IRS Funding Repeal Could Cost Over $100 Billion, Encourage Tax Cheating

1/9 Update: CBO released a score of the bill, incorporated below.

The House is likely to vote today on a bill that would rescind roughly $70 billion of Internal Revenue Service (IRS) funding over the next decade. According to the Congressional Budget Office (CBO), the bill would increase deficits by more than $100 billion over the next decade while encouraging tax cheating, expanding the tax gap, and undermining a policy supported by every President since Ronald Reagan, including Donald Trump.

Last year, the Inflation Reduction Act appropriated roughly $80 billion to the IRS to expand operational support, modernize systems, improve customer service, and strengthen tax enforcement. According to recent estimates, 13 percent of taxes owed are never paid – mainly because of underreported income and overreported deductions and credits. CBO estimated the new IRS funding would improve compliance modestly, generating about $180 billion of revenue through 2031.

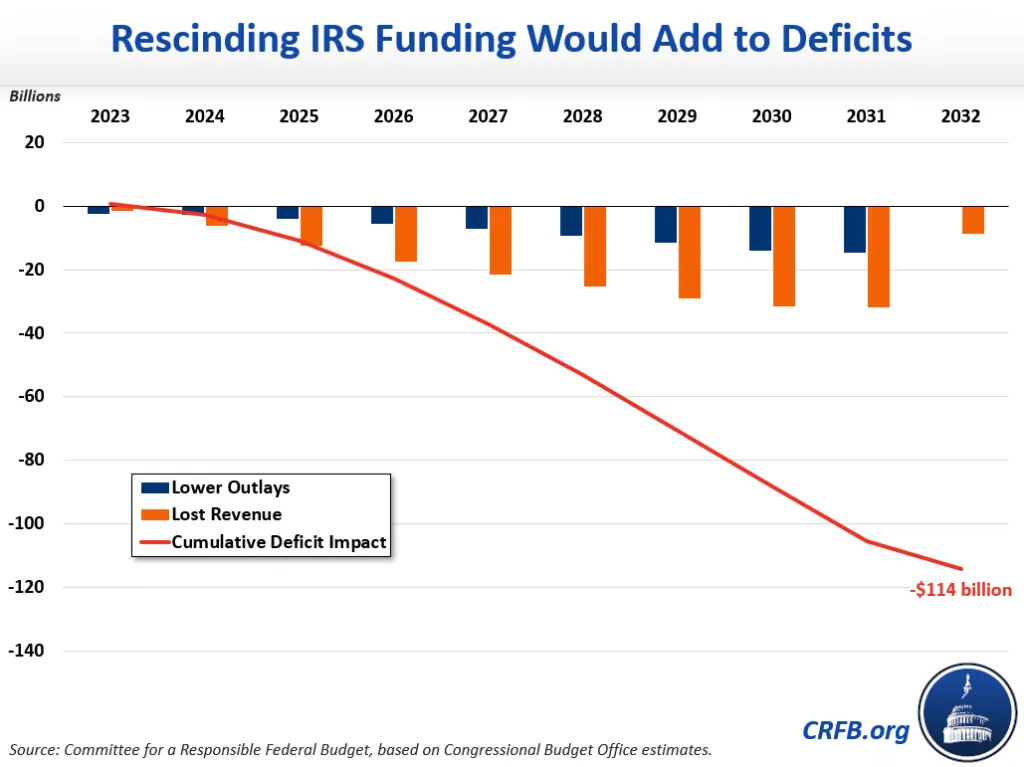

Legislation currently under consideration in the House would rescind most of this new funding, leaving funds that have already been obligated as well as money earmarked exclusively for taxpayer services or business system modernization (but not funding for operational support, which could be used for those purposes). CBO estimates it would rescind roughly $71 billion and result in about $186 billion of lost revenue through 2032. As a result, it would increase deficits by about $114 billion over a decade.

Although additional reforms and accountability measures to accompany new IRS funding could be constructive, there is little case for rescinding the money outright. Increasing funding for the IRS is one of the few ways to raise more revenue without raising taxes, and it has a long history of bipartisan support – including from every recent president from Ronald Reagan through Joe Biden. In fact, the legislation would reduce the IRS's additional enforcement budget well below the level proposed by President Trump.

Even under good economic and fiscal conditions, it would make little sense to reduce revenue by allowing more individuals and businesses to avoid paying taxes they rightfully owe. With inflation high, interest rates rising, and debt approaching record levels, rescinding IRS enforcement funds would be a big mistake.