Interest Costs Will Grow the Fastest Over the Next 30 Years

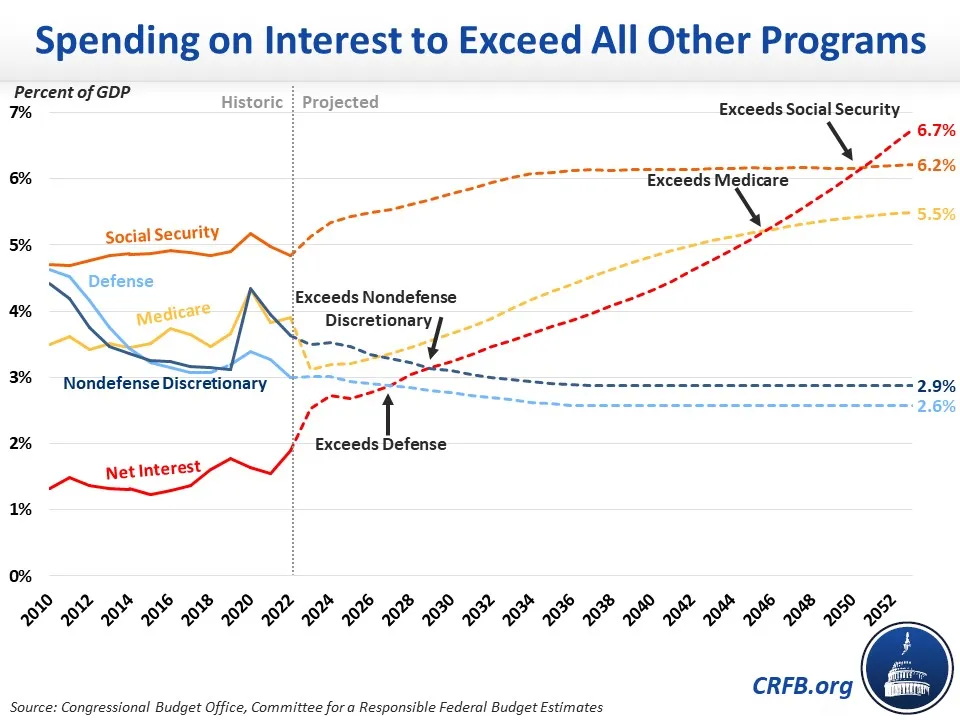

According to the Congressional Budget Office’s (CBO) long-term baseline, federal spending as a percentage of Gross Domestic Product (GDP) will grow to 29.1 percent over the next three decades. Driving a large part of that growth is spending on interest payments to service the national debt.

Net interest payments hit a nominal dollar record of $475 billion in Fiscal Year (FY) 2022 and will nearly triple by FY 2033 to $1.4 trillion, growing to $2.7 trillion by 2043 and to $5.4 trillion by 2053. As a share of the economy, net interest will rise from 1.9 percent of GDP in FY 2022 to hit a record 3.2 percent by 2030 and more than double to 6.7 percent by 2053.

By 2051, spending on interest will be the single largest line item in the federal budget, surpassing Social Security, Medicare, Medicaid, and all other mandatory and discretionary spending programs.

By the end of the next three decades, interest will consume 6.7 percent of GDP and 35 percent of federal revenues annually.

High and rising national debt will mean that more of the budget will go towards servicing that debt with interest payments instead of going towards other priorities. Importantly, a high interest burden also makes it more difficult for lawmakers to borrow more in times of emergency or during a war without significant consequences. Policymakers should work together to address these fiscal challenges before they become even more difficult to confront.