Net Interest Payments Topped $475 Billion in FY 2022

One of the main reasons to be concerned about our high and rising national debt is the growing size of interest payments needed to service it. In Fiscal Year (FY) 2022, net interest payments topped $475 billion – a 35 percent increase over FY 2021 – and hit a new record nominal-dollar high.

The $475 billion in net interest is $100 billion higher than the previous nominal-dollar record in FY 2019. As a share of Gross Domestic Product (GDP), interest payments in FY 2022 were 1.9 percent, their highest level in 20 years. While the Congressional Budget Office (CBO) originally projected net interest to total $399 billion in its May 2022 budget and economic baseline, higher-than-expected inflation coupled with rising interest rates made the increase $76 billion larger than CBO’s estimate.

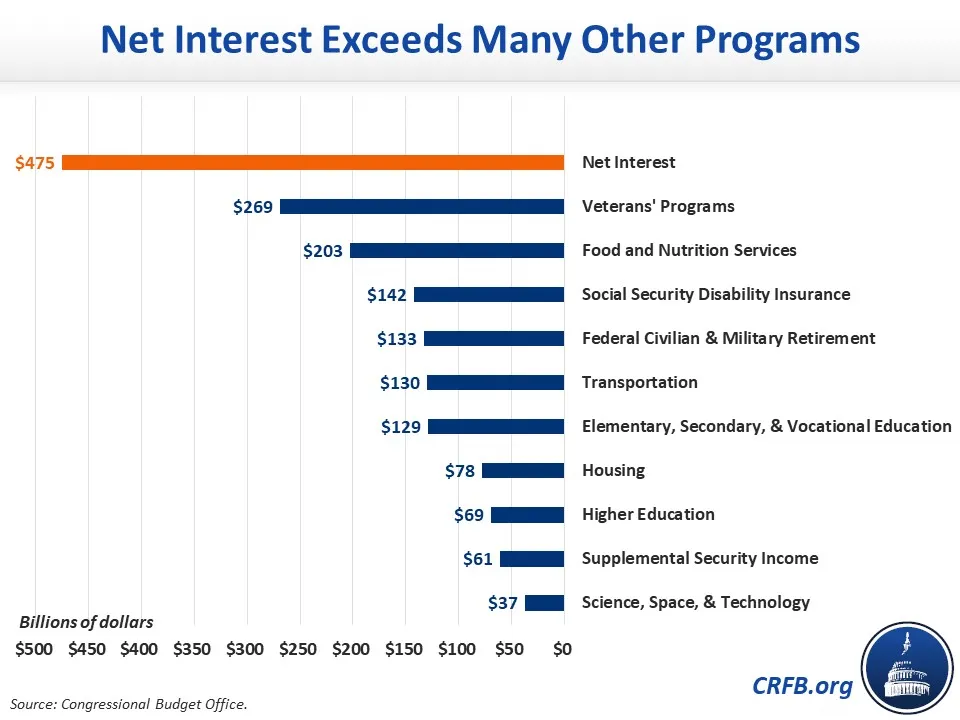

Net interest payments are now one of the largest line items in the federal budget, exceeding spending on veterans’ programs, food and nutrition services, transportation, and higher education spending, among others. In 2022, only Social Security, Medicare, Medicaid, and spending on all defense programs were larger than interest payments.

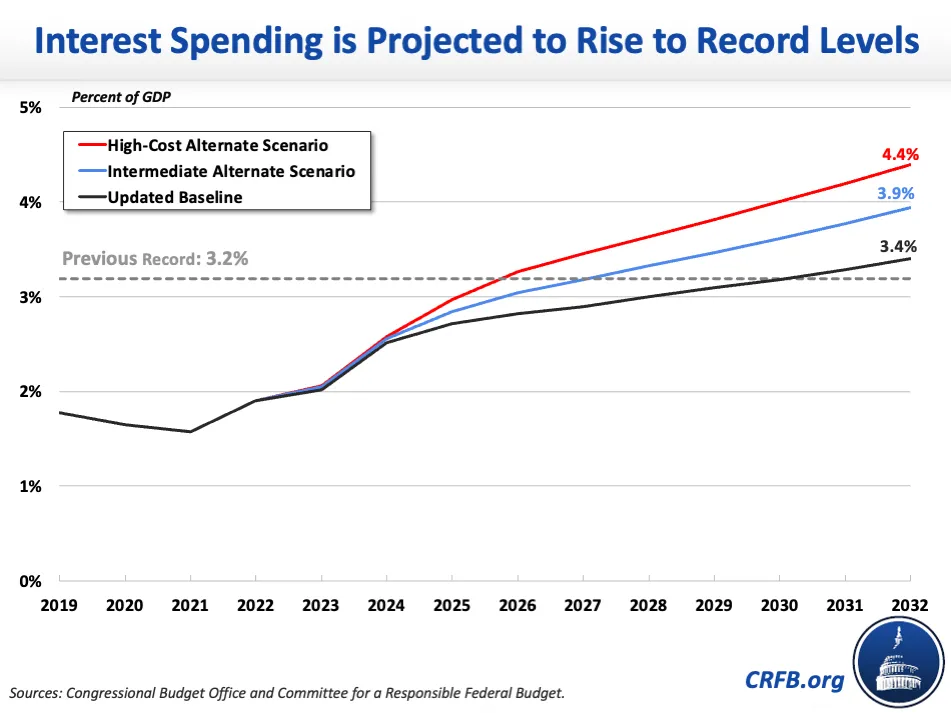

Unfortunately, $475 billion may be a low point over the next decade. In May, CBO projected interest to be $525 billion in 2024, exceed $1 trillion by 2030, and top nearly $1.2 trillion by 2032. As a share of GDP, interest wasn’t set to reach 1.9 percent until 2024 – which it reached two years earlier, in 2022 – and was previously on track to exceed its record as a share of GDP, 3.2 percent, by 2032.

When incorporating legislation enacted since May, using actual fiscal data for 2022, and updating economic projections to match those of the median Federal Reserve forecast, we estimate that interest could be much higher. Under our baseline scenario, interest will now top $1 trillion in 2029 (one year sooner) and rise to $1.3 trillion by 2032; more pessimistic scenarios could mean $1.4 trillion to $1.6 trillion by 2032.

Nearly $500 billion in net interest spending alone should sound the alarm for policymakers that it is time to start taking steps to get the national debt on a sustainable downward path. The longer we wait to address the severe fiscal challenges facing our country, the more difficult they will be to confront, and we will have wasted hundreds of billions of dollars on interest payments instead of the priorities of the American people.