Interpreting Changes in Long-Term Projections

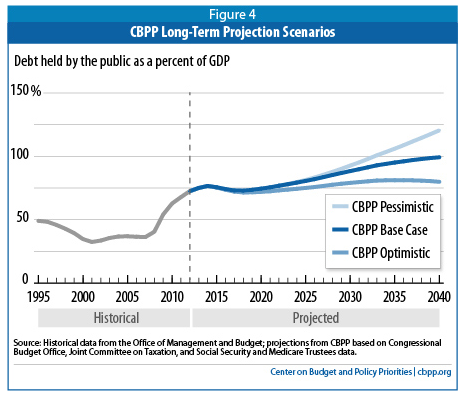

Yesterday, the Center on Budget and Policy Priorities updated its long-term outlook for the federal budget and like our long-term Realistic Baseline, its shows debt on a clear upward path. Debt will fall in the next few years as the economy recovers and revenue rebounds, but will steadily rise in the following decades as the baby boomers retire and entitlement spending grows. By 2040, debt will have grown to nearly 100 percent of GDP in CBPP's Base Case scenario.

While both CBPP and CRFB agree that long term projections have indeed improved (a very welcomed sign) from savings we’ve enacted so far and changes in underlying budget projections, it is also clear that both organizations show debt is on an unsustainable path. As they say:

Although the long-term budget problem appears significantly more manageable than in previous projections, policymakers still face difficult choices to put the budget on a more sustainable path for the long term. We have long maintained that stabilizing the debt-to-GDP ratio over the coming decade (with deficit reduction measures phased in after the economy has recovered more fully) is a minimum appropriate budget course.

While Congressional Budget Office updated its ten-year projections as early as May, CBO's last long-term outlook was released last June, meaning it hasn't taken into account budgetary and economic developments since then. To update for legislative, economic, and technical changes since the last long-term outlook, CBPP incorporates the most recent ten-year projections from CBO along with data from the Social Security and Medicare trustees to produce their long-term analysis. Along with using a different data projections for Medicare and Social Security from CRFB (CRFB continues to use CBO projections), CBPP includes a number of different assumptions that are not in our realistic baseline. These include:

- Social Security spending is based on projections from the Social Security trustees in CBPP's scenario, while CRFB uses those from CBO (using recent ten-year projections and CBO's long-term growth rate).

- For Medicare, CBPP relies on projections an alternate scenario from the Medicare trustees in which lawmakers continue to enact doc fixes but maintain the Medicare cost controls in the Affordable Care Act. For other health, CBPP uses CBO's current law projections. By contrast, CRFB uses a mix of growth rates in overall health care spending from CBO's June 2012 current law and Alternative Fiscal Scenario projections.

- Discretionary spending and other mandatory spending grow at a rate of population growth plus inflation in CBPP's projections, while they grow with GDP in CRFB's Realistic Baseline. As GDP growth outpaces the combined growth of population and inflation, spending for these two categories grows more slowly in CBPP's outlook.

- CBPP extends the tax extenders (except bonus depreciation) without offsets, unlike CRFB's projections which allow them to expire (or assume that they are paid for). That makes CBPP's revenue projections slightly lower than CRFB's.

If CRFB's assumptions are adjusted to match those in the CBPP long-term baseline, our estimates are very close to theirs. But regardless of which assumptions are preferred, both projections show debt rising on an unsustainable course. Despite recent improvements, the problem remains far from solved.

Source: CBPP

CBPP notes that long-term projections have improved compared to those in 2010, as a combination of enacted savings and underlying economic and technical revisions. But of course, the year chosen for comparison will change the story.

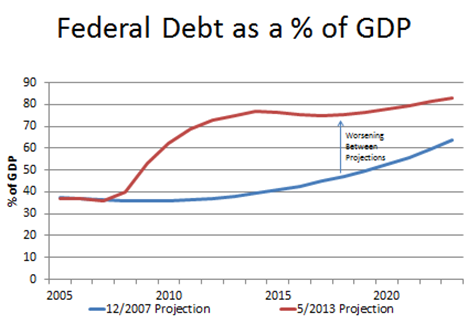

Over at E21, Chuck Blahous argues that comparing long-term projections to those in 2010 may overstate the improvement in the federal budget picture. Blahous shows that while budget projections have improved since 2010, that comparison ignores a significant deterioration in the outlook between 2007 and 2010 due mostly to the recession. While not a long-term source of deterioration, it was a substantial change nonetheless, and the U.S. has expended a lot of its fiscal space in the past few years.

Source: Blahous

As a result of the recession, debt is now well higher in each year over the next decade than it was projected to be in the 2007 long-term outlook. That outlook had debt starting at a much lower level than it is now initially but rising exponentially over the long term. While it is unclear whether that will be true over the longer term until CBO releases new long-term projections -- the slope of the 2007 line looks steeper than that of the 2013 line -- it is clear that we have much less breathing room for that kind of growth in debt. Blahous's piece is a reminder that budget projections can change for the worse in a hurry, and that the best approach is to be cautious when interpreting revisions.

While ten-year projections are pervasive in budget policy and savings estimates, it is important to remember that our long-term problem is the most worrisome. Putting debt on a downward path at the end of the decade will help to give us some running room as we look to address long-term drivers of debt.