How Much Will Medicare for All Cost?

Representative Pramila Jayapal (D-WA), a co-chair of the Medicare for All Caucus, released a bill today that would adopt a single-payer system, where the federal government replaces private health insurance companies as the sole provider of most health care financing. While we are not aware of any estimates of this particular proposal, similar proposals have been estimated to cost the federal government roughly $28-32 trillion over a decade.

Representative Jayapal’s Medicare for All Act would replace nearly all current insurance with a government-run single-payer plan and extend that plan to those who currently lack health coverage. The plan itself would be far more generous than either Medicare or most private coverage, as it would include no deductibles or copayments, would not restrict beneficiaries to networks of care, and would offer a broad suite of benefits including dental care, vision care, transportation for disabled and low-income patients, certain dietary and nutritional care, long-term care, and other long-term services and support. The proposal also establishes a global health budget, moves away from fee-for-service and toward lump-sum payments for many providers, includes a number of measures to hold down drug prices, and makes a variety of other changes to the health care system.

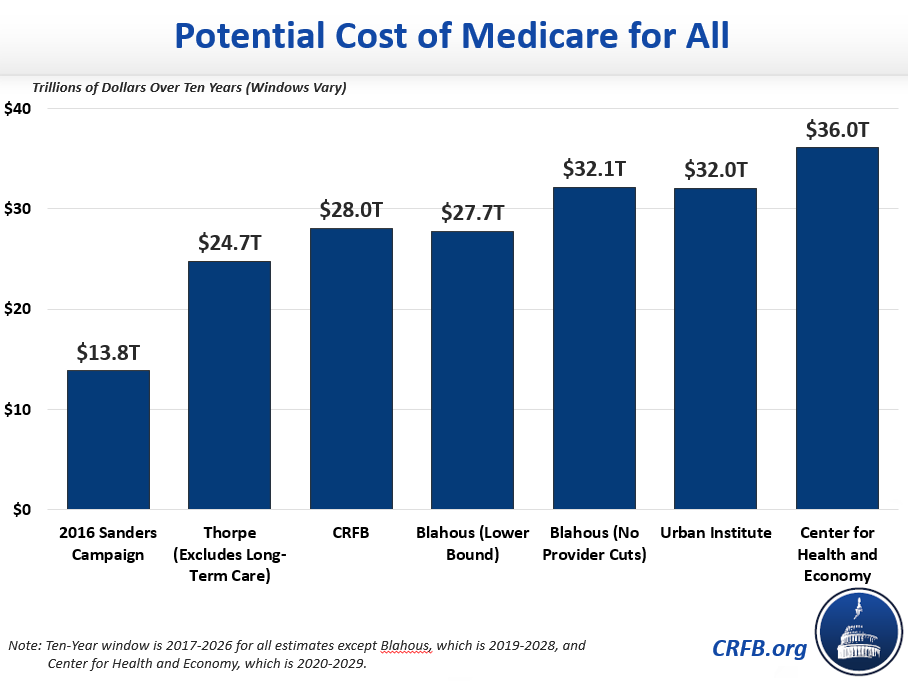

The proposal is broadly similar to Senator Sanders's proposed single-payer plan introduced during the 2016 Presidential campaign. While the campaign itself estimated that plan would cost the federal government about $14 trillion over a decade, most other estimates that we are aware of are at least twice that high.

At the time, for example, the Committee for a Responsible Federal Budget estimated roughly that the plan would cost $28 trillion through 2026 (we estimated the Sanders plan in particular would also raise $11 trillion of revenue, leading to $17 trillion of net costs). All other estimates come to similar conclusions.

For example, economist Kenneth Thorpe estimated that single-payer health care would cost the federal government $24.7 trillion through 2026, excluding the costs associated with long-term care benefits (likely about $3 trillion). The Urban Institute estimated a $32 trillion cost over the same period, including those long-term care benefits. The Center for Health and Economy (H&E) produced an estimate that the American Action Forum calculates would cost the federal government $36 trillion through 2029.

In addition, former Social Security and Medicare Trustee and current Mercatus Center fellow Chuck Blahous estimated that Medicare for All as proposed in Senator Sanders's 2017 legislation would cost the federal government $27.7 trillion through 2028 assuming steep provider cuts and $32.1 trillion assuming no provider cuts (these estimates, like most others, assume immediate implementation).

Importantly, these totals represent the increased cost to the federal government, not the change of total national health expenditures. National health expenditures would likely change by no more than a few trillion dollars over the decade. The direction of that change is unclear and would depending on the whether the increased cost of expanding coverage (by making health insurance more generous and offering it to more people) is larger or smaller than the amount saved from lower provider payments, drug payments, and administrative spending.

The totals also do not represent debt impact, which would depend not only on the cost to the federal government but also on any funds the government might choose to raise through premiums, taxes, or both. For example, Senator Sanders's campaign plan included roughly $11 trillion of tax increases, which could fund more than one-third of Medicare for All.

While any new revenue would in part be replacing current premiums, identifying pay-fors still remains a challenge. Enacting this type of Medicare for All would mean increasing federal spending by about 60 percent (excluding interest), and financing a $30 trillion program would require the equivalent of tripling payroll taxes or more than doubling all other taxes.

Supporters of Medicare for All should work to identify new revenue, premiums, and/or spending cuts to finance new federal costs or else scale back their proposal if they are unable to identify sufficient funding.