Ignoring PAYGO Could Add $2.5 Trillion to the Debt

CBO's official budget estimates rely on general adherence to current law, meaning that no new laws are passed other than to keep the government functioning basically as is. This means that temporary tax cuts or spending increases are expected to expire as scheduled, and legislated spending cuts and tax increases go into effect as scheduled. Of course, that assumption has had mixed success in recent years, and we've pointed out that if lawmakers don't stick adhere to current law, debt would go from bad to worse.

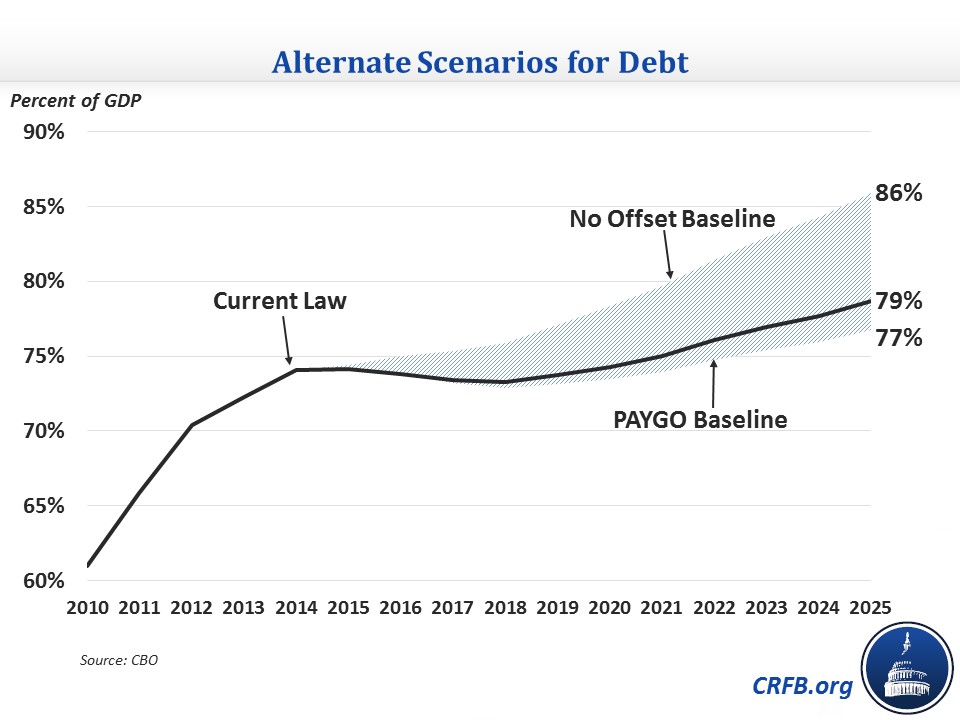

To illustrate that, we first construct a "PAYGO baseline," which is CBO's current law projections plus an assumed drawdown of war spending, as scheduled. Since CBO's baseline assumes war spending will grow with inflation from its current level of $74 billion, lawmakers can achieve "savings" of $455 billion simply by reflecting the withdrawal from Afghanistan and spending $30 billion per year on Overseas Contingency Operations. This does not represent real savings, since the drawdown is already in place, but it would preclude the possibility of the war designation becoming a permanent slush fund. Under this baseline, debt would grow from 74 percent in 2020 to 77 percent by 2025.

Building off the PAYGO baseline, we then create a "No Offset" baseline, in which lawmakers take fiscally irresponsible stances on a series of decision points, many of which are Fiscal Speed Bumps this year. These decisions include:

- Permanently extending the "tax extenders" that expired at the end of 2014 ($737 billion)

- Enacting a permanent "doc fix" to prevent a 21 percent Medicare physician payment cut in April ($137 billion)

- Permanently repealing the sequester starting in 2016 ($1.01 trillion)

- Permanently extending refundable tax credit expansions beyond 2017 ($203 billion)

In total, including the added spending on interest costs from this extra debt ($425 billion), these costs would add $2.5 trillion to deficits through 2025 and increase debt from 77 to 86 percent of GDP in 2025. This jump in debt is not surprising, since enacting these policies would in essence back-track on previous deficit reduction and break precedents of responsibility.

Notably, all these scenarios show debt on an upward path, so following PAYGO is really the very least policymakers can do to not harm our current fiscal situation. Ignoring PAYGO would cause debt to rise much faster, though, and that added debt would harm growth and raise interest rates, making the situation even worse than the above numbers indicate.

In short, lawmakers will have to stick to (at least the equivalent of) the deficit reduction they have done so far, but also go further with tax and entitlement reforms to put debt on a clearly sustainable path.