lower non-interest outlays, and $770 billion lower interest outlays between 2017 and 2026. There hasn’t been any significant legislation passed since the President’s budget was released, so the changes in the MSR are from economic and technical changes to baseline projections of current law and estimates of the President's policies. The biggest differences between the President’s budget and the updated estimates in the MSR include:

- $391 billion lower revenue from worse economic projections in the baseline (with the majority of the remainder due to technical/economic effects on the President's proposed changes).

- $770 billion lower interest outlays, mostly from lower interest rates.

- $216 billion lower Social Security outlays due to lower inflation and lower-than-expected participation in the disability insurance program.

- $87 billion lower Medicare outlays from lower projected Part A spending that are partially offset by other factors.

- $308 billion lower costs from the health exchange subsidies due to the incorporation of more recent enrollment data.

Like the President's budget, the MSR overstates the actual savings (claimed at $3.53 trillion) by including war drawdown savings in the total and using an inflated baseline for 2022-2026 that assumes discretionary spending will revert to pre-sequester levels, rather than growing from the lower post-sequester levels as CBO does. On the latter issue, the Better Budget Process Initiative recommends Congress clarify that discretionary spending will grow at post-sequester levels once the sequester ends at the end of 2021.

Overall, the MSR slightly improves the outlook for the President's policies. The President’s budget now just barely stabilizes and begins to reduce the debt as a percentage of GDP under OMB's projections. The deficit reduction needed to stabilize the debt-to-GDP ratio is the bare minimum standard of what should be done in addressing our fiscal situation; instead, we should be aiming to make debt clearly decline as a share of GDP.

The current proposals from the presidential candidates have yet to address our long-term debt problem, and in their current form would actually worsen our situation. This report shows that the next President will face a large and growing deficit that will need to be addressed despite the fact that neither candidate has put forward a substantive proposal to do so.