The Infrastructure Bill’s Impact on the Highway Trust Fund

In addition to new investments in surface transportation, transit, broadband, energy, water, tax breaks, and other transportation spending, the bipartisan infrastructure law (officially the Infrastructure Investment and Jobs Act) included a five-year reauthorization of surface transportation programs, also known as a Highway Bill.

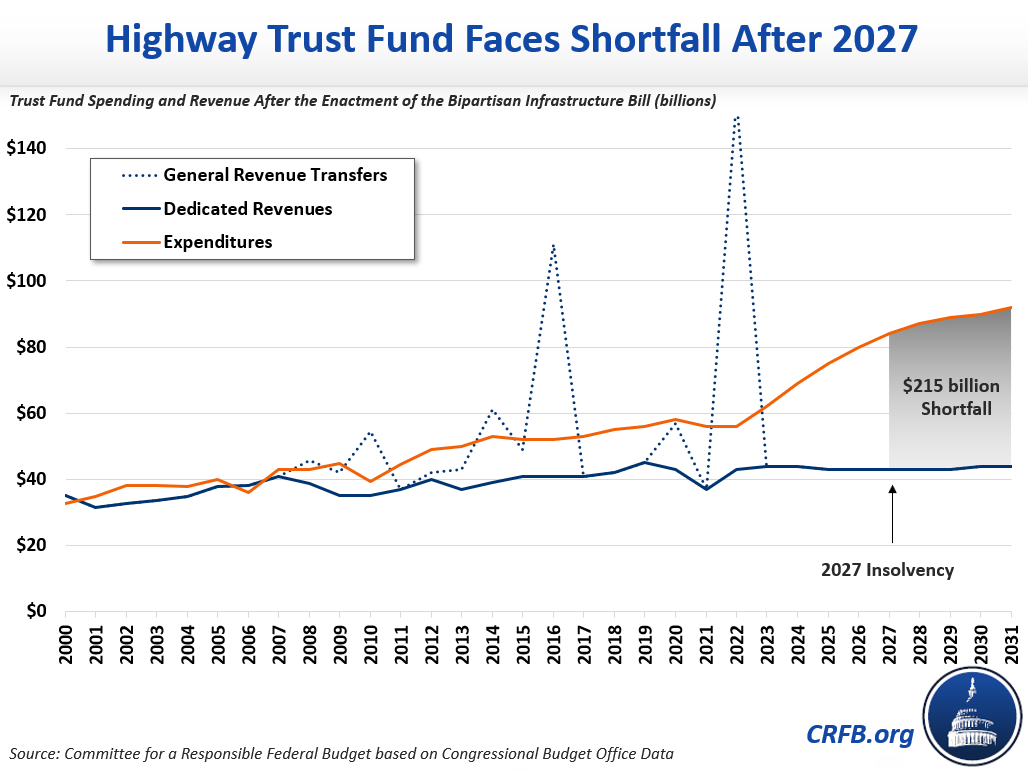

The legislation included a one-time transfer of general revenues into the Highway Trust Fund, extending its near-term solvency by five years through 2027. The bill also authorized higher spending levels that have negatively impacted the program’s long-term financial outlook. If spending levels from the infrastructure bill are maintained, dedicated revenue coming into the Highway Trust Fund over the coming decade will be sufficient to cover only about half of ongoing spending, and the trust fund will face a $215 billion cumulative shortfall through 2031.

Like other federal trust fund programs, the Highway Trust Fund is generally financed through dedicated revenue streams, primarily taxes on gasoline and diesel. However, since 2008, these revenues have been insufficient to cover spending out of the trust fund. Rather than raise gas taxes, reduce spending, or identify new financing, lawmakers have relied on nearly $155 billion of general revenue transfers to close this gap and keep the trust fund solvent.

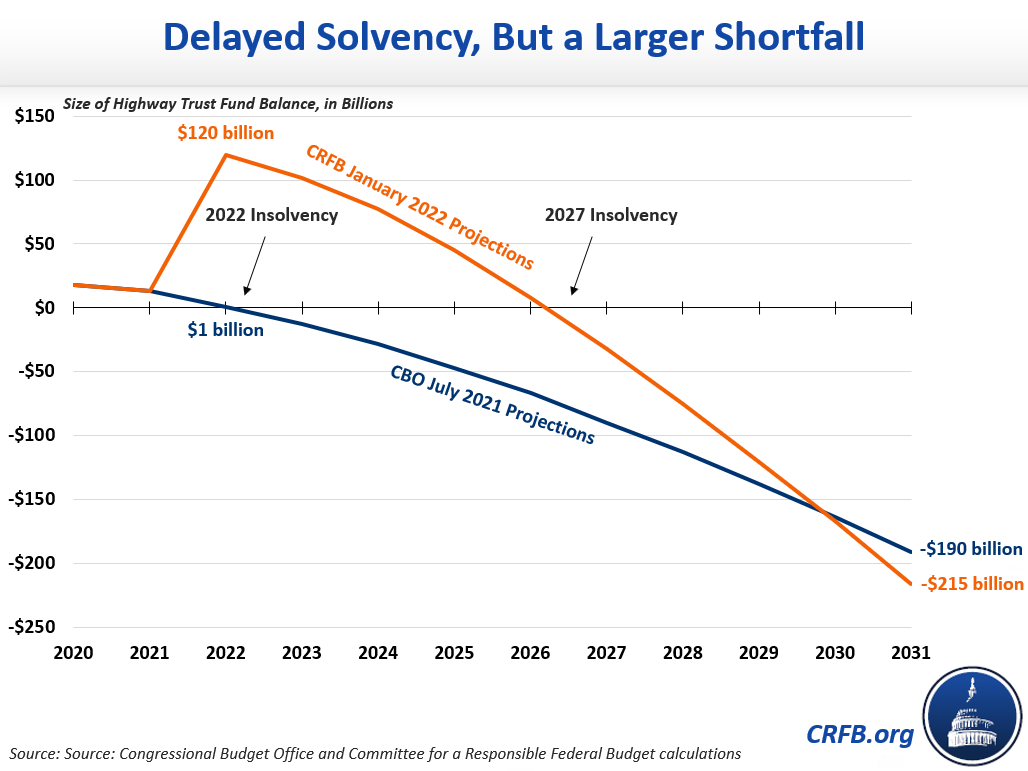

Prior to the enactment of the bipartisan infrastructure law, the trust fund was projected to become insolvent in 2022, with dedicated revenue sufficient to cover only 77 percent of projected spending at that point. The trust fund faced a cumulative shortfall of $190 billion through FY 2031.

The infrastructure law plugged the trust fund’s near-term gap through a large $118 billion general revenue transfer, delaying insolvency from 2022 to 2027. But rather than narrowing the long-term structural funding gap, increased highway and transit spending levels authorized under the law will widen the gap. Beyond 2027, we estimate dedicated revenue will cover only about half of future spending. Through FY 2031, despite projected revenue of $44 billion, the fund will face a cumulative shortfall of $215 billion – larger than was projected before the law was enacted.

Different parts of the infrastructure law affected the Highway Trust Fund in different ways. For instance, the $118 billion transfer of general revenues into the trust fund eliminated the entire projected cumulative funding gap over the coming five years and 62 percent of the $190 billion ten-year gap. Unfortunately, unlike many past transfers, this one was not offset with tax and spending changes outside the highway program and thus added to the debt.

At the same time, higher spending levels widened the long-term funding gap. The infrastructure law authorizes $383 billion of five-year contract authority, roughly $90 billion above the prior baseline. This will result in nearly $70 billion of additional surface transportation spending and $20 billion of additional transit spending, enough to worsen the ten-year solvency gap by 46 percent.

The law also increases “baseline” highway spending after the current surface transportation program authorizations expire at the end of FY 2026 since scoring conventions dictate that projections of highway spending through the rest of the decade reflect the final year of authorized funding. As a result, we estimate CBO’s next baseline will include an additional $55 billion of projected highway spending through 2031 – worsening solvency by 29 percent. This scoring convention reflects the reality that the next infrastructure bill will likely be negotiated against this starting point.

| 5-Year | 10-Year | % of 10-Year Gap Closed | |

|---|---|---|---|

| July 2021 Highway Trust Fund Gap | $67 billion | $190 billion | N/A |

| General Revenue Transfer | -$118 billion | -$118 billion | 62% |

| Increased Highway Spending | $35 billion | $70 billion | -36% |

| Increased Transit Spending | $10 billion | $20 billion | -10% |

| Increased Baseline Spending | $16 billion | $55 billion | -29% |

| February 2022 Highway Trust Fund Gap | N/A | $215 billion | -13% |

| Gap Assuming Extension of Infrastructure Bill | N/A | $160 billion | 16% |

In total, the infrastructure law increased the Highway Trust Fund's cumulative shortfall by $25 billion, or 13 percent, despite the general revenue transfer. By FY 2031, the trust fund will now face a cumulative shortfall of $215 billion, as opposed to $190 billion prior to the law's enactment. Even without the assumed baseline spending increase past FY 2026, the gap will still remain $160 billion through 2031.

Instead of having to transfer more and more general revenue into the trust fund each time it approaches insolvency, lawmakers should consider how to bring spending and dedicated revenue into line. There are numerous revenue and spending options to secure the Highway Trust Fund. On the revenue side, increasing gas and diesel taxes, establishing a vehicle miles traveled tax, imposing an excise tax on barrels of oil, or enacting a carbon tax could provide significant revenues to the fund. On the spending side, freezing highway spending, replacing surface transportation block grants with matching grants, cutting federal transit spending, reducing the federal share of the National Highway Performance Program, and repealing the Davis-Bacon Act are all available options.

With trust funds for Medicare, Social Security, and highway spending approaching insolvency in the near future, Congress should take immediate action to secure each of these trust funds for the long-term and not just paper over the holes with band-aids. That will require hard choices and trade-offs that will ultimately put us on a more fiscally responsible path.